Markets Overview – August 28, 2025

Major Indices Surged :

S&P 500 (SPX): +0.32% to 6,501.85

Dow Jones (DJI): +0.16% to 45,636.90

Russell 2000 (RUT): +0.19% to 2,378.41

S&P 500 and Dow Jones Industrial Average hit record highs, up 0.3% and 0.2% respectively, while Nasdaq Composite rose 0.5%, nearing its own record; all indexes on track for fourth consecutive month of gains.

Nvidia shares fell nearly 1% despite beating revenue and profit estimates, as high investor expectations and slightly underwhelming data center revenue weighed on the stock.

Weekly jobless claims met expectations, and Q2 GDP growth was revised upward; markets await the Federal Reserve’s preferred inflation report on August 29, 2025, amid rate cut speculation.

Bitcoin at $112,000, up from $110,900; U.S. dollar index down 0.4% to 97.88; 10-year Treasury yield fell to 4.21%; WTI crude oil futures gained 0.3% to $64.30/barrel; gold futures rose 0.8% to $3,475/ounce.

Key Movers: Winners and Losers

Broadcom gained 3%, Alphabet 2%, Apple and Amazon 1% each, while Tesla dropped 1% after weak EU sales; Datadog surged 7% as the top S&P 500 performer.

Snowflake jumped 20% after strong results and raised guidance; CrowdStrike and HP Inc. up 4.5% each; Hormel Foods fell 13% on weak profit outlook; Cooper Companies and Brown-Forman down nearly 13% and 4.9% respectively.

Today’s Economic Calendar — Friday, August 29

8:30 am- Personal income & Personal spending (July).

8:30 am- PCE index & Core PCE index (July & YoY).

8:30 am- Advanced U.S. trade balance in goods (July), and Advanced retail & wholesale inventories (July).

9:45 am- Chicago Business Barometer (PMI) (Aug).

10:00 am- Consumer sentiment (final) (Aug).

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The Dow gained 0.16%, closing at 45,636.90. Key support sits at 45,525-45,500; holding above could spark a rebound toward 45,665.91 and 45,762.77.

NASDAQ 100 (NDX)

The index ended at 23,703.45. Key support lies at 23,595.38; holding above this level could open upside toward 23,748.55 and 23,842.95.

S&P 500 (SPX)

Closing at 6,501.86, the S&P is trading above support at 6,487. If buyers hold this level, potential upside targets are 6,508 and 6,525.

SPDR S&P 500 ETF Trust (SPY)

SPY was trading at $647.40 pre-market, with support at $646.12 and potential upside targets at $648.97 and $649.84.

Invesco QQQ Trust Series 1(QQQ)

QQQ was trading at $574.48 pre-market, with key support at $573.47. Holding above this level keeps upside targets in play at $575.20 and $577.07.

IWM was trading at $235.84 pre-market. Support is nearby at $234.87, while the potential upside levels stand at $236.30 and $237.15.

VanEck Semiconductor ETF (SMH)

SMH traded at $295.81 pre-market. Support lies at $295; a bounce could test $296.73 and $298.25.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL was at $27.43 pre-market. Support at $27.13 must hold to fuel a move towards $27.76 and $27.98.

Earnings Snapshot: Reported Yesterday (After Close)

