Markets Overview – September 24, 2025

Major Indices Closed Lower :

S&P 500 (SPX): -0.28% to 6,637.98

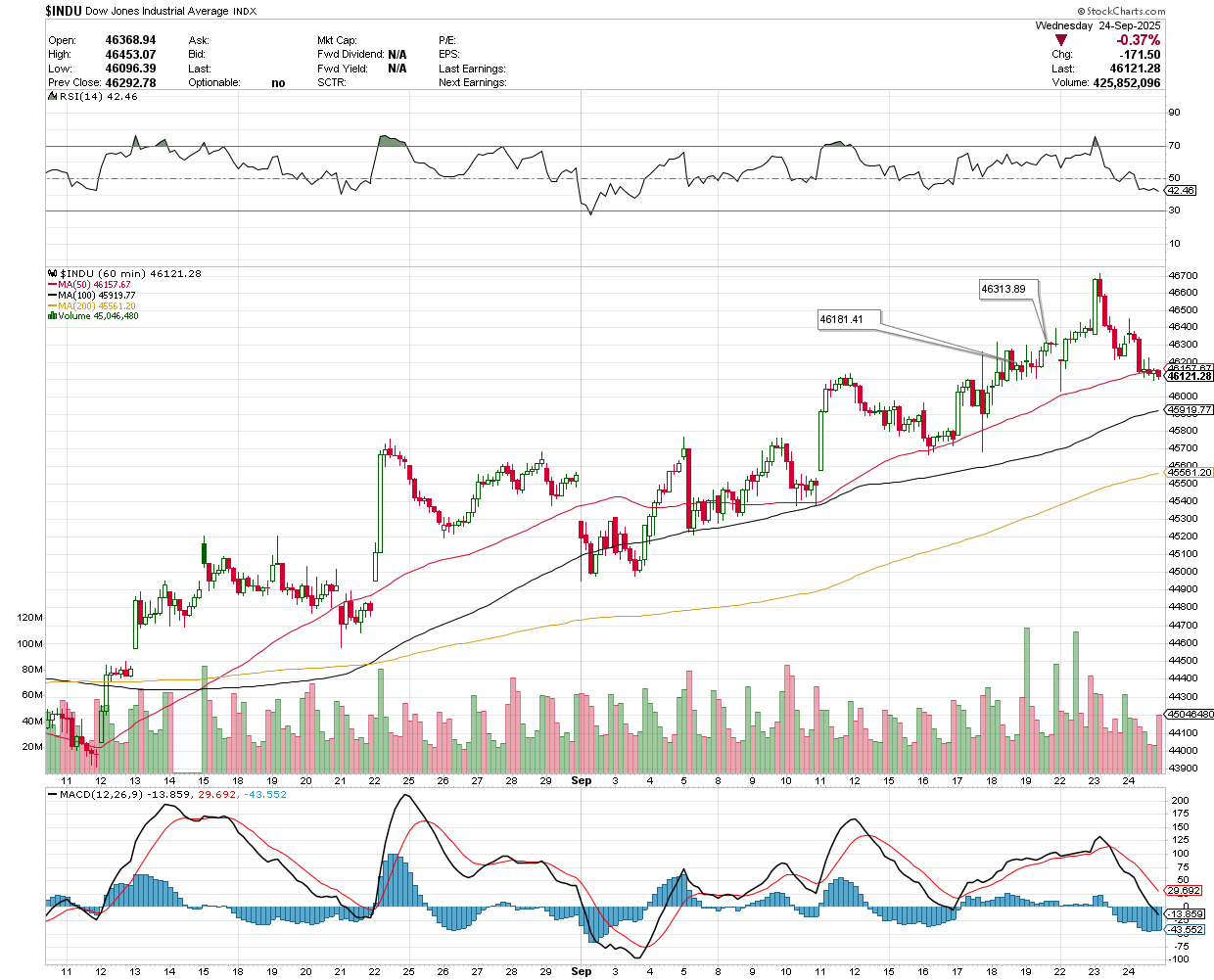

Dow Jones (DJI): -0.37% to 46,121.28

Russell 2000 (RUT): -0.92% to 2,434.98

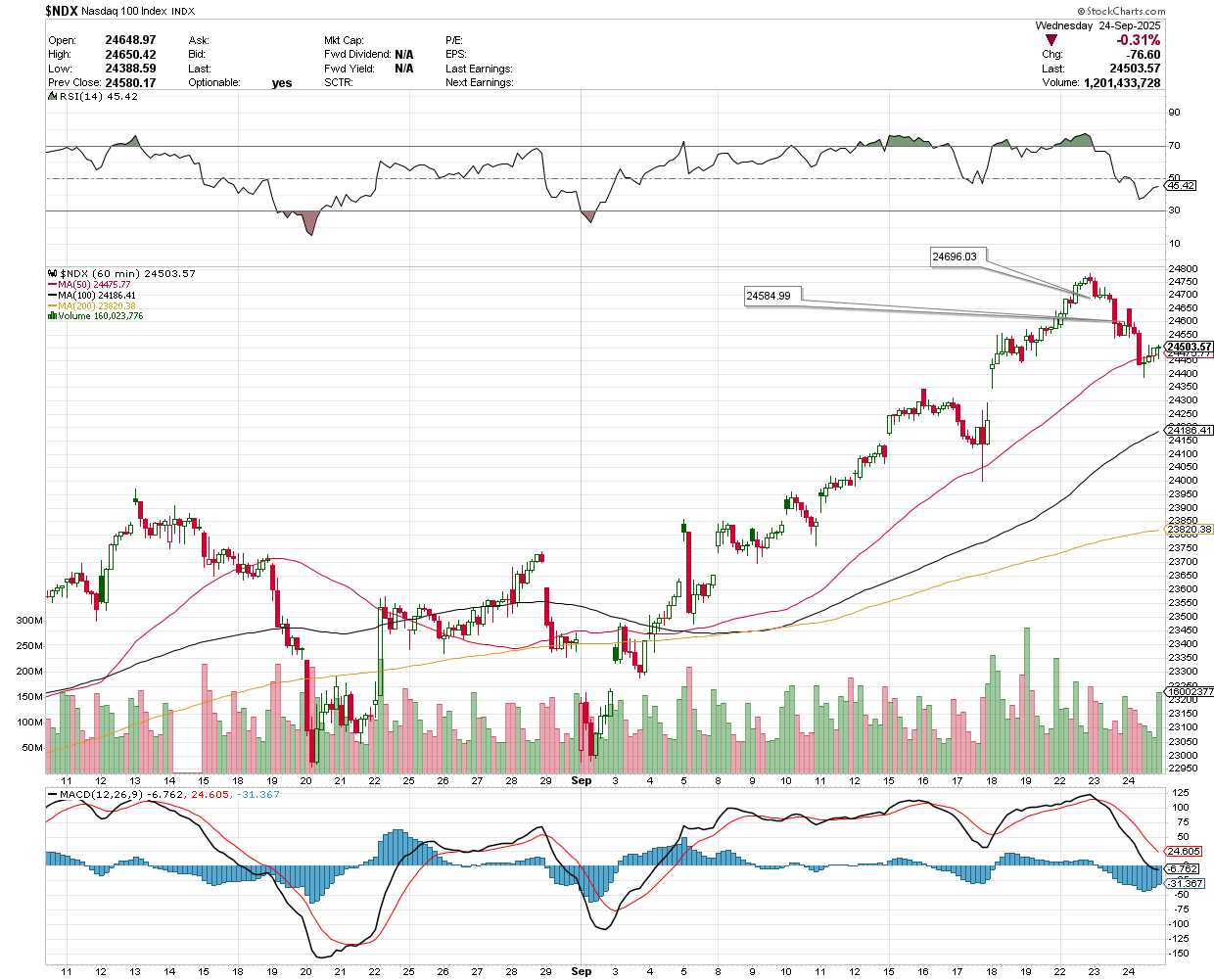

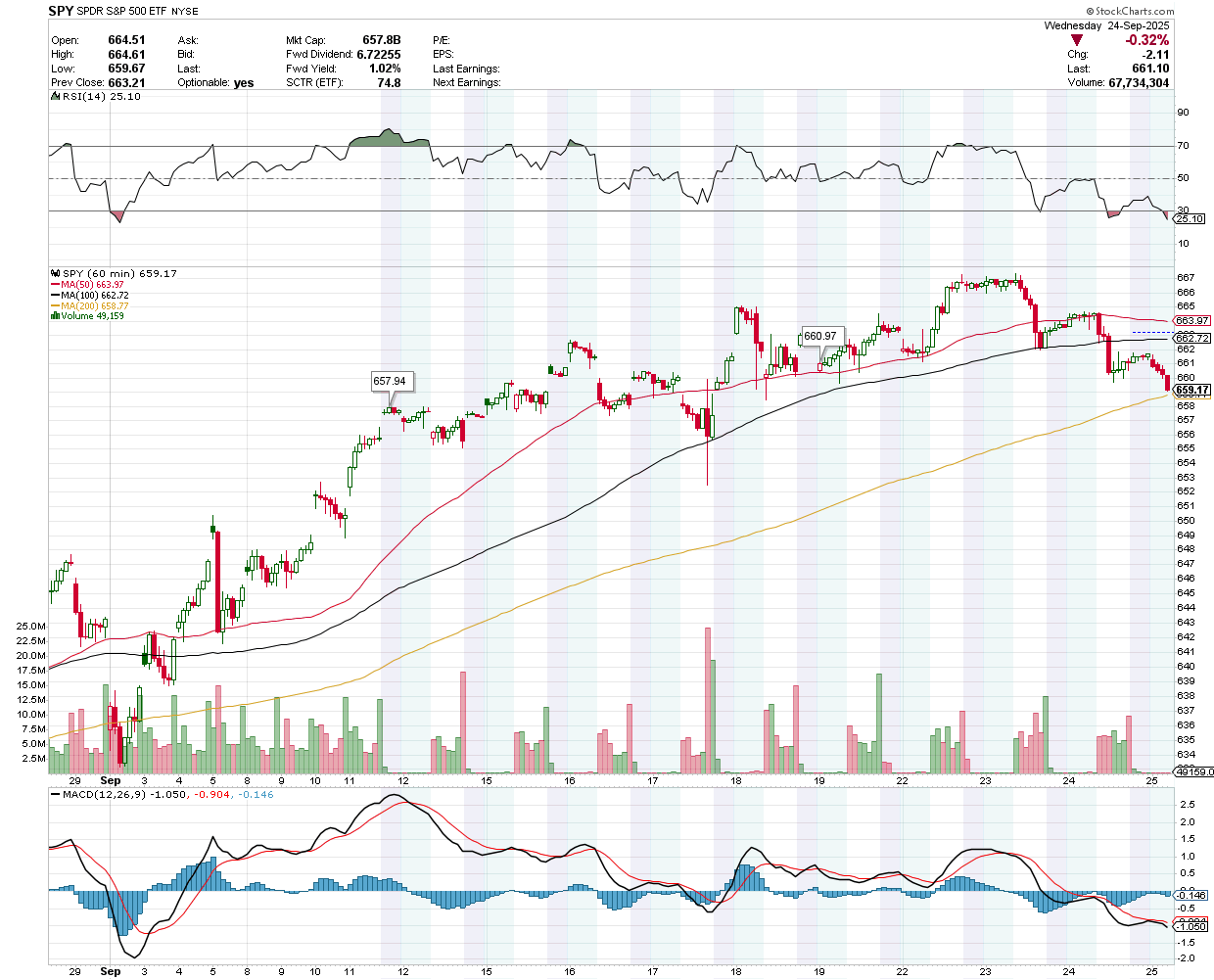

On September 24, 2025, major U.S. stock indexes, including the Dow Jones Industrial Average, S&P 500, and Nasdaq, closed lower for the second consecutive day, each down about 0.3%-0.4%, following a three-day streak of record highs.

Significant decliners included Freeport-McMoRan (-17%) after lowering copper and gold sales forecasts due to issues at its Indonesia mine, and Axon Enterprise (-10%) following an acquisition announcement.

Gold futures fell 1.5% to $3,765/ounce, the 10-year Treasury yield rose to 4.15%, Bitcoin increased 1.6% to $113,500, and the U.S. dollar index rose 0.6% to 97.87.

Federal Reserve Chair Jerome Powell’s comment that stocks are “fairly highly valued” raised concerns about overvaluation, drawing comparisons to the 1990s Dotcom Bubble. Other highlights included uniQure’s stock tripling after positive