Markets Overview – September 8, 2025

Major Indices Surged :

S&P 500 (SPX): +0.21% to 6,495.16

Dow Jones (DJI): +0.25% to 45,514.95

Russell 2000 (RUT): +0.16% to 2,394.89

On September 8, 2025, U.S. stock markets closed higher, with the Nasdaq Composite hitting a record high, up 0.5%, while the S&P 500 and Dow Jones Industrial Average gained 0.2% and 0.3%, respectively. Investors were optimistic about potential Federal Reserve interest rate cuts, spurred by a weaker-than-expected August jobs report, with key inflation data expected later in the week.

The 10-year Treasury yield dropped to 4.04%, its lowest since April. Gold futures hit a record high at $3,680/ounce, crude oil futures rose to $63.32/barrel, and Bitcoin traded at $112,900. The U.S. dollar index fell 0.3% to 97.44.

Traders increased bets on multiple Fed rate cuts in 2025, with a 100% chance of a cut next week.

Key Movers: Winners and Losers

Tech stocks showed mixed results, with Broadcom up 3%, Amazon up 1.5%, but Tesla down over 1%. AppLovin and Robinhood surged 12% and 16%, respectively, after being added to the S&P 500.

Broadcom’s strong earnings and potential competition with Nvidia were highlighted, with analysts suggesting both could benefit from the growing AI market. StubHub announced an IPO aiming to raise $850 million, targeting a $9.3 billion valuation.

S&P 500 Advancers: Take-Two Interactive (+3.8%), Uber (+3.7%), Broadcom (+3.2%).

S&P 500 Decliners: CVS Health (-4.8%), Brown-Forman (-4.6%), Norwegian Cruise Line (-4.4%).

Other Notable Movers: QuantumScape (+21%), EchoStar (+20%), Forward Industries (+59%). Forward Industries pivoted to a Solana-focused crypto treasury, boosting its stock. EchoStar sold spectrum licenses to SpaceX for $17 billion, easing regulatory pressures.

Today’s Economic Calendar — Tuesday, September 9

6:00 am- NFIB optimism index (Aug) (100.7 median forecast vs 100.3 previous).

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The Dow gained +0.25%, closing at 45,514.95. Key support sits at 45,382.78; holding above could spark a rebound toward 45,603.39 and 45,698.33.

NASDAQ 100 (NDX)

The index ended at 23,762.30. Key support lies at 23,704.69; holding above this level could open upside toward 23,863.81 and 23,922.48.

S&P 500 (SPX)

Closing at 6,495.15, the S&P is trading above support at 6,460.93. If buyers hold this level, potential upside targets are 6,503.84 and 6,532.65.

SPDR S&P 500 ETF Trust (SPY)

SPY was trading at $648.97 pre-market, with support at $648.19 and potential upside targets at $649.86 and $652.21.