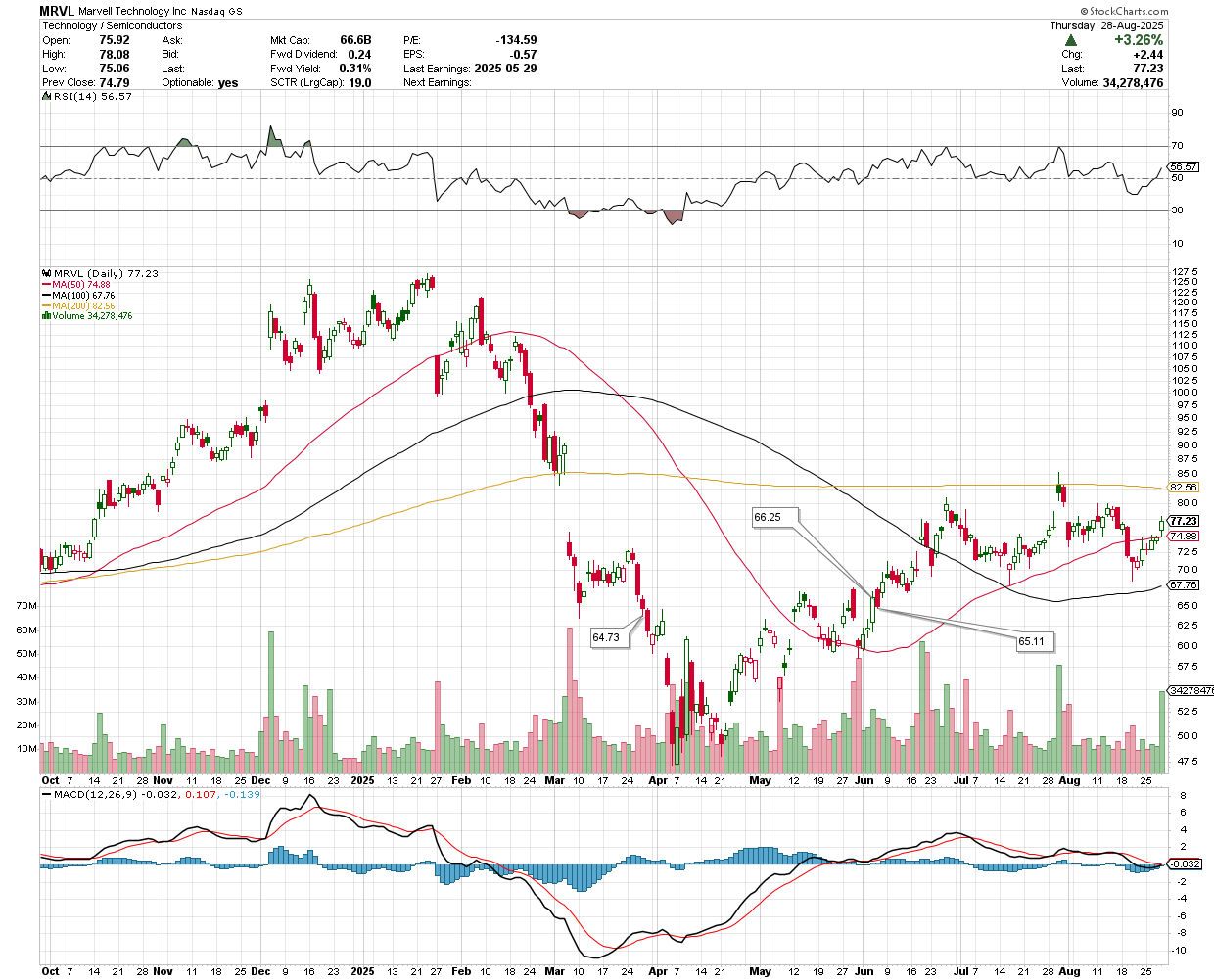

Marvell Technology Inc (MRVL)

Financial Performance and Investor Sentiment - Marvell’s Q2 2026 revenue hit $2.006B, up 58%, but the stock dropped 12% due to concerns over flat Q3 data center revenue.

AI Strategy- Divested Automotive Ethernet for $2.5B, investing 30.48% of 2025 revenue in AI R&D, securing $10–$12B hyperscaler deals.

Competitive Challenges- Faces Broadcom in the $55B AI chip market, aiming for a 20% share by 2028, but scaling custom silicon is capital-intensive.

Supply Chain Risks- DDR4 shortages, copper volatility, and TSMC reliance expose Marvell to disruptions; 2025 price hike may strain hyperscaler ties.

Investment Outlook- 79% FY2026 earnings growth projected, but supply chain and geopolitical risks challenge long-term gains in the AI market.

MRVL was trading at $65.90 during pre-market. The stock has immediate resistance at $66.25, with potential for a downside towards $65.11 and $64.73.

Earnings Snapshot: Reporting Today (Before Open)

Alibaba Group Holding Ltd (BABA)

Financial Performance- Q1 2026 revenue increased 2% to 247.65 billion yuan ($34.6B), below the 252.9 billion yuan estimate; net income of 43.11 billion yuan exceeded the 28.5 billion yuan forecast.

Cloud Division Growth- Cloud revenue grew 26% to 33.4 billion yuan, up from 18% in the prior quarter, fueled by AI monetization efforts.

E-Commerce and Market Context- Core China e-commerce revenue improved, driving a 40%+ stock rise in 2025 despite a slowing Chinese economy in July.

AI Investments- Q1 2026 aggressive launches of AI models and cloud-based AI services bolster Alibaba’s position as a global AI leader.

BABA was trading at $123.35 pre-market. Support at $122.31 must hold to fuel a move towards $123.82 and $124.59.

Frontline Plc (FRO)

Financial Performance- Q2 2025 profit was $77.9 million, with a net income of 35 cents per share; adjusted earnings were 36 cents per share.

Revenue- Q2 2025 revenue reached $479.9 million, with adjusted revenue of $285.3 million.

FRO was trading at $20.70 during pre-market. The stock has immediate support at $20.43, with potential for a rebound to $20.785 and $20.95.

BRP Inc (DOOO)

Financial Performance- Q2 2025 revenue rose 4.3% to C$1.89 billion, with adjusted EPS of C$0.92, nearly doubling analyst expectations; normalized EBITDA fell 9.2% due to higher operating costs.

Product Segment Performance- Year-round products (e.g., off-road vehicles) grew 13.1% in revenue, driven by strong demand and pricing; parts and OEM engines up 7.2%; seasonal products (e.g., personal watercraft) dropped 13.3%.

Future Outlook- Raised fiscal 2026 revenue guidance to C$8.15-8.3 billion and EPS to C$4.25-4.75, supported by C$420 million in production and capital spending.

Broader Implications- Strong demand for year-round recreation products offsets seasonal weaknesses, positioning BRP well in the evolving outdoor market if trends persist.

DOOO was trading at $61.75 during pre-market. The stock has immediate support at $61.15, with potential for a rebound to $63.07 and $63.44.