Markets Overview – August 25, 2025

Major Indices Declined :

S&P 500 (SPX): -0.43%

Dow Jones (DJI): -0.77%

Russell 2000 (RUT): -0.96%

On August 25, 2025, major U.S. stock indexes declined, with the Dow Jones Industrial Average dropping 0.8% (350 points) after a record high the previous Friday, the S&P 500 falling 0.4%, and the Nasdaq Composite slipping 0.2%. The retreat followed strong gains driven by expectations of Federal Reserve interest rate cuts signaled by Chair Jerome Powell.

Investors are focused on Nvidia’s upcoming earnings report and key inflation data. Despite the downturn, major indexes are on track for a fourth consecutive month of gains in August.

Key Movers

Nvidia shares rose 1% ahead of its Wednesday earnings, with analysts raising price targets, citing strong AI demand. Intel shares ended 1% lower after early gains, following a U.S. government deal to take a 10% stake in the chipmaker.

Keurig Dr. Pepper shares fell 11.5% after announcing an $18.4 billion acquisition of JDE Peet’s, planning to split into two companies.

Crypto stocks like MicroStrategy and Coinbase dropped over 4% as bitcoin prices fell to $110,200.

Furniture retailers like RH (-5.33%) and Wayfair (-5.91%) saw sharp declines after President Trump announced a tariff investigation on imported furniture, while U.S.-based manufacturers like Ethan Allen gained. The 10-year Treasury yield rose to 4.28%, the U.S. dollar index increased 0.7%, and West Texas Intermediate crude oil futures climbed 1.7% to $64.75 per barrel.

Today’s Economic Calendar — Tuesday, August 26

8:30 am- Durable-goods orders and Durable-goods orders minus transportation (July)

9:00 am- S&P Case-Shiller home price index (20 cities) (June)

10:00 am- Consumer confidence (Aug)

