Markets Overview – August 11, 2025

Major Indices Declined :

S&P 500 (SPX): -0.25%

Dow Jones (DJI): -0.45%

Russell 2000 (RUT): -0.09%

On August 11, 2025, U.S. stock indexes dipped, with the S&P 500 and Nasdaq each down 0.3% and the Dow falling 0.5%, stepping back from recent highs.

Investors focused on the upcoming CPI report, expected to show inflation at 2.8% annually for July. Chip stocks Nvidia and AMD fell 0.3% after agreeing to share 15% of China chip revenues with the U.S. government.

Stock futures mostly dipped early Tuesday, with Dow futures up 0.17%, Nasdaq 100 down 0.02%, and S&P 500 down 0.35%, as investors awaited the July CPI report, expected to show 2.8% annual inflation and 3.1% core inflation. Investors ignored Trump’s 90-day tariff pause on Chinese goods, focusing on potential Fed rate cuts, with an 87% chance priced in for September.

Key Movers

Intel rose 3.5% amid a CEO-White House meeting, and Micron gained 4% after raising guidance. Gold futures dropped 2.48% to $3,404.7, oil edged up 0.13% to $63.96, and the 10-year Treasury yield held at 4.279%.

Intuit fell 5.7%, Hershey 4.8%, while TKO Group surged over 10%. C3.ai plummeted over 25% after weak results, and marijuana and meme stocks rallied.

Today’s Economic Calendar — Tuesday, August 12

6:00 am- NFIB optimism index for July (99.0 median forecast vs 98.6 previous).

8:30 am- Consumer Price Index and Core CPI for July & YoY.

2:00 pm- Monthly U.S. federal budget for July ($227.7B median forecast vs $244B previous).

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The index declined -0.45% to close at 43,975.09.

Support for the day: 43,915.86, with potential upside levels at 44,085.52 and 44,236.45.

NASDAQ 100 (NDX)

The index closed at 23,526.63, with support for the day at 23,449.34 and potential upside levels at 23,543.77 and 23,605.99.

S&P 500 (SPX)

The index closed at 6,373.45, with support at 6,348.18 and potential upside levels at 6,397.84 and 6,414.04.

SPDR S&P 500 ETF Trust (SPY)

The price was trading at $635.87 pre-market, with support at $634.66 and potential upside levels at $637.35 and $638.95.

Invesco QQQ Trust Series 1(QQQ)

The price was trading at $572.92 pre-market, with support at $571.91 and potential upside levels at $574.36 and $575.96.

The price was trading at $220.51 pre-market, with support at $220.12 and potential upside levels at $221.05 and $221.45.

VanEck Semiconductor ETF (SMH)

The price was trading at $293.90 pre-market, with support at $293.66 and potential upside levels at $294.35 and $294.92.

