Markets Overview – September 9, 2025

Major Indices Surged :

S&P 500 (SPX): +0.27% to 6,512.62

Dow Jones (DJI): +0.43% to 45,711.34

Russell 2000 (RUT): -0.55% to 2,381.82

On September 9, 2025, major U.S. stock indexes—the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite—closed at record highs, each gaining around 0.3-0.4%, driven by expectations of Federal Reserve interest rate cuts following a weak jobs report. Investors awaited key inflation data, with producer prices due Wednesday and consumer prices Thursday, as these could influence the Fed’s decisions. The 10-year Treasury yield rose to 4.09%.

Gold futures dipped to $3,680/ounce, while WTI crude oil futures rose 0.7% to $62.70/barrel. Bitcoin fell to $111,500, and the U.S. dollar index rose 0.3% to 97.74. The economy saw a revision of 911,000 fewer jobs added through March 2025, raising concerns about labor market weakness and reinforcing rate-cut expectations.

Key Movers: Winners and Losers

UnitedHealth Group (UNH) led gains, soaring nearly 9% after projecting 78% of its Medicare Advantage enrollees would qualify for bonus payments. Other health insurers like Centene (CNC) also rose 7.7%, while Humana (HUM) dropped 12% due to stricter CMS rating criteria.

Apple (AAPL) fell 1.5% after unveiling the iPhone 17 lineup, which included the slim iPhone 17 Air. Mega-cap stocks like Alphabet (GOOG), Meta (META), Nvidia (NVDA), and Amazon (AMZN) gained, but Broadcom (AVGO) fell 2.6%.

Oracle (ORCL) surged 25% in after-hours trading, boosting its cloud infrastructure sales outlook to $18 billion due to AI demand. Nebius Group (NBIS) soared 50% after a $19.4 billion AI deal with Microsoft. CoreWeave (CRWV) rose 7% after launching an AI-focused venture fund. Anglo American and Teck Resources announced a $53 billion merger to form a copper giant, driven by AI and renewable energy demand.

Today’s Economic Calendar — Wednesday, September 10

8:30 am- Producer price index & Core PPI (Aug & YoY).

10:00 am- Wholesale inventories (July)

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The Dow gained +0.43%, closing at 45,711.34. Key support sits at 45,640.67; holding above could spark a rebound toward 45,750 and 45,800.

