Markets Overview – September 2, 2025

Major Indices Declined :

S&P 500 (SPX): -0.69% to 6,415.53

Dow Jones (DJI): -0.55% to 45,295.81

Russell 2000 (RUT): -0.60% to 2,352.21

On September 2, 2025, U.S. stock markets started the month lower, with the Dow Jones Industrial Average falling 0.6%, the S&P 500 dropping 0.7%, and the Nasdaq Composite declining 0.8%.

The U.S. dollar index rose 0.6%, while Bitcoin climbed to $111,400. Investors are focused on upcoming labor market data, particularly the August jobs report, which could influence Federal Reserve interest rate decisions later in September. Despite September's historical weakness, analysts remain optimistic about the tech and AI sectors, citing strong earnings and expected rate cuts.

Gold futures hit a record high of $3,600 per ounce, driven by market volatility and tariff uncertainty, boosting shares of Newmont and Barrick Mining.

U.S. stock futures rose on September 3, 2025, with Nasdaq 100 futures up 0.6% and S&P 500 futures up 0.4%, driven by a favorable antitrust ruling allowing Google to retain its Chrome browser, while investors awaited the JOLTS report and corporate earnings from Macy's, Salesforce, and Dollar Tree.

Key Movers: Winners and Losers

The tech sector, particularly chip stocks, led the downturn, with Nvidia down 2% and the PHLX Semiconductor Index falling 1%. Kraft Heinz plummeted 7% after announcing a split into two companies, undoing its 2015 merger.

Constellation Brands dropped 6.6% due to reduced profit guidance from tariff impacts and weaker beer demand. Conversely, Ulta Beauty surged 8.1% after positive analyst upgrades, and PepsiCo gained 1% following activist investor Elliott Management's $4 billion stake announcement.

Today’s Economic Calendar — Wednesday, September 3

10:00 am- Job openings (July) and Factory orders (July).

2:00 pm- Fed Beige Book

Auto sales (Aug).

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The Dow declined 0.55%, closing at 45,295.81. Key support sits at 45,141.27; holding above could spark a rebound toward 45,421.46 and 45,510.79.

