Markets Overview – August 20, 2025

Major Indices Fell :

S&P 500 (SPX): -0.24%

Dow Jones (DJI): +0.04%

Russell 2000 (RUT): -0.32%

The S&P 500 dropped 0.24%, marking its fourth consecutive day of losses, driven by a continued tech stock sell-off. The Nasdaq Composite fell 0.7%, while the Dow Jones rose slightly.

Investors are focused on Federal Reserve Chair Jerome Powell’s upcoming Jackson Hole Symposium speech for clues on potential interest rate cuts, expected to begin next month.

The S&P 500 and Nasdaq have faced recent declines, partly due to a tech sector sell-off, with concerns about high valuations in AI-related stocks like Nvidia and Meta. Walmart’s upcoming earnings are anticipated to reflect consumer spending trends, while recent retail reports from Target and TJX showed mixed results.

Key Movers

Major tech stocks like Apple, Amazon, and Intel declined, with Intel dropping 7% after recent gains.

Retailers like Target fell 6% despite strong earnings, due to a CEO change, while TJX and Lowe’s gained after positive results.

Bitcoin rose to $114,300, and oil and gold prices increased. Analysts remain optimistic about tech’s long-term prospects, particularly in AI.

Today’s Economic Calendar — Thursday, August 21

8:30 am- Initial jobless claims for August 16 (225,000 median forecast vs 224,000 previous) and Philadelphia Fed manufacturing survey for Aug.

9:45 am- S&P flash U.S. services & U.S. manufacturing PMI for Aug.

10:00 am- Existing home sales and U.S. leading economic indicators for July.

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The index ended flat with +0.04% to close at 44,938.31.

Resistance for the day: 45,015.64, with potential downside levels at 44,841.51 and 44,755.82.

NASDAQ 100 (NDX)

The index closed at 23,249.57, with resistance for the day at 23,300.59 and potential downside levels at 23,200 and 23,099.70.

S&P 500 (SPX)

The index closed at 6,395.78, with resistance at 6,410 and potential downside levels at 6,390.62 and 6,371.63.

SPDR S&P 500 ETF Trust (SPY)

The price was trading at $636.73 pre-market, with resistance at $638.61 and potential downside levels at $635.85 and $635.15.

Invesco QQQ Trust Series 1(QQQ)

The price was trading at $565.26 pre-market, with resistance at $566.07 and potential downside levels at $563.89 and $562.79.

The price was trading at $224.26 pre-market, with resistance at $225.58 and potential downside levels at $223.75 and $221.79.

VanEck Semiconductor ETF (SMH)

The price was trading at $289.18 pre-market, with support at $288.42 and potential upside levels at $291.08 and $292.08.