Huntington’s disease trial results, Adobe falling 2.4% after a Morgan Stanley downgrade, and optimism for Nike’s stock recovery. Costco’s upcoming earnings were noted for potential volatility, and new AI data centers were announced by OpenAI, Oracle, and SoftBank as part of the Stargate project.

Key Movers: Winners and Losers

The decline was led by the S&P 500 Materials sector, which fell 1.6%, and technology shares, down 0.5%. Notable tech decliners included Oracle (-1.7%), Nvidia (-0.8%), Amazon (-0.2%), and Micron Technology (-2.8%), despite Micron’s strong quarterly sales. However, some tech stocks performed well, with Alibaba (+8%) boosting AI infrastructure spending, Marvell Technology (+7%), and Intel (+6.4%) on news of a potential Apple stake.

The S&P 500 Energy Sector rose 1.23%, with Xcel Energy (+6.7%), EQT (+4%), and Phillips 66 (+3%) among the top gainers, supported by a 2.2% increase in West Texas Intermediate crude oil to $64.80 per barrel. Lithium Americas surged nearly 96% on reports of a potential U.S. government stake, and General Motors, its partner, gained 2.3%.

Today’s Economic Calendar — Thursday, September 25

8:30 am- Initial jobless claims (September 20), & GDP (third estimate) (Q2).

8:30 am- Advanced U.S. trade balance in goods (Aug), Advanced retail & wholesale inventories (Aug) and Durable-goods orders & Durable-goods minus transportation (Aug).

10:00 am- Existing home sales (Aug).

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The Dow declined -0.37%, closing at 46,121.28. Key support sits at 46,000; holding above could spark a rebound toward 46,181.41 and 46,313.89.

NASDAQ 100 (NDX)

The index ended at 24,503.57. Key support lies at 24,400; holding above this level could open upside toward 24,584.99 and 24,696.03.

S&P 500 (SPX)

Closing at 6,637.97, the S&P is trading above support at 6,618.60. If buyers hold this level, the potential upside targets are 6,648.63 and 6,662.84.

SPDR S&P 500 ETF Trust (SPY)

SPY was trading at $659.17 pre-market, with support at $657.94 and potential upside targets at $660.97 and $662.72.

Invesco QQQ Trust Series 1(QQQ)

QQQ was trading at $593.63 pre-market, with key support at $592.16. Holding above this level keeps upside targets in play at $596.05 and $597.10.