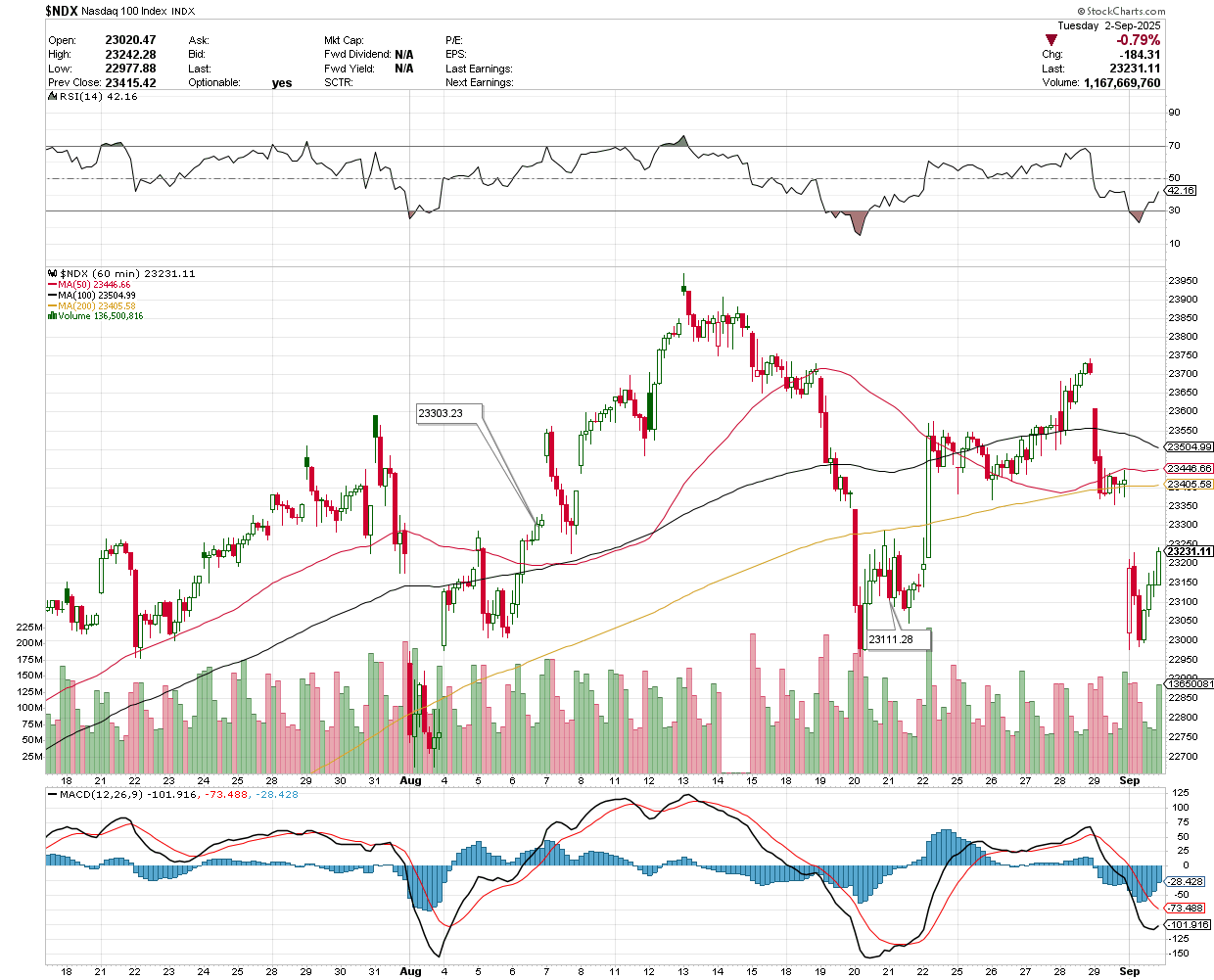

NASDAQ 100 (NDX)

The index ended at 23,231.11. Key support lies at 23,111.28; holding above this level could open upside toward 23,303.23 and 23,405.58.

S&P 500 (SPX)

Closing at 6,415.54, the S&P is trading above support at 6,388.41. If buyers hold this level, potential upside targets are 6,440.48 and 6,452.50.

SPDR S&P 500 ETF Trust (SPY)

SPY was trading at $643.23 pre-market, with support at $641.80 and potential upside targets at $644.30 and $645.23.

Invesco QQQ Trust Series 1(QQQ)

QQQ was trading at $569.35 pre-market, with key support at $567.06. Holding above this level keeps upside targets in play at $571.01 and $571.99.

IWM was trading at $233.61 pre-market. Support is nearby at $231.86, while the potential upside levels stand at $234.87 and $235.34.

VanEck Semiconductor ETF (SMH)

SMH traded at $287.70 pre-market. Support lies at $286.48; a bounce could test $289.10 and $290.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL was at $25.41 pre-market. Support at $25.25 must hold to fuel a move towards $25.51 and $25.629.

Earnings Snapshot: Reporting Today (Before Open)

Dollar Tree Inc (DLTR)

Sales Growth- DLTR reported a 12.3% increase in sales from continuing operations, reaching $4.6 billion in Q2 2025.

Same-Store Sales- The Dollar Tree banner saw a 6.5% rise in same-store net sales, surpassing the consensus estimate of 5.2%, driven by a 3.0% increase in customer traffic.

Sales and Profit Forecasts- Dollar Tree raised its 2025 annual sales and profit forecasts due to strong demand for cheaper groceries, apparel, and home decor across various income groups. The company, which sold its Family Dollar banner for $1 billion, now projects net sales of $19.3 billion to $19.5 billion, up from $18.5 billion to $19.1 billion, and adjusted earnings per share of $5.32 to $5.72, compared to the prior $5.15 to $5.65.

DLTR was trading at $104.20 pre-market, with resistance at $104.79 and potential downside targets at $103.02 and $102.35.

Earnings Snapshot: Reporting Today (After Close)

Salesforce Inc (CRM)

Q2 Earnings Expectations- Salesforce reports Q2 earnings after market close on September 3, 2025, with analysts forecasting revenue of $10.14B and EPS of $2.78, both up over 8% year-over-year, testing AI-driven growth.

Key Growth Drivers- AI platforms like Agentforce and Data Cloud are expected to drive recurring revenue and margin expansion, supported by a reliable execution record.

Potential Risks- Softer enterprise IT demand, tougher macro conditions, or slower AI tool adoption could pressure near-term results and guidance.

Outlook- Investors will focus on guidance and subscription trends to gauge whether Salesforce can sustain scalable growth through AI adoption.

CRM was trading at $253.97 pre-market. Support is at $250.71, while the potential upside levels stand at $255.89 and $258.

Figma Inc (FIG)

Earnings Expectations- First public earnings report on September 3, 2025, will test Figma’s growth trajectory and valuation sustainability.

Key Metrics- 132% Net Dollar Retention and 47% YoY growth in >$100K ARR customers (1,031) highlight strong retention and enterprise potential.

Financial Strengths- 91% gross margin underscores SaaS competitiveness, supported by March 2025 pricing increase.

Challenges Ahead- AI investments may reduce margins to 87% in 2025 and 83% in 2026, challenging the 240x forward P/E valuation. Earnings will assess Figma’s ability to balance growth and profitability amid high valuation expectations.

FIG was trading at $66.49 pre-market. Support is at $66, while the potential upside levels stand at $66.74 and $67.

Hewlett Packard Enterprise Co (HPE)

Earnings Overview- HPE reports Q3 earnings after market close on Wednesday, September 3, 2025, with expected revenue of $8.54B (+10.8% YoY) and EPS of $0.41.

Recent Performance- Last quarter, HPE beat revenue estimates by 2.3%, reporting $7.63B (+5.9% YoY), with strong ARR and EPS beats.

AI Influence- HPE is positioned to benefit from generative AI trends, though it trails semiconductor leaders like Nvidia and AMD in market attention.

HPE was trading at $22.78 pre-market. Support is at $22.62, while the potential upside levels stand at $22.855 and $23.