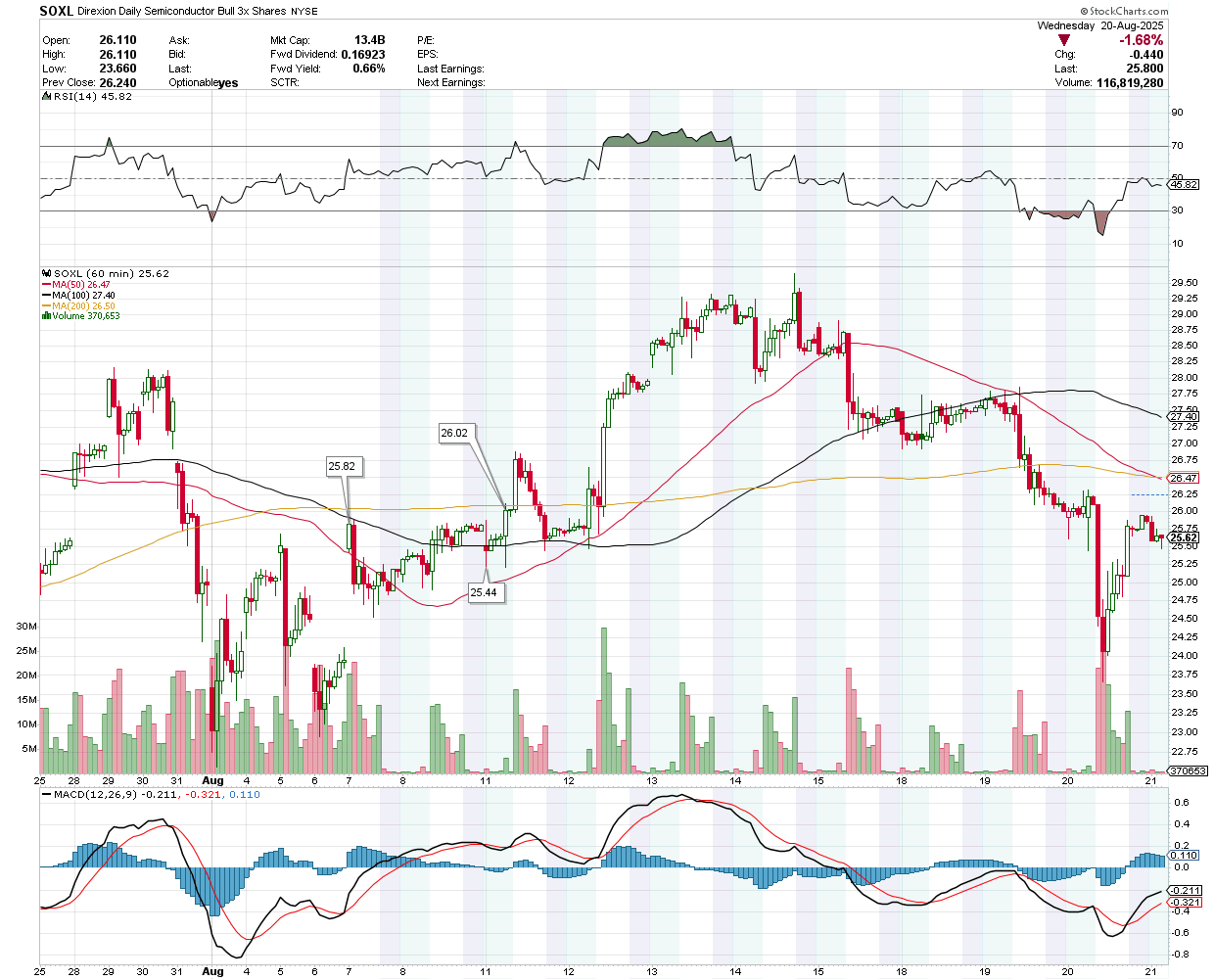

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

The price was trading at $25.62 pre-market, with support at $25.44 and potential upside levels at $25.82 and $26.02.

Earnings Snapshot: Reporting Today (Before Open)

Walmart Inc (WMT)

Walmart is set to release its Q2 2025 earnings, with analysts expecting earnings of $0.74 per share (up 10.45% year-over-year) and revenue of $174.38 billion (up 3.94%). The stock has risen 13.53% year-to-date, outperforming consumer staples peers, driven by strong e-commerce and technology investments, including a $2.3 billion acquisition of Vizio to boost its advertising business.

Walmart plans to open 150 new stores, emphasizing brick-and-mortar retail. However, challenges include a 10% profit drop in Walmart Mexico and Central America due to tech and labor costs, and potential risks from inflation impacting low-price strategies and e-commerce growth sustainability.

The stock was trading at $101.11 pre-market, with support at $100.05 and potential upside levels at $101.59,$102.11, and $102.79.

Earnings Snapshot: Reporting Today (After Close)

