Markets Overview – September 3, 2025

Major Indices Showed Mixed Performance :

S&P 500 (SPX): +0.51% to 6,448.27

Dow Jones (DJI): -0.05% to 45,271.23

Russell 2000 (RUT): -0.10% to 2,349.97

The S&P 500 gained about 0.5%, the Nasdaq composite rose nearly 1% on tech strength, while the Dow slipped around 0.1%. Oil prices declined, gold extended gains, and overall sentiment turned cautiously optimistic as softer labor data increased hopes for policy easing.

Job openings fell to the lowest level in nearly a year, raising expectations of a potential Fed rate cut later this month. Bond yields eased on the news.

Key Movers: Winners and Losers

Alphabet surged almost 9% to a record high after a favorable antitrust ruling, boosting Apple, which climbed about 4%.

Retailer Macy’s surged 20.7% on strong comparable-store results and raised guidance. Campbell’s, Western Digital, and others exceeded earnings forecasts and posted gains. Dollar Tree, despite solid Q2 sales, slumped (~-8.4%) after warning tariffs would weigh on profits. Health-tech companies like Intuitive Surgical also fell 6% amid tariff concerns.

Today’s Economic Calendar — Thursday, September 4

8:15 am- ADP employment for August

8:30 am- Initial jobless claims (August 30), U.S. productivity (revision) (Q2), and U.S. trade deficit (July).

9:45 am- S&P final U.S. services PMI (August)

10:00 am- ISM services (August).

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The Dow declined 0.05%, closing at 45,271.23. Key support sits at 45,172.98; holding above could spark a rebound toward 45,374.20 and 45,510.79.

NASDAQ 100 (NDX)

The index ended at 23,414.84. Key support lies at 23,303.23; holding above this level could open upside toward 23,471.97 and 23,535.99.

S&P 500 (SPX)

Closing at 6,448.26, the S&P is trading above support at 6,429.97. If buyers hold this level, potential upside targets are 6,460.22 and 6,474.59.