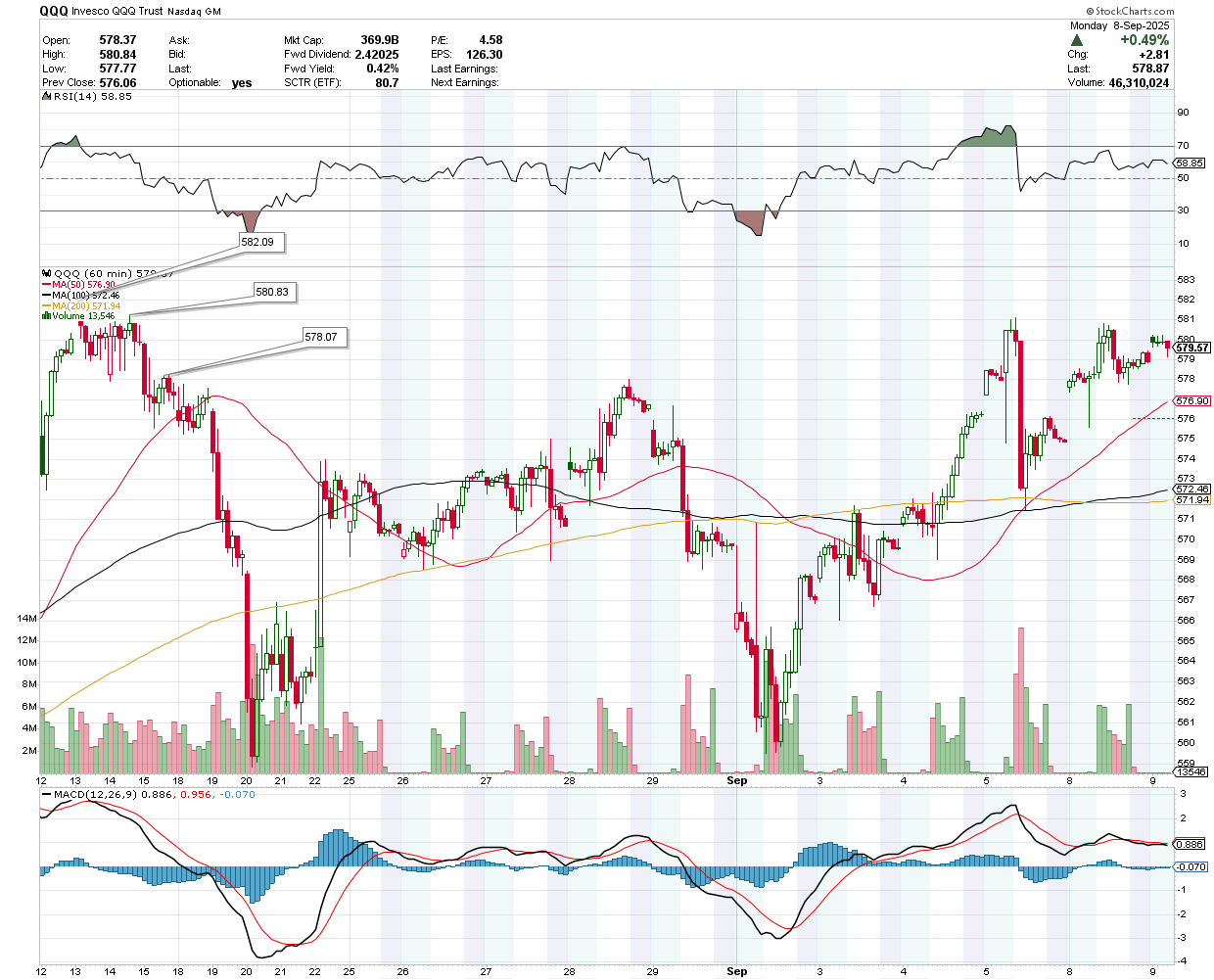

Invesco QQQ Trust Series 1(QQQ)

QQQ was trading at $579.62 pre-market, with key support at $578.07. Holding above this level keeps upside targets in play at $580.83 and $582.09.

IWM was trading at $238.19 pre-market. Support is nearby at $237.77, while the potential upside level stands at $239.16.

VanEck Semiconductor ETF (SMH)

SMH traded at $297.87 pre-market. Support lies at $296.84; a bounce could test $299.71.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL was at $27.16 pre-market. Support at $26.95 must hold to fuel a move towards $27.26 and $27.54.

Earnings Snapshot: Reporting Today (Before Open)

Core & Main Inc (CNM)

Company Overview- Core & Main (NYSE: CNM) is a top distributor of water, sewer, and fire protection products.

Recent Performance- Q1 Fiscal 2025 saw record $1.9B net sales from organic growth and $150M in acquisitions, though gross margins fell to 26.9% due to higher inventory costs.

Earnings Expectations- Earnings set for September 9, 2025, pre-market, forecasting $0.79 adjusted EPS and 7.6% YoY revenue growth to $2.12B.

Risks- Growth depends on acquisitions, raising integration and debt issues; plus, margin squeezes and infrastructure spending delays from regulations and competition.

CNM was trading at $66.99 pre-market. Support is at $66.59, while the potential upside levels stand at $67.26 and $67.50.

Earnings Snapshot: Reporting Today (After Close)

Oracle Corp (ORCL)

Earnings Overview- Oracle (ORCL) reports Q1 fiscal 2026 earnings on September 9, 2025, with expected EPS of $1.47 and revenue of $15 billion, driven by 12–14% YoY revenue growth guidance.

Cloud Infrastructure Growth- Oracle Cloud Infrastructure (OCI) saw 52% YoY growth last quarter, fueled by demand for AI and traditional enterprise workloads, with a $138 billion backlog signaling strong future revenue potential.

Financial Performance- Last quarter’s revenue rose 11% to $15.9 billion, with adjusted EPS at $1.70 and operating cash flow up 12% to $20.8 billion, but heavy capex and $100 billion debt raise profitability concerns.

Strategic Investments- Oracle’s $30 billion “Stargate” data center project and partnerships with Microsoft, Google, and Amazon aim to scale OCI, potentially generating $60 billion in annual revenue by 2028.

Valuation Concerns- Trading at a GAAP P/E of 53.6, Oracle’s valuation exceeds the sector median, leaving little room for error as investors demand proof of profitable growth from its cloud pivot.

Investor Expectations- The market seeks evidence that Oracle can sustain 40%+ cloud growth, convert its backlog into revenue, and maintain margins amidst rising capex and debt pressures.

ORCL was trading at $240.80 pre-market. Support is at $238.48, while the potential upside levels stand at $242.54 and $244.29.

Rubrik Inc (RBRK)

Earnings Expectations- Rubrik (RBRK) is set to release Q2 fiscal 2026 earnings on September 9, 2025. Revenue guidance is $281-283 million (consensus $282.2 million, +37.7% YoY); EPS loss expected at 33 cents vs. 40 cents last year.

Key Growth Factors- Expansion to 2,381 high-value customers (+28% YoY) and Subscription ARR of $1.18 billion (+38% YoY); partnerships with Microsoft, Alphabet, Deloitte, NTT Data, and Rackspace drive top-line momentum.

RBRK was trading at $95.96 pre-market. Support is at $95.61, while the potential upside level stands at $97.01.

GameStop Corp (GME)

Company Overview- GameStop (NYSE: GME) is a brick-and-mortar video game retailer that has become a volatile meme stock with ongoing strategic shifts.

Earnings Expectations- Q2 earnings release after market close on September 9, 2025. Estimated EPS of $0.16 (up from $0.01 YoY) and revenue of $823.25 million (+3.12% YoY).

Q1 2025 Performance- Beat EPS estimates ($0.17 vs. $0.08) but missed revenue ($732.4M vs. $750M), with collectibles revenue up 54%.

Q4 2024 Performance- Exceeded EPS ($0.30 vs. $0.08) while revenue fell short ($1.28B vs. $1.48B).

Strategic Moves- Updated investment policy to include Bitcoin as a treasury reserve asset, initially boosting stock price but adding volatility risks.

Positive Factors- Loyal shareholder base, revenue diversification via collectibles, and innovative approaches like Bitcoin adoption.

Future Challenges- Success depends on navigating digital gaming shifts, competition, and effective strategy execution.

GME was trading at $23.20 pre-market. Support is at $23.114, while the potential upside levels stand at $23.30 and $23.38.