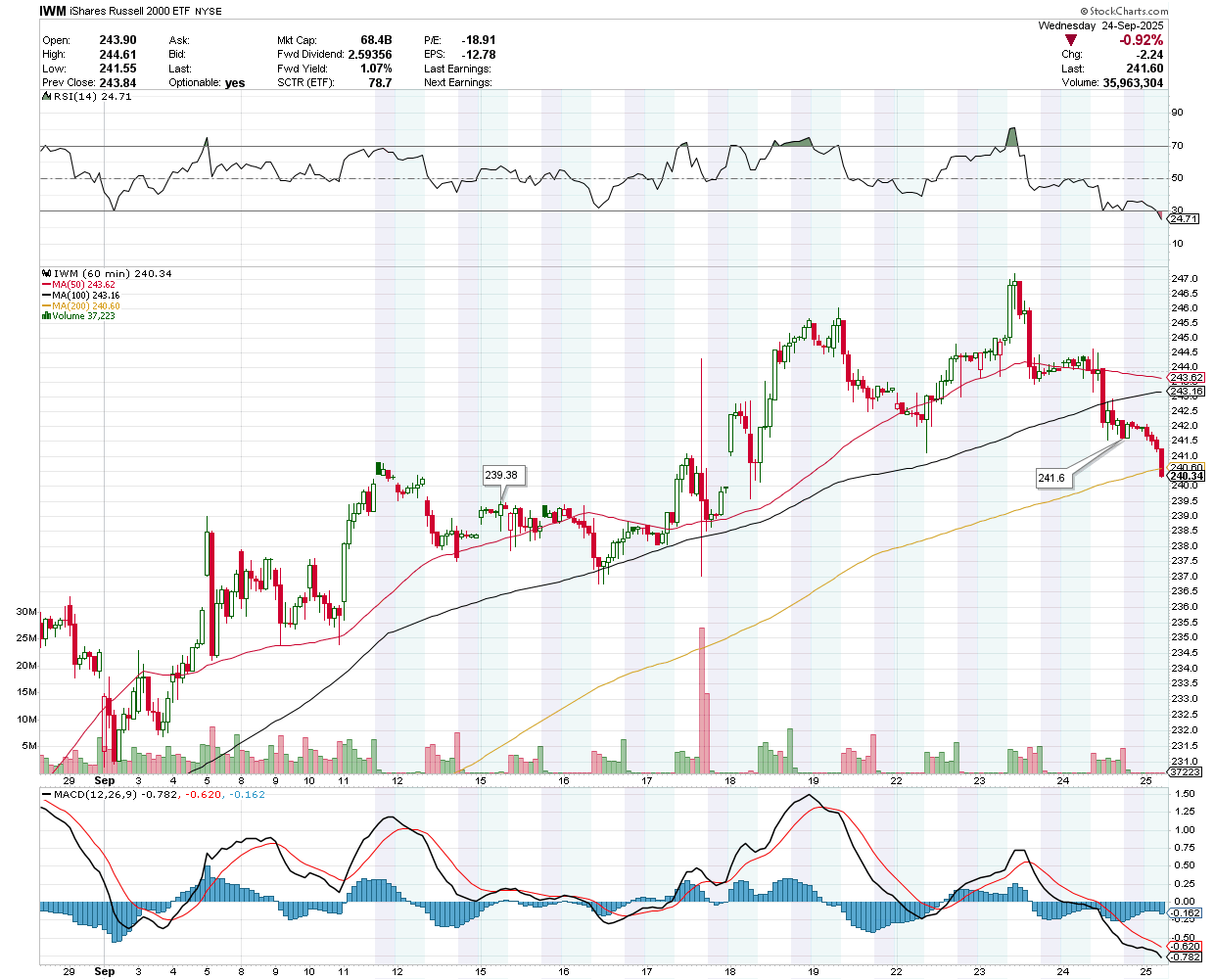

IWM was trading at $240.34 pre-market. Support is nearby at $239.38, while the potential upside levels stand at $241.60 and $243.16.

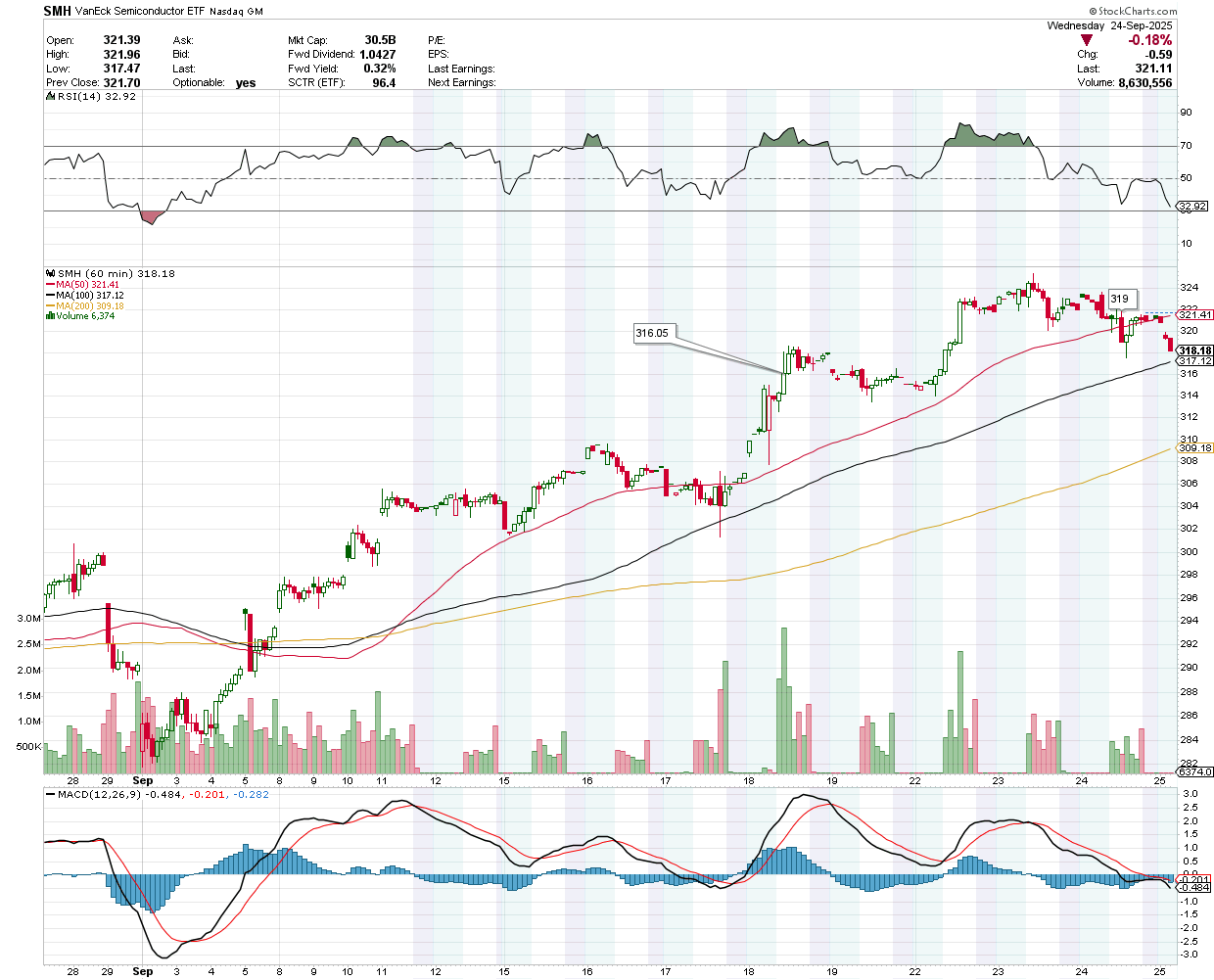

VanEck Semiconductor ETF (SMH)

SMH traded at $318.18 pre-market. Support lies at $316.05; a bounce could test $319 and $321.41.