Technical Setups- Indices & ETFs

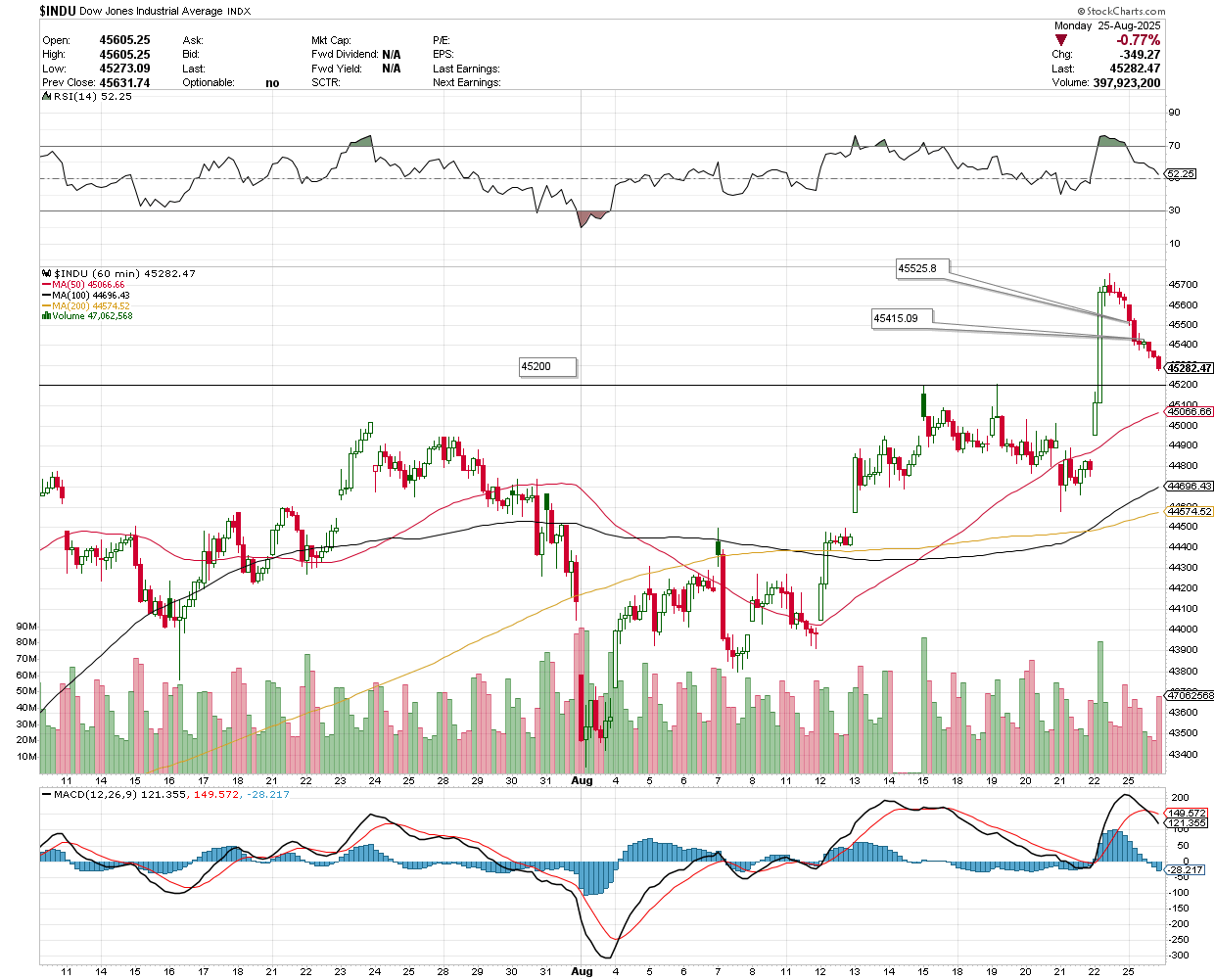

Dow Jones Industrial Average (DJI)

The index declined -0.77% to close at 45,282.47.

Support for the day: 45,200, with potential upside levels at 45,415.09 and 45,525.80.

NASDAQ 100 (NDX)

The index closed at 23,425.61, with support for the day at 23,340.62 and potential upside levels at 23,513.56 and 23,595.38.

S&P 500 (SPX)

The index closed at 6,439.32, with support at 6,426.79 and potential upside levels at 6,449.54 and 6,465.21.

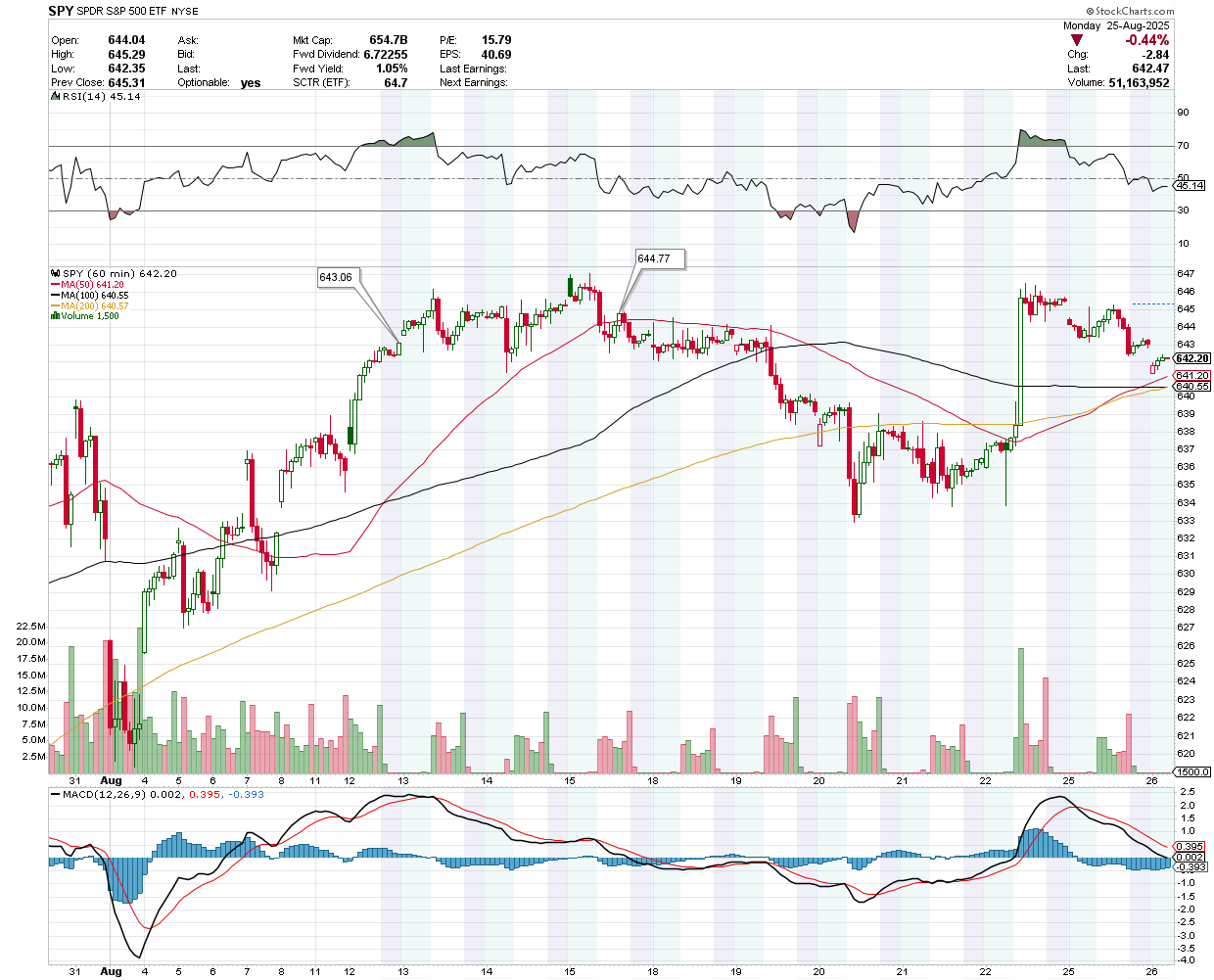

SPDR S&P 500 ETF Trust (SPY)

The price was trading at $642.20 pre-market, with support at $641.20 and potential upside levels at $643.06 and $644.77.

