Markets Overview – August 19, 2025

Major Indices Fell :

S&P 500 (SPX): -0.59%

Dow Jones (DJI): +0.02%

Russell 2000 (RUT): -0.78%

On August 19, 2025, the Dow Jones Industrial Average closed slightly higher, nearing its record high, while the S&P 500 and Nasdaq Composite fell 0.6% and 1.5%, respectively, driven by declines in major tech stocks like Nvidia, Broadcom, Meta, and Tesla.

Investors are focused on Federal Reserve Chair Jerome Powell’s upcoming speech at the Jackson Hole Symposium for indications of potential rate cuts in September, amid mixed inflation and labor market data.

Goldman Sachs highlighted stablecoin growth potential, favoring Circle’s USDC over Tether’s USDT. Robinhood launched trading on football game outcomes, and Apple plans to produce iPhone 17 models in India.

Key Movers

Retail earnings are in the spotlight, with Home Depot shares rising 3% after affirming guidance, while Lowe’s, Target, and Walmart are set to report soon.

Intel surged 7% on a $2 billion investment from SoftBank, and Palo Alto Networks gained 3% after strong earnings.

Bitcoin-related stocks dropped as Bitcoin fell to $113,300. The 10-year Treasury yield dipped to 4.30%, and oil and gold prices also declined.

Palantir fell 9% amid valuation concerns, and Viking Therapeutics dropped 42% due to side effect issues in a weight-loss drug trial. Best Buy launched a U.S. digital marketplace, expanding its product offerings.

Today’s Economic Calendar — Wednesday, August 20

2:00 pm- Minutes of Federal Reserve's July FOMC meeting

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The index ended flat with +0.02% to close at 44,922.27.

Resistance for the day: 45,015.64, with potential downside levels at 44,841.51 and 44,755.82.

NASDAQ 100 (NDX)

The index closed at 23,384.77, with resistance for the day at 23,449.34 and potential downside levels at 23,300.59 and 23,252.93.

S&P 500 (SPX)

The index closed at 6,411.37, with resistance at 6,429.97 and potential downside levels at 6,397.84 and 6,390.62.

SPDR S&P 500 ETF Trust (SPY)

The price was trading at $639.14 pre-market, with resistance at $640.01 and potential downside levels at $637.86 and $637.24.

Invesco QQQ Trust Series 1(QQQ)

The price was trading at $568.38 pre-market, with resistance at $570.20 and potential downside levels at $567.07 and $566.07.

The price was trading at $226.27 pre-market, with resistance at $226.90 and potential downside levels at $225 and $224.48.

VanEck Semiconductor ETF (SMH)

The price was trading at $290.28 pre-market, with resistance at $291.12 and potential downside levels at $288.97 and $288.42.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

The price was trading at $25.97 pre-market, with resistance at $26.24 and potential downside levels at $25.82 and $25.69.

Earnings Snapshot: Reporting Today (Before Open)