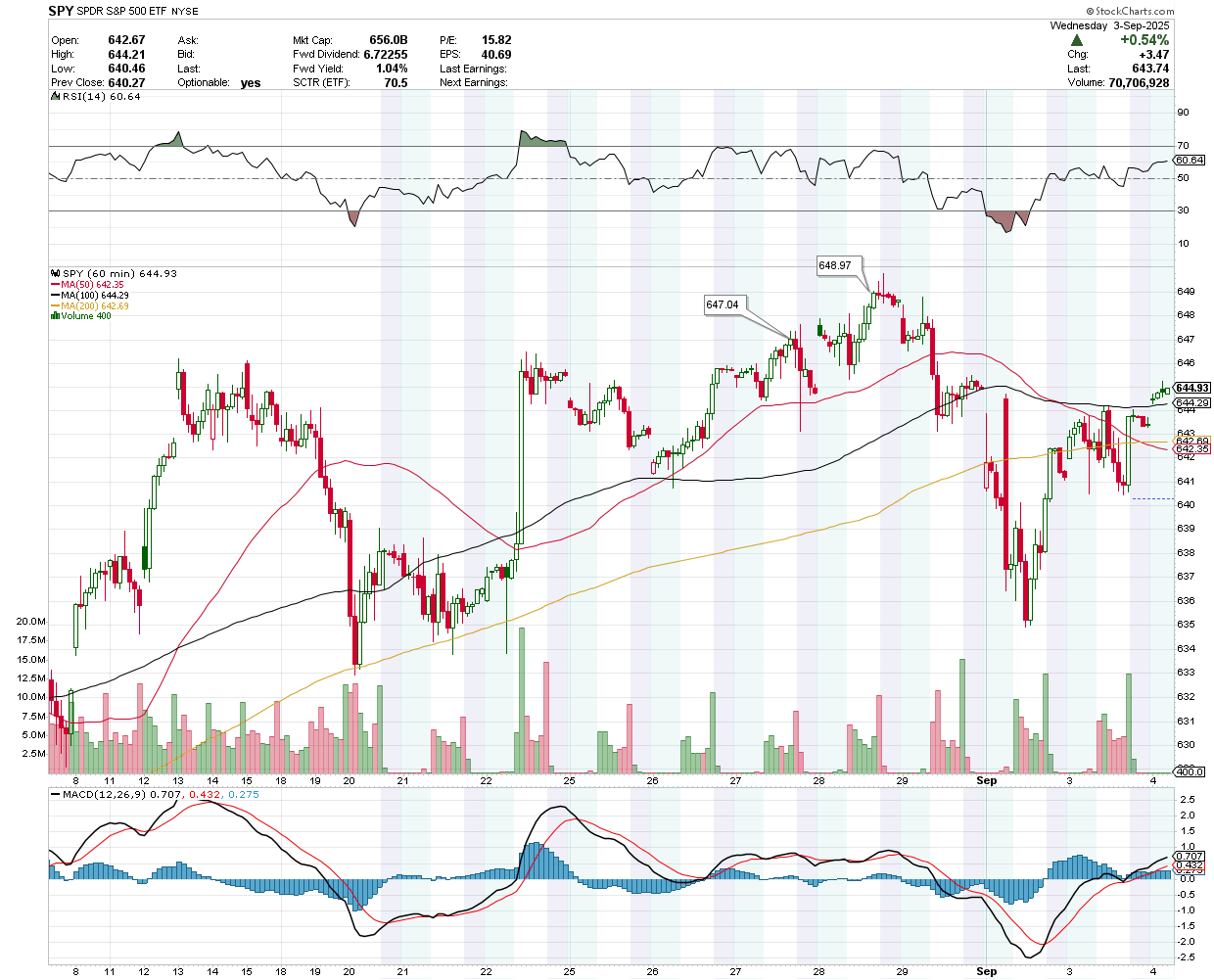

SPDR S&P 500 ETF Trust (SPY)

SPY was trading at $644.93 pre-market, with support at $642.69 and potential upside targets at $647.04 and $648.97.

Invesco QQQ Trust Series 1(QQQ)

QQQ was trading at $571.67 pre-market, with key support at $570.07. Holding above this level keeps upside targets in play at $572.89 and $573.95.