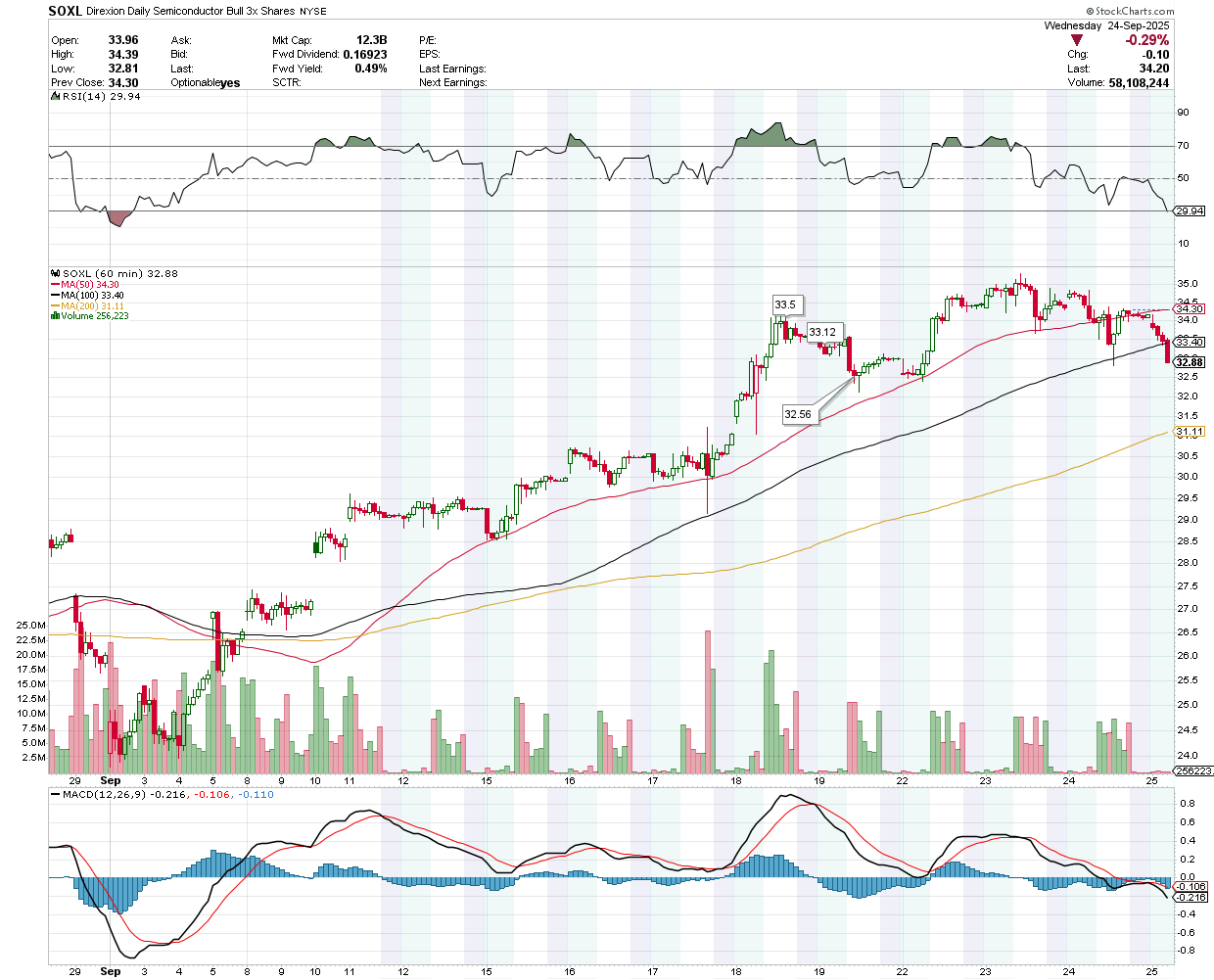

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL was at $32.88 pre-market. Support at $32.56 must hold to fuel a move towards $33.12 and $33.50.

Earnings Snapshot: Reporting Today (Before Open)