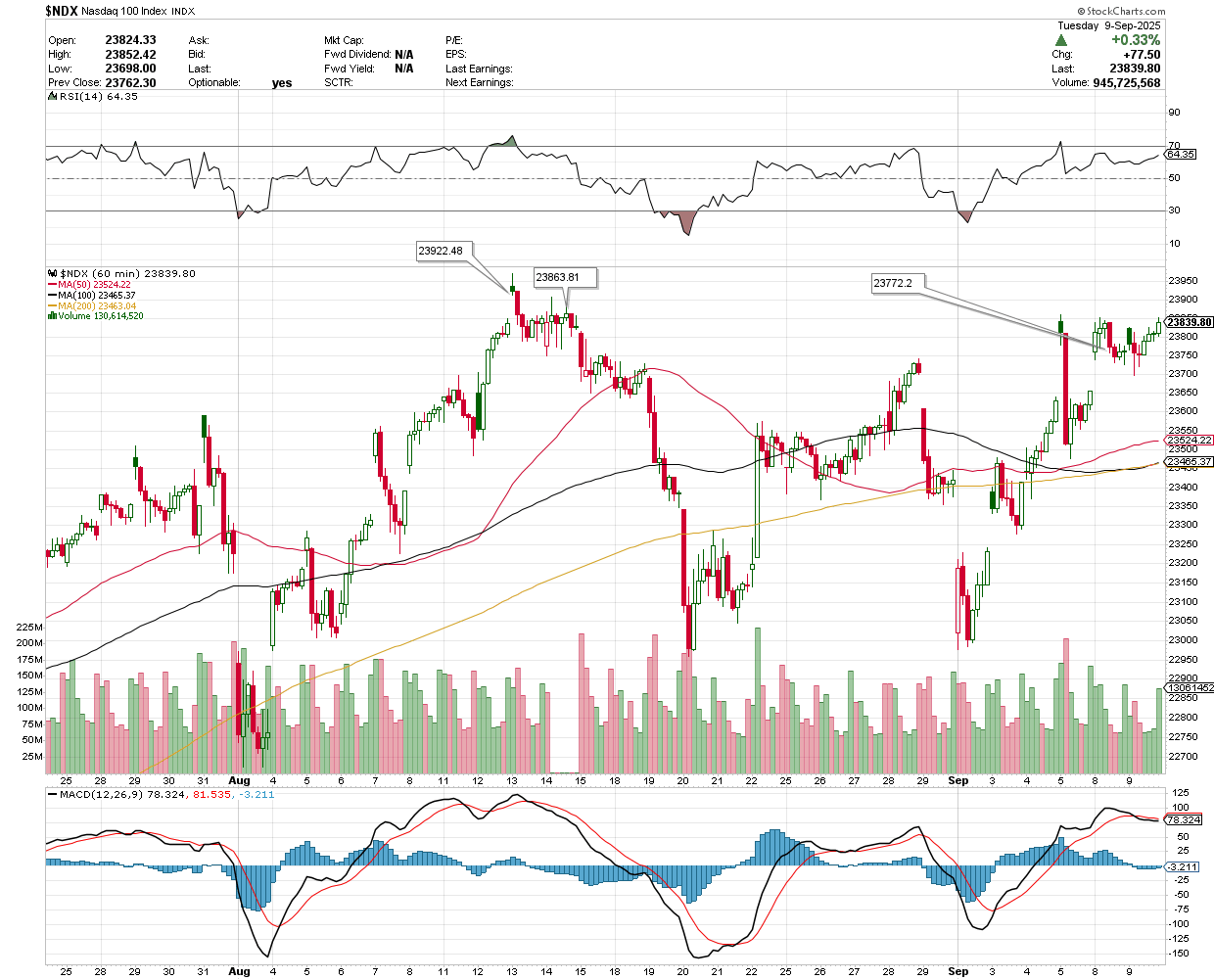

NASDAQ 100 (NDX)

The index ended at 23,839.80. Key support lies at 23,772.20; holding above this level could open upside toward 23,863.81 and 23,922.48.

S&P 500 (SPX)

Closing at 6,512.61, the S&P is trading above support at 6,503.84. If buyers hold this level, the potential upside target is 6,532.65.

SPDR S&P 500 ETF Trust (SPY)

SPY was trading at $652.79 pre-market, with support at $650 and potential upside targets at $655 and $656.

Invesco QQQ Trust Series 1(QQQ)

QQQ was trading at $582.71 pre-market, with key support at $580.83. Holding above this level keeps upside targets in play at $585.

IWM was trading at $236.21 pre-market. Support is nearby at $234.59, while the potential upside levels stand at $237.77 and $239.16.

VanEck Semiconductor ETF (SMH)

SMH traded at $299.30 pre-market. Support lies at $298; a bounce could test $300 and $301.95.