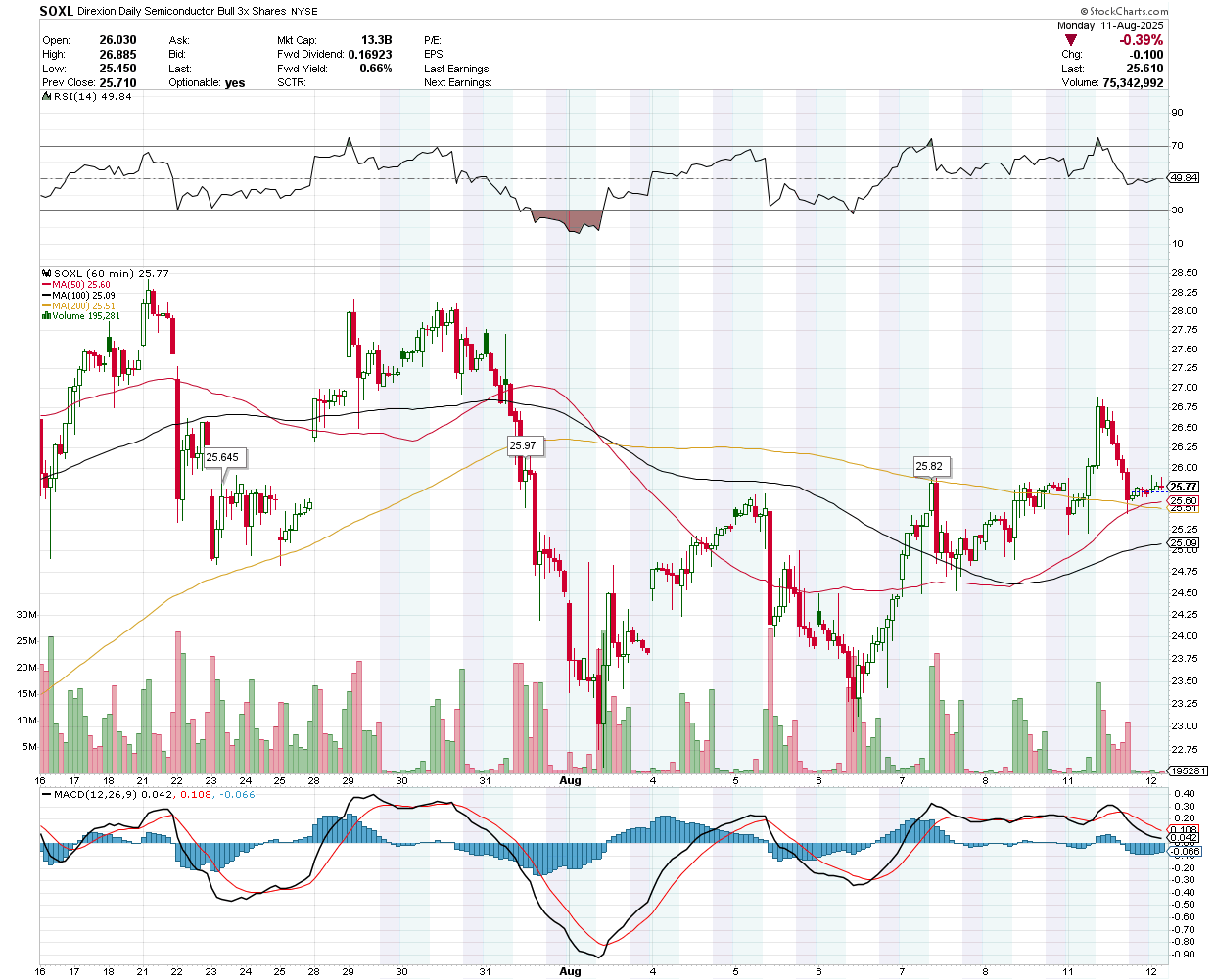

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

The price was trading at $25.77 pre-market, with support at $25.645 and potential upside levels at $25.82 and $25.97.

Earnings Snapshot: Reported Today (Before Open)

Sea Ltd (SE)

Sea Limited reported a robust Q2 2025 with total GAAP revenue of US$5.3 billion (up 38.2% YoY), gross profit of US$2.4 billion (up 52.1% YoY), and net income of US$414.2 million, driven by strong growth in e-commerce (Shopee: US$3.8 billion revenue, 28.2% GMV growth), digital financial services (Monee: US$882.8 million revenue, 70.0% YoY growth), and digital entertainment (Garena: US$559.1 million revenue, 28.4% YoY growth), with total adjusted EBITDA rising 84.9% to US$829.2 million.

The price was trading at $158.50 pre-market, with support at $158.01 and potential upside levels at $160.06 and $161.30.

On Holding AG (ONON)

On Holding AG (NYSE: ONON) reported record Q2 2025 results, with net sales reaching CHF 749.2 million, up 32.0% year-over-year (38.2% on a constant currency basis), driven by a 47.2% increase in direct-to-consumer sales (CHF 308.3 million) and a 23.1% rise in wholesale sales (CHF 441.0 million).

Gross profit grew 35.4% to CHF 460.8 million, with a gross profit margin of 61.5% (up from 59.9%), and adjusted EBITDA increased 50.0% to CHF 136.1 million, with an 18.2% margin. However, net income fell 232.7% to a loss of CHF 40.9 million, with basic and diluted EPS at CHF -0.12, impacted by foreign exchange losses.

For the six-month period, net sales rose 37.2% to CHF 1,475.8 million, gross profit increased 39.2% to CHF 896.1 million (60.7% margin), and adjusted EBITDA grew 52.2% to CHF 256.1 million, though net income dropped 87.1% to CHF 15.8 million. On raised its full-year 2025 guidance, expecting net sales of at least CHF 2.91 billion (31% growth on a constant currency basis), a gross profit margin of 60.5-61.0%, and an adjusted EBITDA margin of 17.0-17.5%.

The price was trading at $50.55 pre-market, with support at $50 and potential upside levels at $50.97 and $51.47.

