Markets Overview – August 18, 2025

Major Indices Ended Flat :

S&P 500 (SPX): -0.01%

Dow Jones (DJI): -0.08%

Russell 2000 (RUT): +0.35%

Major U.S. stock indexes ended nearly flat, with the Dow Jones Industrial Average down 0.1%, the S&P 500 slightly lower, and the Nasdaq Composite up less than 0.1%. Investors were cautious ahead of retail earnings from companies like Home Depot, Lowe’s, Walmart, Target, and TJX, and Federal Reserve Chair Jerome Powell’s upcoming Jackson Hole Symposium speech, which could signal potential interest rate cuts in September. Expectations for rate cuts had moderated after concerning wholesale inflation data, though major indexes remained near record highs.

On August 19, 2025, U.S. stock futures showed mixed performance after a flat close on Monday. Dow Jones futures were up 0.01%, while S&P 500 and Nasdaq 100 futures dipped 0.06% and 0.05%, respectively. Investors focused on upcoming retail earnings from Home Depot, Target, and Walmart, and anticipated Federal Reserve rate cut signals, with an 83.1% chance priced in for September. The 10-year Treasury yield was 4.33%.

Key Movers

Key market movers included Dayforce (up 26%) on buyout talks with Thoma Bravo, First Solar (up 9.7%) and other solar stocks due to favorable Treasury guidance on clean energy tax credits, and Novo Nordisk (up 2.56%) after FDA approval of Wegovy for liver disease treatment.

Decliners included EQT Corp. (down 4.4%) after a downgrade, Intel (down 3.7%), and Electronic Arts (down 3.2%).

Today’s Economic Calendar — Tuesday, August 19

8:30 am- Housing starts for July (Median forecast 1.29 million vs previous 1.32 million)

8:30 am- Building Permits for July (Median forecast 1.39 million vs previous 1.4 million)

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The index fell -0.08% to close at 44,911.82.

Support for the day: 44,841.51, with potential upside levels at 45,015.64 and 45,077.95.

NASDAQ 100 (NDX)

The index closed at 23,713.76, with support for the day at 23,659.34 and potential upside levels at 23,748.55 and 23,800.38.

S&P 500 (SPX)

The index closed at 6,449.15, with support at 6,429.97 and potential upside levels at 6,458.64 and 6,480.99.

SPDR S&P 500 ETF Trust (SPY)

The price was trading at $642.69 pre-market, with support at $642.06 and potential upside levels at $644.02 and $645.62.

Invesco QQQ Trust Series 1(QQQ)

The price was trading at $576.43 pre-market, with support at $573.98 and potential upside levels at $577.98 and $579.25.

The price was trading at $227.61 pre-market, with support at $226.90 and potential upside levels at $228.19 and $228.97.

VanEck Semiconductor ETF (SMH)

The price was trading at $297 pre-market, with support at $296.55 and potential upside level at $298.13.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

The price was trading at $27.56 pre-market, with support at $27.20 and potential upside levels at $27.83 and $28.05.

Earnings Snapshot: Reporting Today (Before Open)

Home Depot Inc (HD)

Home Depot is set to report its upcoming earnings ahead of the market open, with analysts estimating Q2 EPS at $4.69 (up from $4.60 year-over-year) and revenues of approximately $45.31 billion.

Despite ongoing challenges—such as a sluggish housing market, high interest rates dampening large-scale renovations, tariff-related margin compression, and cautious consumer spending—analysts remain positive on Home Depot’s strategic strengths and outlook.

The stock was trading at $387.00 pre-market, with support at $385.80 and potential upside levels at $392 and $395.59.

Medtronic PLC (MDT)

Medtronic is set to report earnings on August 19, 2025, with analysts expecting flat EPS of $1.23 and revenue rising to $8.37 billion from $7.92 billion last year.

Over the past five years, Medtronic has also underperformed the S&P 500, trading near $95 compared to the index’s strong gains, raising questions about its appeal as a long-term investment.

The stock was trading at $95.56 pre-market, with support at $94.50 and potential upside levels at $95.85, $96.50, and $97.