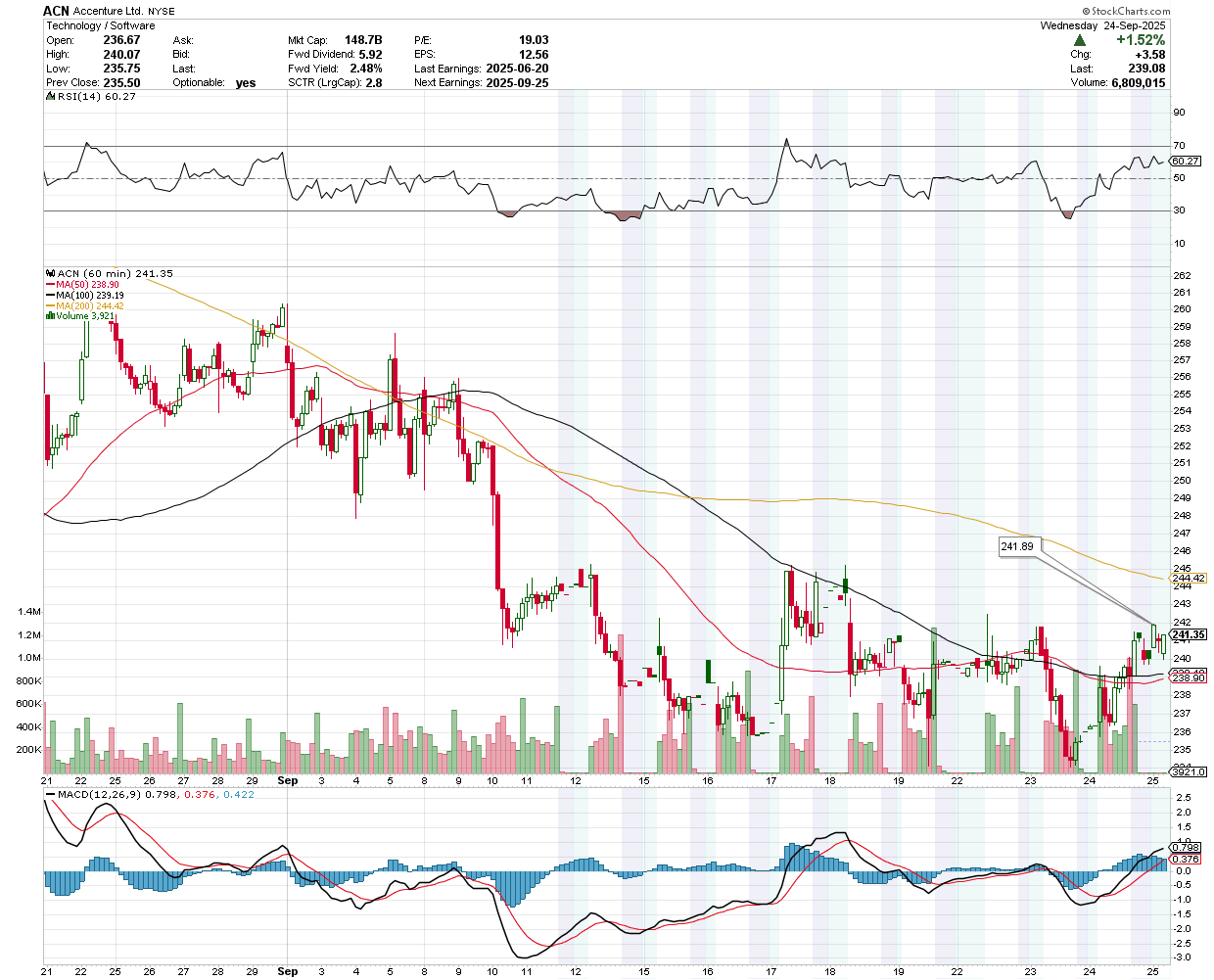

Accenture Plc (ACN)

Earnings Expectations- Accenture's Q4 fiscal 2025 earnings is scheduled for release on September 25, 2025, before market open. Analysts forecast 5.9% YoY growth to $17.37 billion and adjusted EPS expected at $2.97.

Previous Quarter- Reported $17.73 billion revenue, up 7.7% YoY, beating estimates by 2.3%.

ACN was trading at $241.35 pre-market. Support is at $239.19, while the potential upside levels stand at $241.89 and $244.42.

