Markets Overview – August 6, 2025

Major Indices Surged :

S&P 500 (SPX): +0.73%

Dow Jones (DJI): +0.18%

Russell 2000 (RUT): -0.20%

The S&P 500 rose 0.73% to 6,345.06, the Nasdaq Composite climbed 1.21% to 21,169.42, and the Dow Jones Industrial Average increased 0.18% to 44,193.12, driven by a 5% surge in Apple shares after a $100 billion U.S. manufacturing investment announcement, bringing its total U.S. investment to $600 billion over four years.

The market was recovering from a volatile period following a disappointing July jobs report and the Federal Reserve's decision not to cut rates. Investors were also assessing President Trump’s tariffs, including a new 25% levy on Indian goods, bringing the total tariff to 50%. Despite tariff concerns, market sentiment improved as their impact was less severe than feared.

Wall Street futures rose as President Trump's latest tariffs took effect on August 7, 2025. The Dow Jones Industrial Average futures gained 0.6%, while S&P 500 and Nasdaq futures increased by 0.7% and 0.9%, respectively. Key drivers include optimism about ongoing trade negotiations, particularly with Canada and Mexico, where deals may lower proposed 25% tariffs.

Key Movers

Corporate earnings were strong, with 81% of S&P 500 companies beating expectations. Notable performers included McDonald’s (+3%) and Arista Networks (+17%), while Snap (-17%) and AMD (-6%) fell due to weak earnings.

Other market movers included Grocery Outlet (+42.7%) and Viasat (+30.7%) on strong results, while Opendoor (-24.6%) and Bloomin’ Brands (-30.7%) dropped after weak guidance.

Disney shares dipped slightly despite raising its earnings outlook, and Uber fell 0.2% on mixed results. Minneapolis Fed President Neel Kashkari indicated potential rate cuts in 2025 as the economy cools, though tariff-related inflation could delay or reverse this.

Today’s Economic Calendar — Thursday, August 7

8:30 am- Initial jobless claims for August 2 (median forecast 221,000 vs previous 218,000)

8:30 am- U.S. productivity for Q2 (median forecast 1.9% vs previous -1.5%)

8:30 am- U.S. unit-labor costs for Q2 (median forecast 1.3% vs previous 6.6%)

10:00 am- Wholesale inventories for June

3:00 pm- Consumer Credit for June.

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The index gained +0.18% to close at 44,193.12.

Support for the day: 44,093.40, with potential upside levels at 44,236.45 and 44,339.11.

NASDAQ 100 (NDX)

The index closed at 23,315.04, with support for the day at 23,252.93 and potential upside levels at 23,381.71 and 23,405.01.

S&P 500 (SPX)

The index closed at 6,345.05, with support at 6,320.80 and potential upside levels at 6,364.02 and 6,389.58.

SPDR S&P 500 ETF Trust (SPY)

The price was trading at $636.87 pre-market, with support at $636.11 and potential upside levels at $637.79 and $638.37.

Invesco QQQ Trust Series 1(QQQ)

The price was trading at $572.02 pre-market, with support at $570.60 and potential upside levels at $574.08 and $575.91.

The price was trading at $222.79 pre-market, with support at $221.89 and potential upside levels at $223.89 and $224.27.

VanEck Semiconductor ETF (SMH)

The price was trading at $292.56 pre-market, with support at $292.08 and potential upside levels at $293.51 and $294.46.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

The price was trading at $25.30 pre-market, with support at $25.025 and potential upside levels at $25.51 and $25.80.

Earnings Snapshot: Reporting Today (Before Open)

Eli Lilly And Co (LLY)

Eli Lilly reported Q2 2025 EPS of $6.31, surpassing the $5.59 analyst estimate, with revenue of $15.56B, exceeding the $14.67B consensus. The company raised its full-year 2025 EPS guidance to $21.75-$23.00 (vs. $21.98 consensus) and revenue guidance to $60.00B-$62.00B (vs. $60.09B consensus).

However, its stock fell 12% premarket after its oral drug orforglipron showed 12.4% weight loss over 72 weeks, below market expectations compared to Novo Nordisk’s Wegovy (14.9% over 68 weeks).

The price was trading at $661 pre-market, with potential upside levels at $664.78 and $673.99.