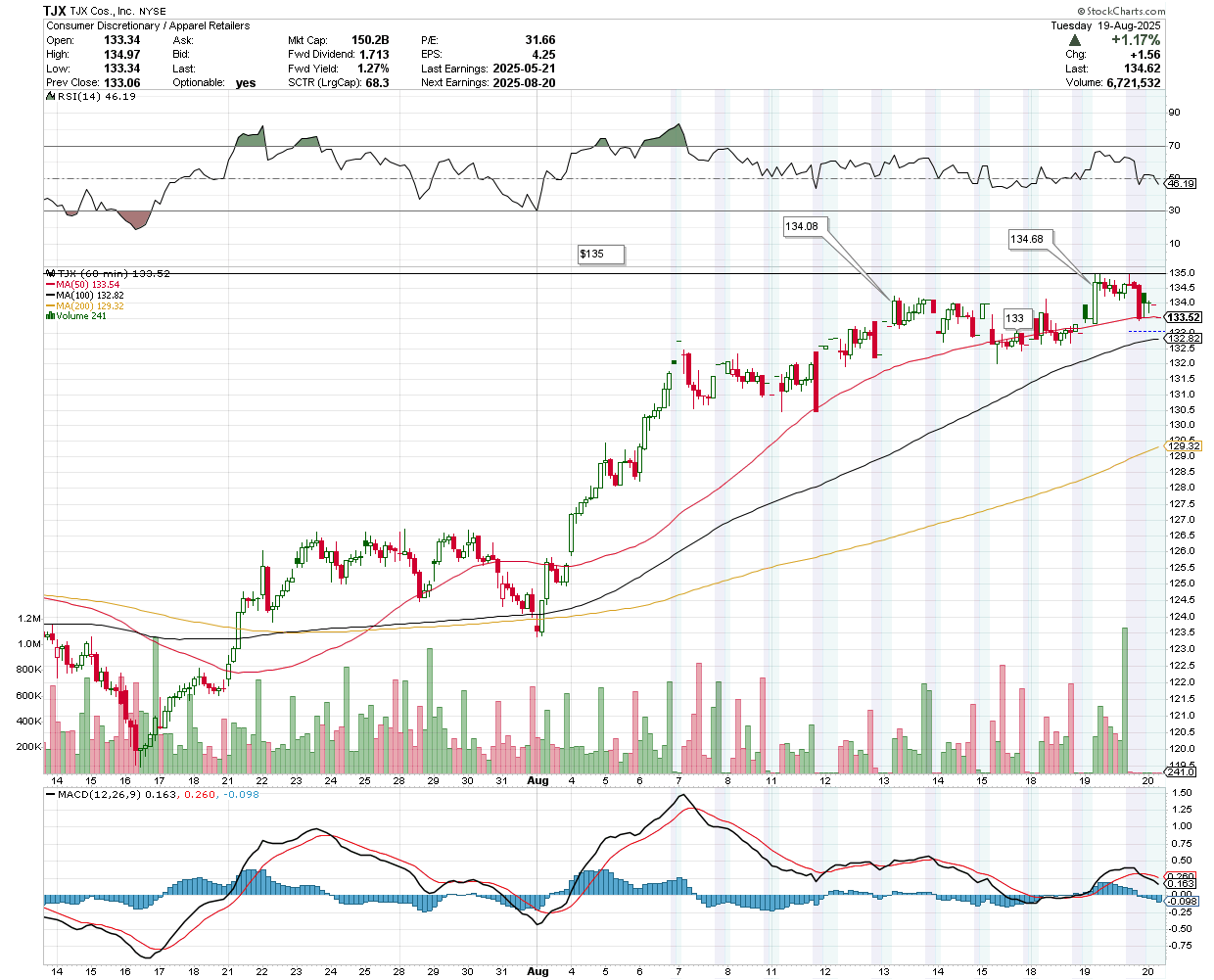

TJX Companies Inc (TJX)

TJX Companies (NYSE: TJX) stock gained 1.17% on August 19, 2025, outperforming the declining Nasdaq, S&P 500, and Russell 2000.

Analysts expect an EPS of $1.01 (up from $0.96 last year) and revenue of $14.17 billion (a 5.18% increase), building on TJX’s strong performance, including Q1 FY2026 sales of $13.11 billion and 3% comp sales growth, and Q4 FY2025’s $16.35 billion sales with 5% comp growth and a 10% EPS rise to $1.23. A robust earnings report could push TJX to new highs, while signs of slowing growth or margin pressure might lead to a pullback.

The stock was trading at $133.52 pre-market, with support at $133 and potential upside levels at $134.08,$134.68, and $135.