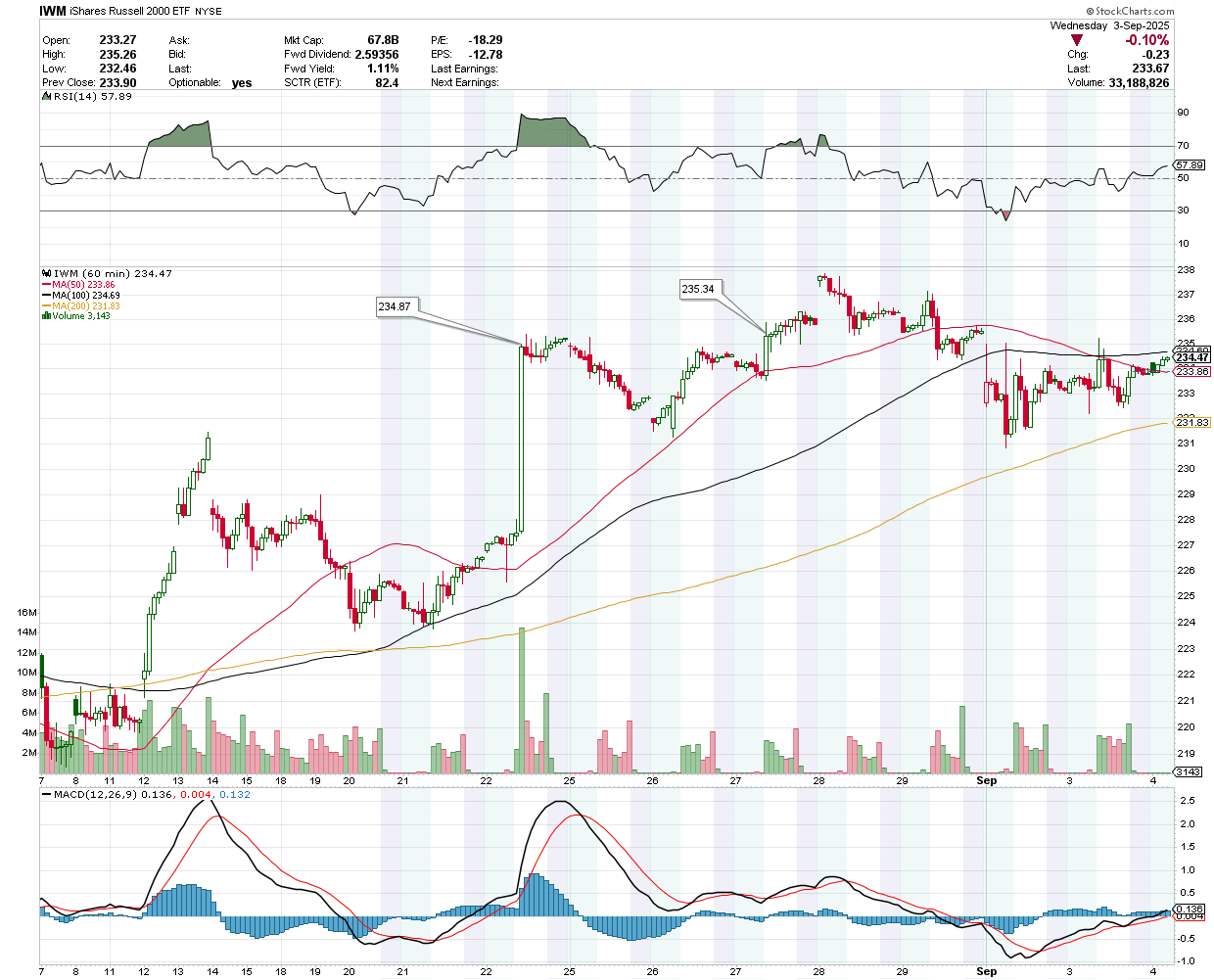

IWM was trading at $234.47 pre-market. Support is nearby at $233.86, while the potential upside levels stand at $234.87 and $235.34.

VanEck Semiconductor ETF (SMH)

SMH traded at $287.29 pre-market. Support lies at $286.48; a bounce could test $289.10 and $290.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL was at $24.98 pre-market. Support at $24.69 must hold to fuel a move towards $25.25 and $25.51.

Earnings Snapshot: Reporting Today (Before Open)

Toro Co (TTC)

Earnings Projections- Analysts predict flat revenue of $1.16 billion, a slowdown from last year's 6.9% growth. Adjusted earnings are expected to be $1.22 per share for the quarter.

Recent Performance- Last quarter, Toro reported $1.32 billion in revenue, down 2.3% year-over-year, missing analyst expectations.

TTC was trading at $79.50 pre-market. Support is at $78.42, while the potential upside levels stand at $80 and $80.93.

Earnings Snapshot: Reporting Today (After Close)

Broadcom Inc (AVGO)

Stock Performance- Broadcom (AVGO) stock has doubled (+119%) since April’s low, surpassing $300 before earnings.

Financial Expectations- Analysts forecast an EPS of $1.66 (up 33.87% Y/Y) and revenue of $15.82 billion (up 21.04% Y/Y).

Recent Results- Q2 2025 earnings beat estimates with an adjusted EPS of $1.58 and revenue of $15 billion. The semiconductor solutions segment grew 17% Y/Y, driven by AI-related products, with $5.1 billion in AI chip sales expected for Q3.

Market Risks- Reliance on hyperscale customers poses risks due to their potential to develop in-house chip designs.

AVGO was trading at $305.42 pre-market. Support is at $303.26, while the potential upside levels stand at $306.98 and $308.90.

Copart Inc (CPRT)

Earnings Projection- Analysts expect revenue to grow 8.7% year-over-year to $1.16 billion, up from 7.2% growth last year. Adjusted earnings are projected at $0.36 per share for the quarter.

Previous Quarter Performance- Last quarter, Copart reported $1.21 billion in revenue, up 7.5% year-over-year but 1% below analyst expectations.

CPRT was trading at $48.62 pre-market. Support is at $48.28, while the potential upside levels stand at $48.80 and $48.99.

Lululemon Athletica Inc (LULU)

Stock Performance- Lululemon (LULU) stock has declined 48% YTD, with a 43% drop over the past six months.

Earnings Expectations- Analysts anticipate an EPS of $2.85 (down from $3.15 last year) and revenue of $2.54 billion (up 7.13% Y/Y).

Recent Results- Q1 2025 showed EPS of $2.54 and revenue of $2.21 billion, both beating Wall Street estimates. Comparable sales rose 6%, driven by a 33% surge in mainland China, with FY26 revenue growth projected at 5.77%.

Tariff and Demand Concerns- Proposed tariffs and inconsistent demand in North America and China are expected to pressure profits in 2025.

Strategic Response-Lululemon plans modest price increases and deeper discounts to counter tariff impacts and demand challenges.

LULU was trading at $200.80 pre-market, with resistance at $202.41 and potential downside targets at $199.20 and $198.09.