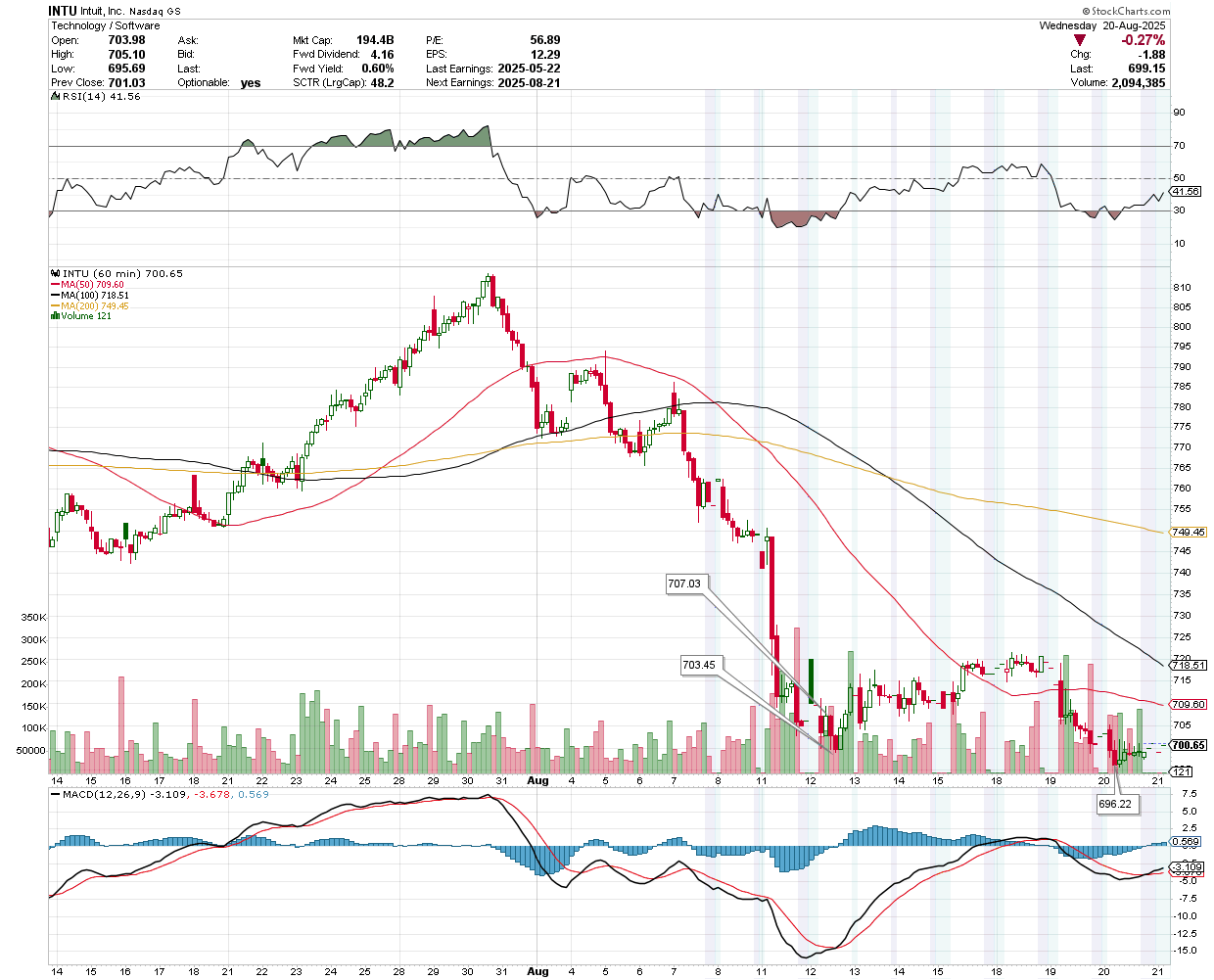

Intuit Inc (INTU)

Intuit Inc. (INTU) is poised to report its Q4 2025 earnings on August 21, 2025, with management forecasting revenues of $3.72-$3.76 billion (17-18% growth) and adjusted EPS of $2.63-$2.68 (33.2% growth).

The company’s growth is fueled by AI integration across TurboTax, QuickBooks, and Credit Karma, with subscription services (77% of revenue) driving predictable income and strong cross-selling synergies, notably a 28% revenue surge expected for Credit Karma.

The stock was trading at $700.65 pre-market, with support at $696.22 and potential upside levels at $703.45 and $707.03.

Workday Inc (WDAY)

Workday (NASDAQ: WDAY) is set to report its Q2 2025 earnings on August 21, 2025, with consensus estimates projecting earnings per share of $2.11 and revenues of $2.34 billion, compared to $1.75 and $2.08 billion in the same quarter last year.

Workday’s market cap is $60.65 billion, with trailing 12-month revenue of $8.7 billion, operating profit of $640 million, and net income of $487 million.

The stock was trading at $228.25 pre-market, with support at $226.52 and potential upside levels at $228.93 and $230.08.

Ross Stores Inc (ROST)

Ross Stores (NASDAQ: ROST) is set to report its Q2 2025 earnings on August 21, 2025, after the market closes, with analysts forecasting revenue of $5.54 billion, a 4.8% year-on-year increase, slower than the 7.1% growth in Q2 2024, and adjusted earnings per share of $1.54.

The company beat revenue expectations by 0.5% last quarter with $4.98 billion, but issued weaker-than-expected guidance for Q2.

The stock was trading at $146.49 pre-market, with resistance at $147.70 and potential downside levels at $145.73 and $145.15.