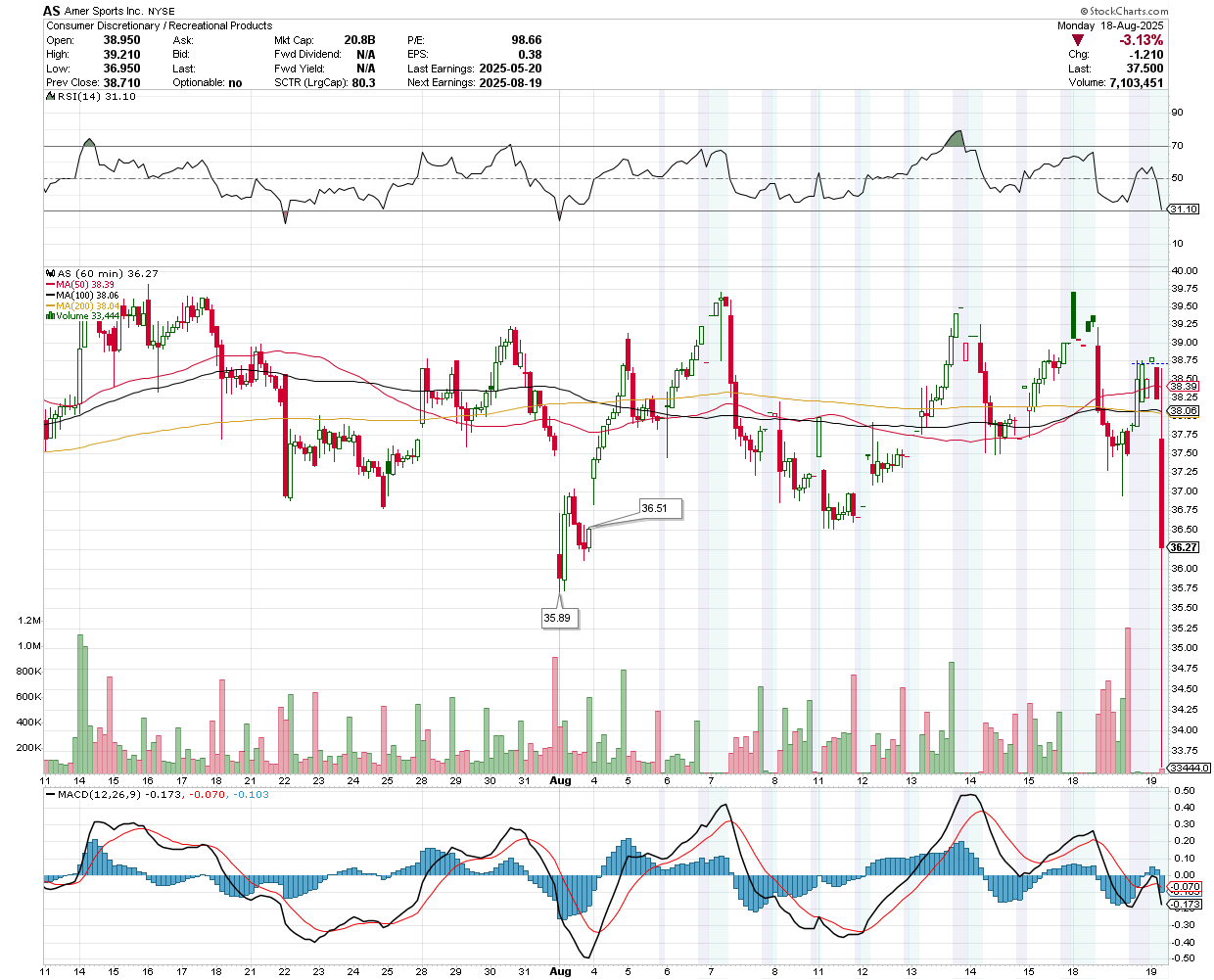

Amer Sports Inc (AS)

Amer Sports delivered a standout second quarter in 2025, with revenue surging 23% year-over-year to $1.24 billion and all key segments—Technical Apparel, Outdoor Performance (led by strong Salomon footwear momentum), and Ball & Racquet Sports—showing robust growth.

Margins expanded notably: gross margin rose nearly 270 basis points, while adjusted operating margin climbed to 5.5%, boosted in part by government grants.

Net income swung to $18 million (or $0.03 per share), with adjusted net income up 46% to $36 million ($0.06 per share). Encouraged by this performance, the company raised its full-year outlook for revenue, margins, and EPS—even amid elevated U.S. tariffs.

The stock was trading at $36.27 pre-market, with resistance at $36.51 and potential downside level at $35.89.

Earnings Snapshot: Reporting Today (After Close)

Keysight Technologies Inc (KEYS)

Keysight, set to report Q2 earnings after the market close on Tuesday, is expected to deliver year-over-year revenue growth of around 8.1% to approximately $1.32 billion, with adjusted earnings forecasted at $1.67 per share.

Last quarter, the company exceeded revenue expectations by 1.8% with $1.31 billion in sales, though its EPS guidance for the next quarter fell short of forecasts. Analyst estimates have largely held steady recently, reflecting confidence in the company's trajectory.

The stock was trading at $164.51 pre-market, with support at $163.58 and potential upside levels at $165.55 and $166.50.