Markets Overview – August 22, 2025

Major Indices Surged :

S&P 500 (SPX): +1.52%

Dow Jones (DJI): +1.89%

Russell 2000 (RUT): +3.86%

On August 22, 2025, US stock markets closed higher, supported by strength in the Consumer Goods, Oil & Gas, and Basic Materials sectors. The NASDAQ Composite climbed 1.88%, the S&P 500 advanced 1.52%, and the Dow Jones Industrial Average jumped 1.89% to a fresh record high.

The CBOE Volatility Index fell 14.28% to a six-month low of 14.23. In commodities, December Gold Futures rose 1.04% to $3,416.85, October Crude Oil gained 0.39% to $63.77, and October Brent Oil rose 0.21% to $67.81. The EUR/USD increased 1.01% to 1.17, USD/JPY fell 0.96% to 146.95, and the US Dollar Index Futures dropped 0.91% to 97.61.

Key Movers

Top Dow performers included Caterpillar Inc (+4.25%), Home Depot Inc (+3.79%), and Goldman Sachs Group Inc (+3.62%), while Verizon Communications Inc (-1.31%), Walmart Inc (-1.15%), and Coca-Cola Co (-0.75%) were the weakest.

On the S&P 500, Enphase Energy Inc (+10.41%), Celanese Corporation (+8.84%), and Builders FirstSource Inc (+8.43%) led gains, while Intuit Inc (-5.03%), CSX Corporation (-3.60%), and Cencora Inc (-3.51%) lagged.

The NASDAQ saw significant gains from EpicQuest Education Group International Ltd (+128.45%), ModivCare Inc (+91.07%), and Cognition Therapeutics Inc (+41.21%), with Aptorum Group Ltd Class A (-37.88%), Ethzilla Corp (-31.39%), and Aethlon Medical Inc (-27.40%) as the worst performers.

Today’s Economic Calendar — Monday, August 25

10:00 am- New home sales for July (632,000 median forecast vs 627,000 previous)