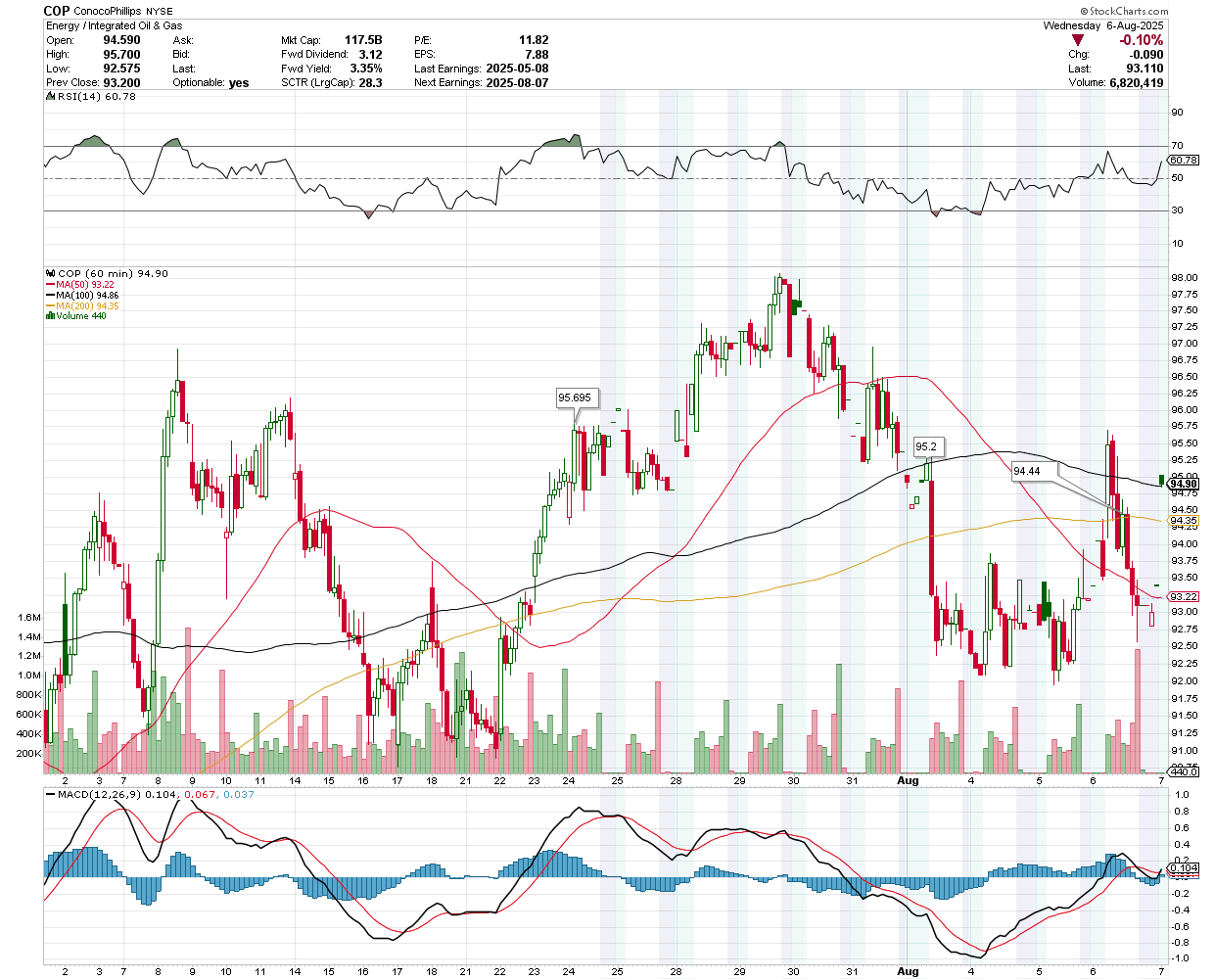

ConocoPhillips (COP)

ConocoPhillips reported Q2 2025 earnings of $1.97 billion, with a profit of $1.56 per share. Adjusted for non-recurring gains, earnings were $1.42 per share, surpassing the $1.36 per share consensus. Revenue reached $14.74 billion, missing the $14.93 billion expected by analysts. The Houston-based energy company’s performance reflects strong earnings despite falling short on revenue forecasts.

The price was trading at $94.90 pre-market, with support at $94.44 and potential upside levels at $95.20 and $95.695.

Earnings Snapshot: Reporting Today (After Close)

Trade Desk Inc (TTD)

The Trade Desk (TTD) is set to report Q2 2025 earnings on August 7, with expectations of $682M in revenue (17% YoY growth) and a 37.5% EBITDA margin. Q1 showed 25% revenue growth to $616M, driven by its Kokai platform, which reduced client costs by 20-24%.

Analysts are divided: some see upside due to TTD’s leadership in connected TV and retail media, while others warn of a correction if margins or execution falter amid competition from Amazon’s DSP and macroeconomic volatility.

The price was trading at $90.97 pre-market, with resistance at $91.11 and potential downside levels at $90.27 and $89.99.

Take-Two Interactive Software, Inc. (TTWO)

Take-Two Interactive Software (TTWO) is set to report Q1 fiscal 2026 earnings on August 7, 2025, with expected GAAP net revenues of $1.35-$1.40 billion and a GAAP net loss per share of $0.78-$0.65.

Strong engagement in NBA 2K, recurrent consumer spending, and Zynga’s mobile titles like Match Factory are expected to drive growth, though Grand Theft Auto Online bookings may decline due to platform maturity. Seasonal softness and higher mobile acquisition costs could limit margin gains, with operating expenses projected to rise 3%.

The price was trading at $228.39 pre-market, with support at $227.77 and potential upside levels at $229.15 and $229.71.