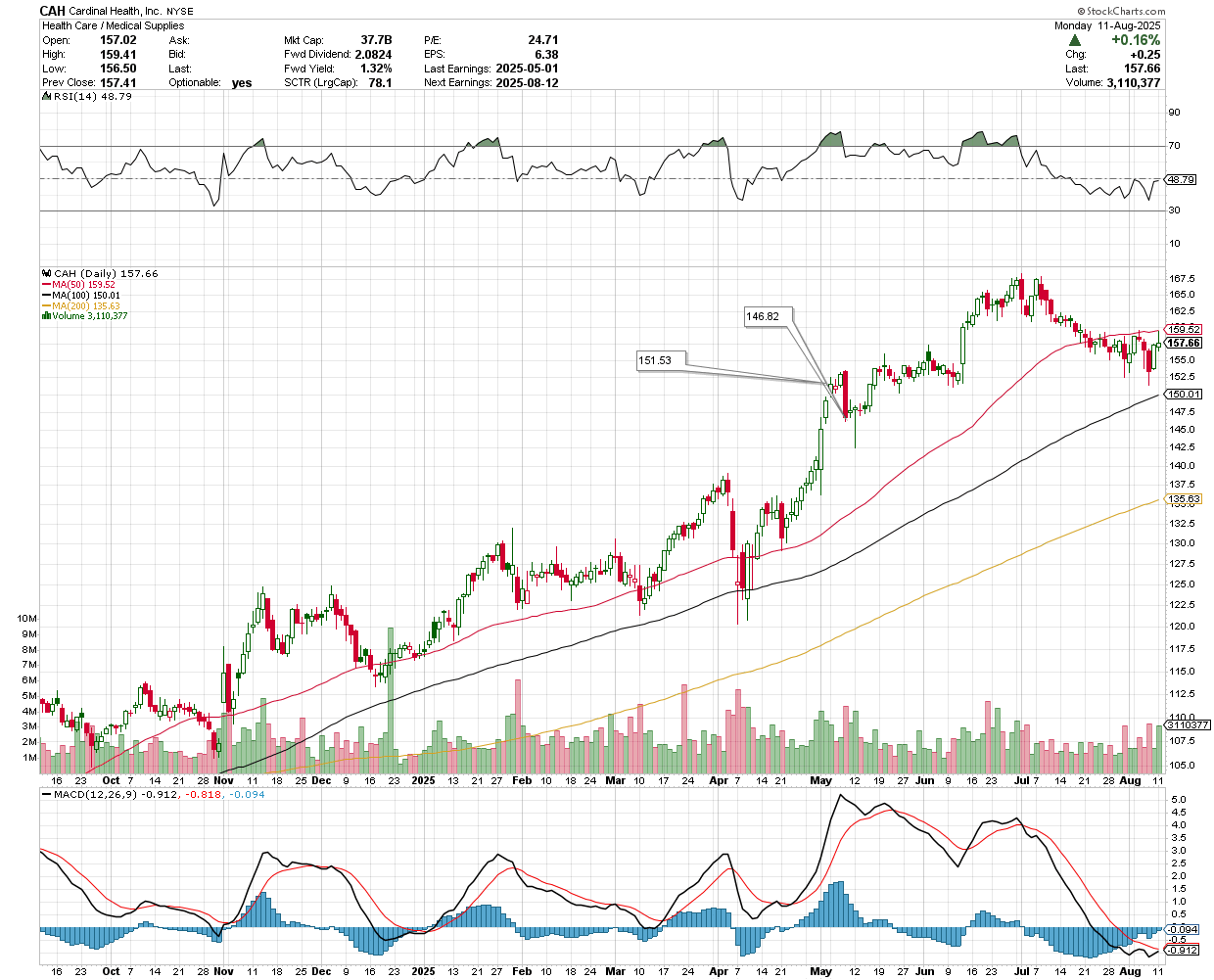

Cardinal Health Inc (CAH)

Cardinal Health’s Q4 FY2025 revenue of $60.2 billion missed estimates, but adjusted EPS rose 13% to $2.08, beating forecasts, with all five segments posting double-digit profit growth. Full-year revenue fell 2% to $222.6 billion (up 18% excluding the expired OptumRx contract), while adjusted EPS climbed 9% to $8.24. The company raised FY2026 EPS guidance to $9.30–$9.50, announced the acquisition of Solaris Health, and reported $2.5 billion in adjusted free cash flow, projecting $2.75–$3.25 billion for FY2026.

The price was trading at $148.90 pre-market, with support at $146.82 and potential upside levels at $150.01 and $151.53.

Earnings Snapshot: Reporting Today (After Close)

CoreWeave Inc (CRWV)

CoreWeave is set to report Q2 2025 results after market close on August 12, with analysts expecting revenue of about $1.08 billion—its first billion-dollar quarter—up from $981.6 million in Q1, but still posting an adjusted loss of $0.17–$0.23 per share due to heavy AI infrastructure spending of $3–$3.5 billion. Investors are watching the August 14 IPO lockup expiry, high client concentration, elevated debt, and the pending Core Scientific acquisition for potential risks.

The price was trading at $135.60 pre-market, with support at $134.55 and potential upside levels at $136.70 and $137.25.