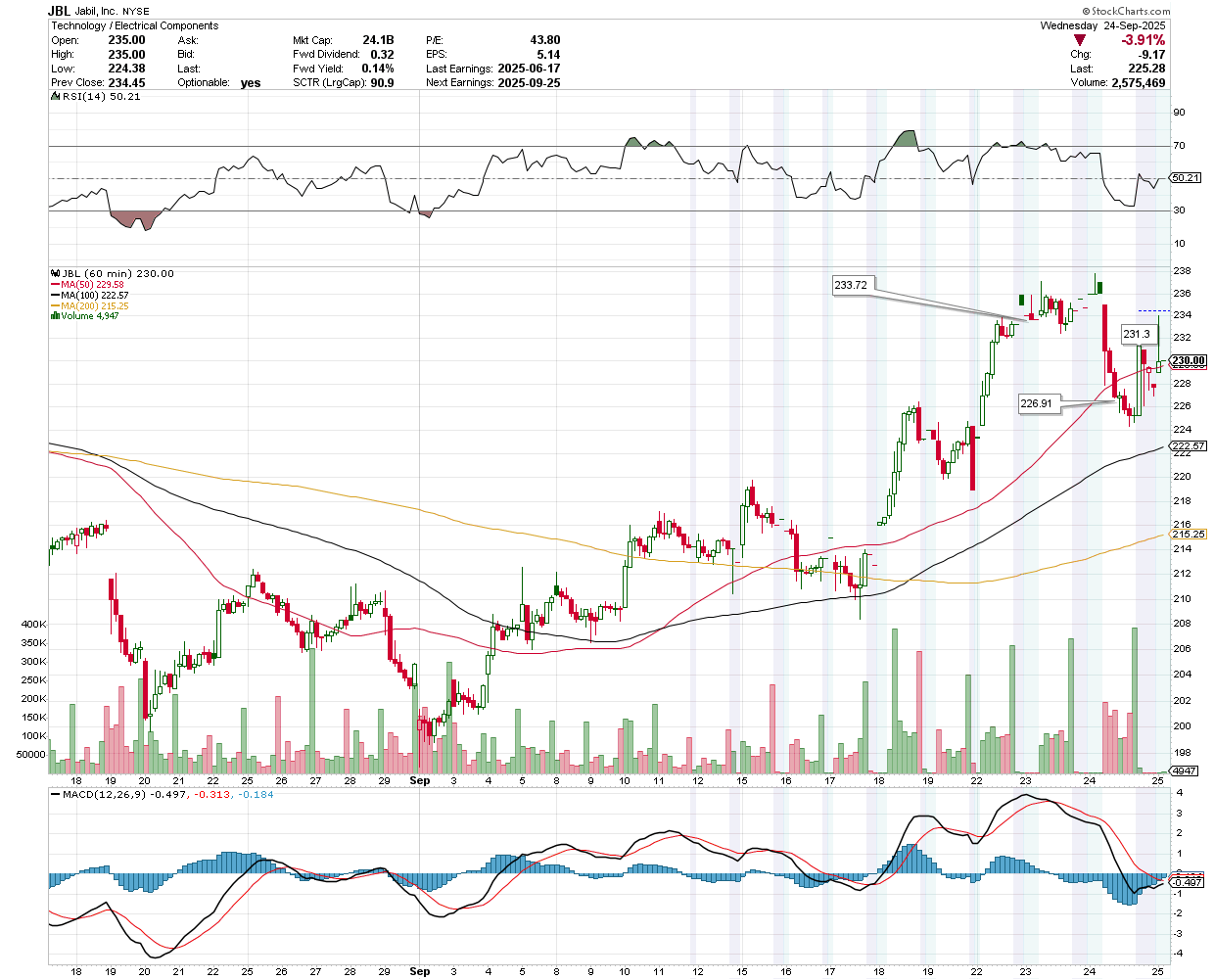

Jabil Inc (JBL)

Q4 Expectations- Analysts forecast 8.2% YoY revenue growth to $7.54 billion and adjusted EPS expected at $2.95.

Previous Quarter Performance- Reported $7.83 billion revenue, up 15.7% YoY, beating estimates by 11.2%.

JBL was trading at $230 pre-market. Support is at $226.91, while the potential upside levels stand at $231.30 and $233.72.

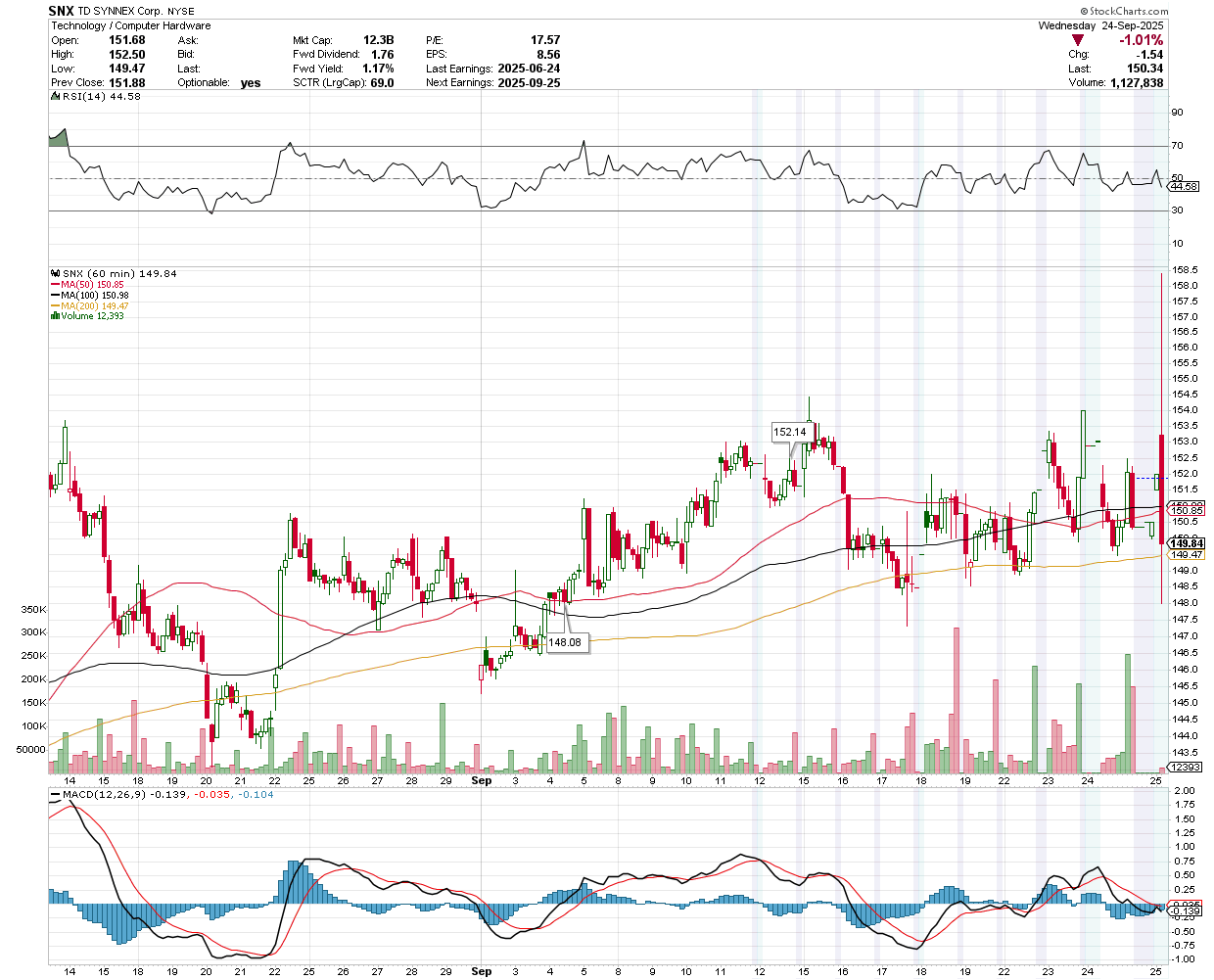

TD Synnex Corp (SNX)

Current Quarter Performance- TD SYNNEX reported $226.8 million in net income. Adjusted EPS was $3.58, surpassing the $3.02 expected by analysts, and revenue reached $15.65 billion, exceeding the $15.14 billion forecast.