Technical Setups- Indices & ETFs

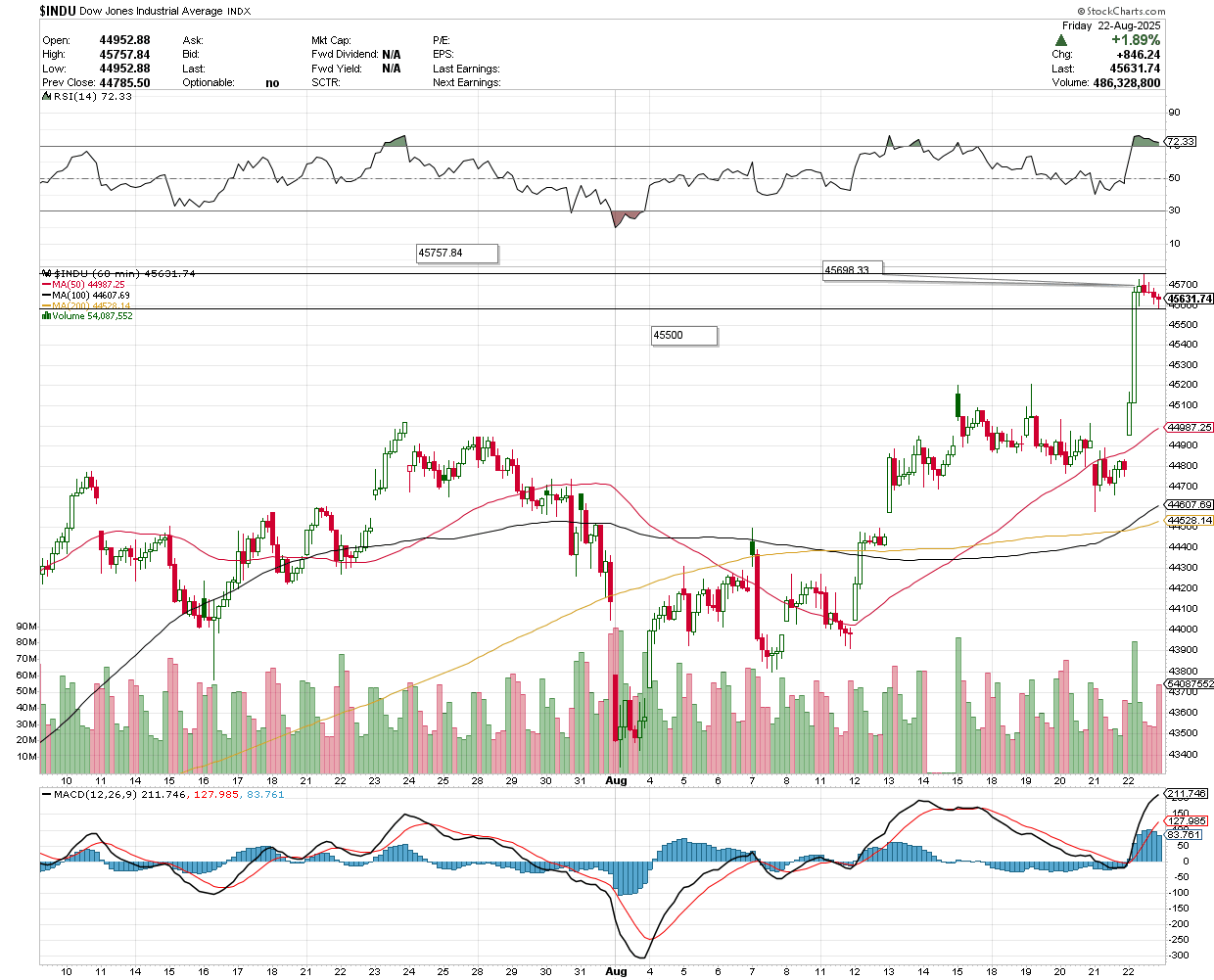

Dow Jones Industrial Average (DJI)

The index gained +1.89% to close at 45,631.74.

Support for the day: 45,500, with potential upside levels at 45,698.33, 45,757.84, and 45,800.

NASDAQ 100 (NDX)

The index closed at 23,498.12, with support for the day at 23,391.35 and potential upside levels at 23,543.77 and 23,659.34.

S&P 500 (SPX)

The index closed at 6,466.91, with support at 6,449.54 and potential upside levels at 6,481.91 and 6,500.

SPDR S&P 500 ETF Trust (SPY)

The price was trading at $643.40 pre-market, with support at $642.06 and potential upside levels at $644.77 and $645.65.

Invesco QQQ Trust Series 1(QQQ)

The price was trading at $569.92 pre-market, with support at $569.58 and potential upside levels at $571.04 and $572.58.

The price was trading at $234.64 pre-market, with support at $234 and potential upside levels at $234.87 and $235.42.

VanEck Semiconductor ETF (SMH)

The price was trading at $293.17 pre-market, with support at $292.01 and potential upside levels at $294.01 and $295.22.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

The price was trading at $27.24 pre-market, with support at $26.765 and potential upside levels at $27.45 and $27.76.

Earnings Snapshot: Reporting Today (Before Open)

PDD Holdings Inc (PDD)

PDD Holdings' stock surged 2.57% in pre-market trading on August 25, 2025, ahead of its Q2 earnings report, reflecting positive investor sentiment. Analysts expect an EPS of CNH 15.53 and revenue of CNH 102.71 billion, despite a prior earnings miss.

The stock has risen 31.05% year-to-date and 6.86% over the past week, driven by confidence in PDD's e-commerce platforms, Pinduoduo and Temu. Institutional support from Banco BTG Pactual S.A.'s new investment and the Public Sector Pension Investment Board's substantial stake further bolsters optimism.

The stock was trading at $129.47 pre-market, with support at $128.11 and potential upside levels at $129.85 and $131.

Napco Security Technologies Inc (NSSC)

Napco Security Technologies (NASDAQ: NSSC) is set to report its Q4 FY2025 earnings on August 25, 2025, before the market opens. Analysts expect a revenue decline of 11.7% year-over-year to $44.45 million, compared to a 12.7% increase in the same quarter last year, with adjusted earnings projected at $0.26 per share.

Last quarter, Napco exceeded revenue expectations by 1.9%, reporting $43.96 million (down 10.8% year-over-year) and beating EPS estimates. The company has missed revenue estimates three times in the past two years. Analyst estimates have remained stable over the last 30 days, indicating confidence in Napco's trajectory.

The stock was trading at $31.70 pre-market, with support at $31.555 and potential upside levels at $32 and $32.47.

Earnings Snapshot: Reporting Today (After Close)

Heico Corp (HEI)

Aerospace and defense company HEICO (NYSE: HEI) is set to announce its Q2 earnings on August 25, 2025, after market close. Analysts expect revenue to grow 12.3% year-over-year to $1.11 billion, a slowdown from the 37.3% increase in the same quarter last year, with adjusted earnings projected at $1.14 per share.

Most analysts have reconfirmed their estimates in the last 30 days, indicating confidence in HEICO’s performance. However, HEICO has missed revenue estimates three times in the past two years.

The stock was trading at $309.59 pre-market, with support at $307.99 and potential upside levels at $310.89 and $312.46.

Semtech Corp (SMTC)

Semtech (NASDAQ: SMTC), a semiconductor company, is set to report its Q2 earnings on August 25, 2025, after market close. Analysts expect revenue to grow 18.9% year-over-year to $256.1 million, compared to a 9.7% decline in the same quarter last year, with adjusted earnings projected at $0.40 per share.

Last quarter, Semtech met revenue expectations with $251.1 million (up 21.8% year-over-year) and exceeded adjusted operating income estimates while improving inventory levels.

The company has missed revenue estimates only once in the past two years, typically beating expectations, and most analysts have maintained their estimates over the last 30 days, signaling confidence.

The stock was trading at $51 pre-market, with support at $50.52 and potential upside levels at $51.57 and $52.