Invesco QQQ Trust Series 1(QQQ)

The price was trading at $570.13 pre-market, with support at $569.35 and potential upside levels at $571.04 and $572.20.

The price was trading at $232.38 pre-market, with support at $230.94 and potential upside levels at $233.13 and $234.

VanEck Semiconductor ETF (SMH)

The price was trading at $294.64 pre-market, with support at $294.01 and potential upside levels at $295.22 and $296.25.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

The price was trading at $27.40 pre-market, with support at $27.16 and potential upside levels at $27.76 and $27.95.

Earnings Snapshot: Reporting Today (Before Open)

KE Holdings Inc (BEKE)

KE Holdings Inc. (BEKE) is set to release its Q2 earnings before the market opens on August 26, 2025. Analysts anticipate quarterly earnings of $1.14 per share, up from 97 cents per share last year, with projected revenue of $1.12 billion, compared to $992.25 million in the prior year.

The company previously reported a 42.4% year-over-year revenue increase in Q1, reaching 23.3 billion Chinese Yuan ($3.21 billion), surpassing estimates.

The stock was trading at $18.96 pre-market, with support at $18.80 and potential upside levels at $19.21 and $19.375.

Earnings Snapshot: Reporting Today (After Close)

Mongodb Inc (MDB)

MongoDB (MDB) will announce its Q2 earnings after market close on Tuesday, August 26, 2025. Analysts expect revenue of $553.6 million, a 15.8% year-on-year increase, compared to 12.8% growth in the same quarter last year, with adjusted earnings of $0.66 per share.

Last quarter, MongoDB reported $549 million in revenue, up 21.9% year-on-year, beating estimates by 4.1%, and added 110 enterprise customers paying over $100,000 annually, reaching 2,506.

MongoDB has a solid history, missing revenue estimates just once in the past two years, yet its stock has dropped ~10% over the past month, lagging behind the data and analytics sector.

The stock was trading at $218.70 pre-market, with support at $217.46 and potential upside levels at $219.52 and $222.07.

Okta Inc (OKTA)

Okta (NASDAQ: OKTA) is set to report Q2 2026 earnings after market close on August 26, 2025, with its stock up 1% in pre-market trading. Analysts expect an EPS of $0.85, up 18% from $0.72 last year, and revenue of $711.84 million, a 10.2% year-over-year increase.

Truist upgraded Okta from Hold to Buy, citing expected strength in Identity Governance and Administration (IGA) and Privileged Access Management (PAM) for a robust second half of FY26.

In Q1 2026, Okta reported an EPS of $0.86 (beating $0.77 estimates) and revenue of $688 million (exceeding $680.14 million), up 11.5% year-over-year, though growth slowed. In Q2 2025, revenue was $646 million (up 16%), with subscription revenue at $632 million (up 17%) and a GAAP net income of $29 million, a significant improvement from a $111 million loss the prior year, driving a 25% stock price surge.

Key focus areas for this earnings include growth drivers like customer acquisition and expansion, amidst concerns about slowing growth, increasing competition, and commoditization in the identity management market. Okta’s high valuation leaves little margin for error.

The stock was trading at $92.40 pre-market, with support at $91.49 and potential upside levels at $93.15 and $93.57.

Box Inc (BOX)

Box Inc. (NYSE: BOX), a cloud content management platform, will report Q2 earnings after market close on Tuesday, August 26, 2025. Analysts expect revenue of $290.8 million, up 7.7% year-on-year, compared to 3.3% growth in the same quarter last year, with adjusted earnings of $0.31 per share.

Last quarter, Box reported $276.3 million in revenue (up 4.4% year-on-year), beating estimates by 0.6%, with strong billings and EPS guidance exceeding expectations. However, Box has missed revenue estimates three times in the last two years. Most analysts have reconfirmed estimates in the past 30 days, indicating stable expectations.

Box’s stock is down 5.16% over the past six months, underperforming the sector’s 2.34% average decline. Macroeconomic uncertainties, including trade policy and tax discussions, may impact future performance.

The stock was trading at $31.50 pre-market, with support at $31.20 and potential upside levels at $31.89 and $32.17.