Q4 Earnings Guidance- Expected EPS for Q4 ranges from $3.45 to $3.95, and forecasted revenue for Q4 is between $16.5 billion and $17.3 billion.

SNX was trading at $149.84 pre-market. Support is at $148.08, while the potential upside levels stand at $150.85 and $152.14.

Earnings Snapshot: Reporting Today (After Close)

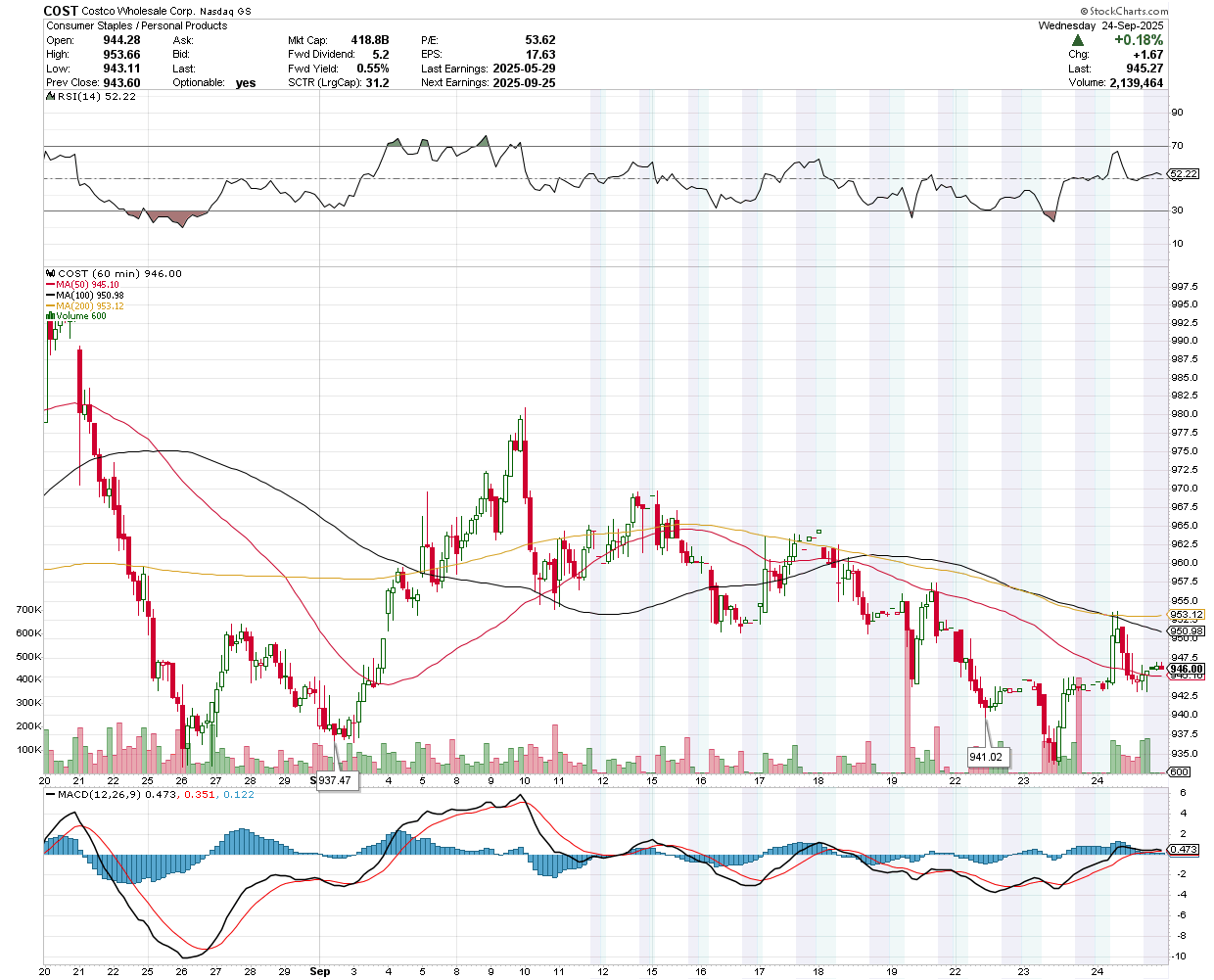

Costco Wholesale Corp (COST)

Q4 Expectations- Analysts forecast $86.03 billion in revenue and adjusted EPS expected at $5.82 for Q4.

Same-Store Sales Growth- Projected 6.2% increase, with U.S. at 6.1%, Canada 6.8%, and international 7.2%.

Market Challenges- Tariff pressures on imports (one-third U.S. sales, 8% from China) and competition from Sam's Club.

Fiscal 2025 Outlook- Revenue expected at $275.1 billion, adjusted EPS at $18.10, same-store sales up 7.5%.

COST was trading at $946 pre-market. Resistance is at $950.98, while the potential downside levels stand at $941.02 and $937.47.