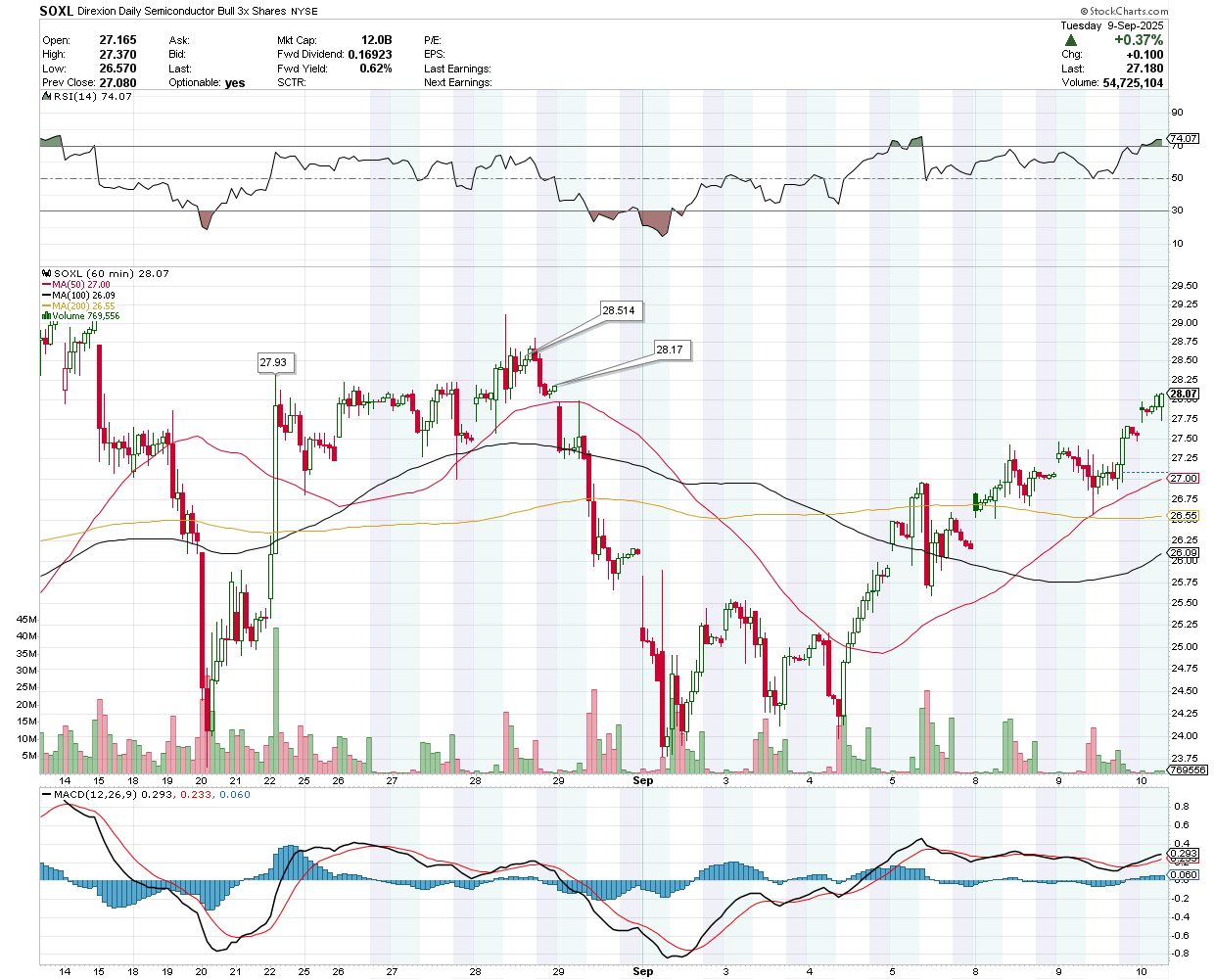

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL was at $28.07 pre-market. Support at $27.93 must hold to fuel a move towards $28.17 and $28.514.

Earnings Snapshot: Reported Yesterday (After Close)

AeroVironment, Inc. (AVAV)

Q1 Performance- AeroVironment (AVAV) reported Q1 revenue of $454.7 million, up 140% YoY, beating estimates by 2.8%, but adjusted EPS of $0.32 missed by 6.7%.

Financial Guidance- Full-year revenue guidance of $1.95 billion is 2.2% below estimates, with raised EPS guidance to $3.65 and EBITDA guidance of $310 million slightly below expectations.

Margin Challenges- Operating margin fell to -15.2% from 12.2% YoY, driven by a higher mix of service contracts and early-stage product investments.

Strategic Acquisitions- The Blue Halo acquisition bolstered AVAV’s portfolio in space technologies, directed energy, and cyber solutions, contributing to revenue and backlog growth.

Key Contracts- Secured a $240 million space laser communications contract and a $95 million Freedom Eagle One missile deal, strengthening AVAV’s position in defense markets.

New Initiatives- Launched the HALO software ecosystem for unified mission software, supporting third-party device integration and aiming to drive future growth.

Future Outlook- Growth hinges on converting a $20 billion+ backlog into revenue, scaling production, and navigating competitive pressures and defense budget uncertainties.

AVAV was trading at $239 pre-market. Support is at $236.41, while the potential upside levels stand at $239.44, $242.81, and $244.08.

Earnings Snapshot: Reporting Today (Before Open)

Chewy Inc (CHWY)

Earnings Expectations- Chewy is expected to report fiscal Q2 2025 EPS of $0.33 (up 37.5% YoY) and revenue of $3.08 billion (up 7.75% YoY), driven by its subscription-based model.

Recent Performance- In Q1 2025, Chewy achieved net sales of $3.12 billion (up 8.3% YoY) and adjusted EPS of $0.35, surpassing expectations, with a 3.8% increase in active customers to 20.76 million.

Competitive Edge- Chewy’s focus on customer service and extensive product offerings fosters strong brand loyalty, giving it a competitive advantage in the pet e-commerce market.

Outlook- The Q2 earnings report will test Chewy’s ability to sustain growth, manage costs, and innovate to maintain its position in the competitive online retail landscape.

CHWY was trading at $39 pre-market, with resistance at $39.43 and potential downside levels at $38.59 and $38.385.

Daktronics Inc (DAKT)

Earnings Expectations- Analysts forecast Q1 2026 EPS of $0.21 (down from $0.36 YoY) and revenue of $196.9 million, a 12.91% YoY decline, signaling ongoing challenges.

Recent Results- Q4 2025 reported a $0.19 per share loss against an expected $0.15 profit, with revenue of $172.6 million missing the $193.97 million forecast. Operating income margin fell to 6.6% from 10.6% YoY, highlighting profitability pressures.

Growth Targets- Daktronics aims for a 7-10% CAGR by 2028, targeting 10-12% operating margins and 17-20% return on invested capital, with revenue growth expected in 2026.

Market Challenges- Operating in a competitive market, Daktronics’ reliance on large projects introduces revenue volatility, requiring consistent execution to meet goals.

DAKT was trading at $18 pre-market. Support is at $17.80, while the potential upside level stands at $18.21.

Earnings Snapshot: Reporting Today (After Close)

Oxford Industries Inc (OXM)

Stock Performance- Oxford Industries (OXM) stock is down 48% YTD, trading just above $40, reflecting a challenging year as it approaches its earnings report.

Earnings Expectations- Analysts anticipate Q2 EPS of $1.18, down from $2.77 YoY, with revenue projected at $406.12 million, a 3.28% YoY decline, signaling weaker profitability and sales.

Recent Performance- Last quarter, OXM reported $392.9 million in revenue, down 1.3% year-on-year but beating estimates by 2.1%, though EPS guidance missed expectations significantly.

Company Strengths- Despite challenges, Oxford Industries benefits from strong brand recognition and a loyal customer base, suggesting potential for recovery.

OXM was trading at $41.10 pre-market. Support is at $40.63, while the potential upside levels stand at $41.33 and $41.60.