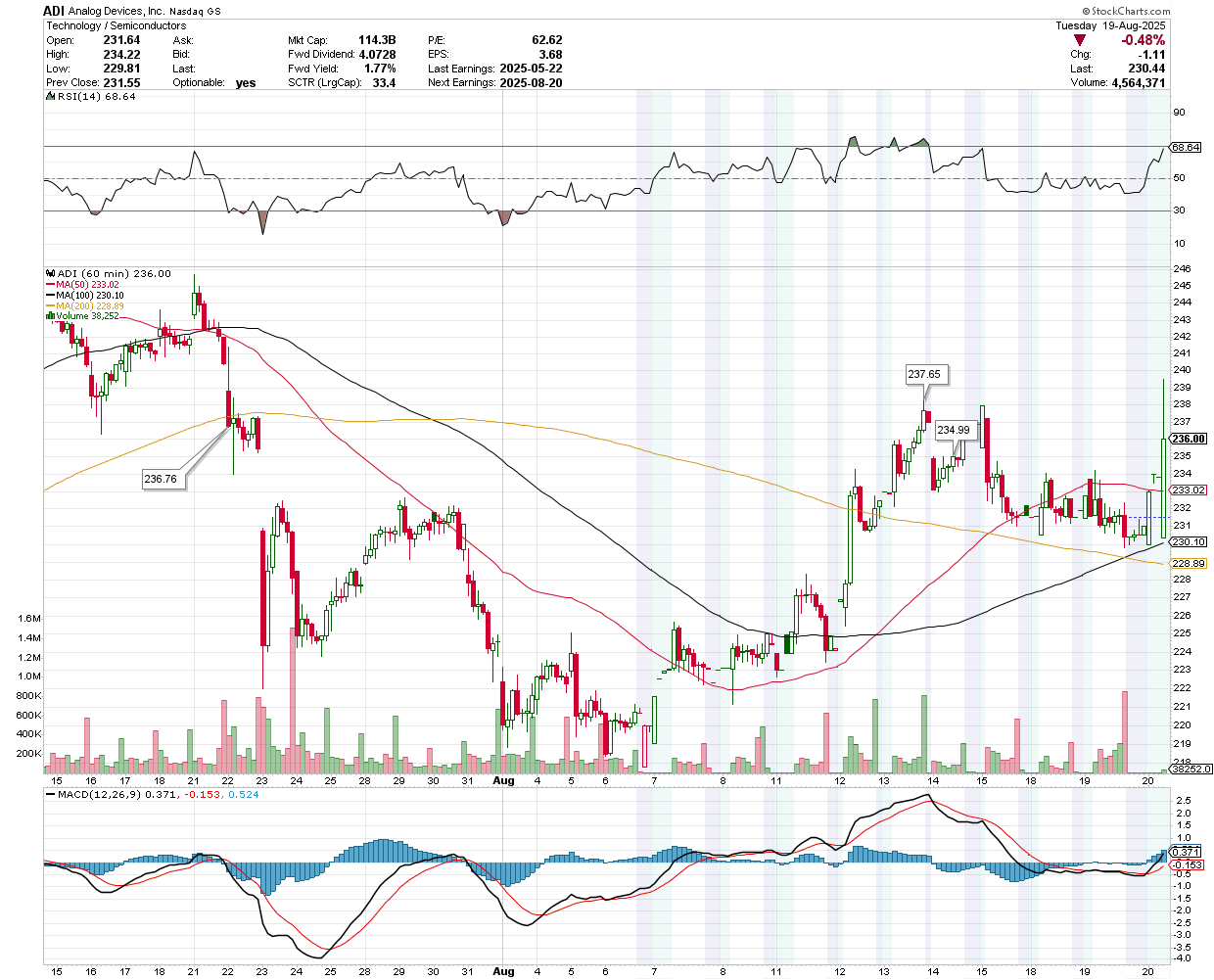

Analog Devices Inc (ADI)

Analog Devices (ADI), a manufacturer of analog chips, is set to report its Q2 earnings on Wednesday before market hours, with analysts expecting revenue to grow 19.5% year-over-year to $2.76 billion, reversing last year's 24.9% decline, and adjusted earnings of $1.95 per share.

Following a strong Q1 where ADI beat revenue expectations by 5.2% with $2.64 billion in sales (up 22.3% year-over-year), the company has a history of exceeding revenue forecasts, missing only once in the past two years.

The stock was trading at $236 pre-market, with support at $234.99 and potential upside levels at $236.76 and $237.65.

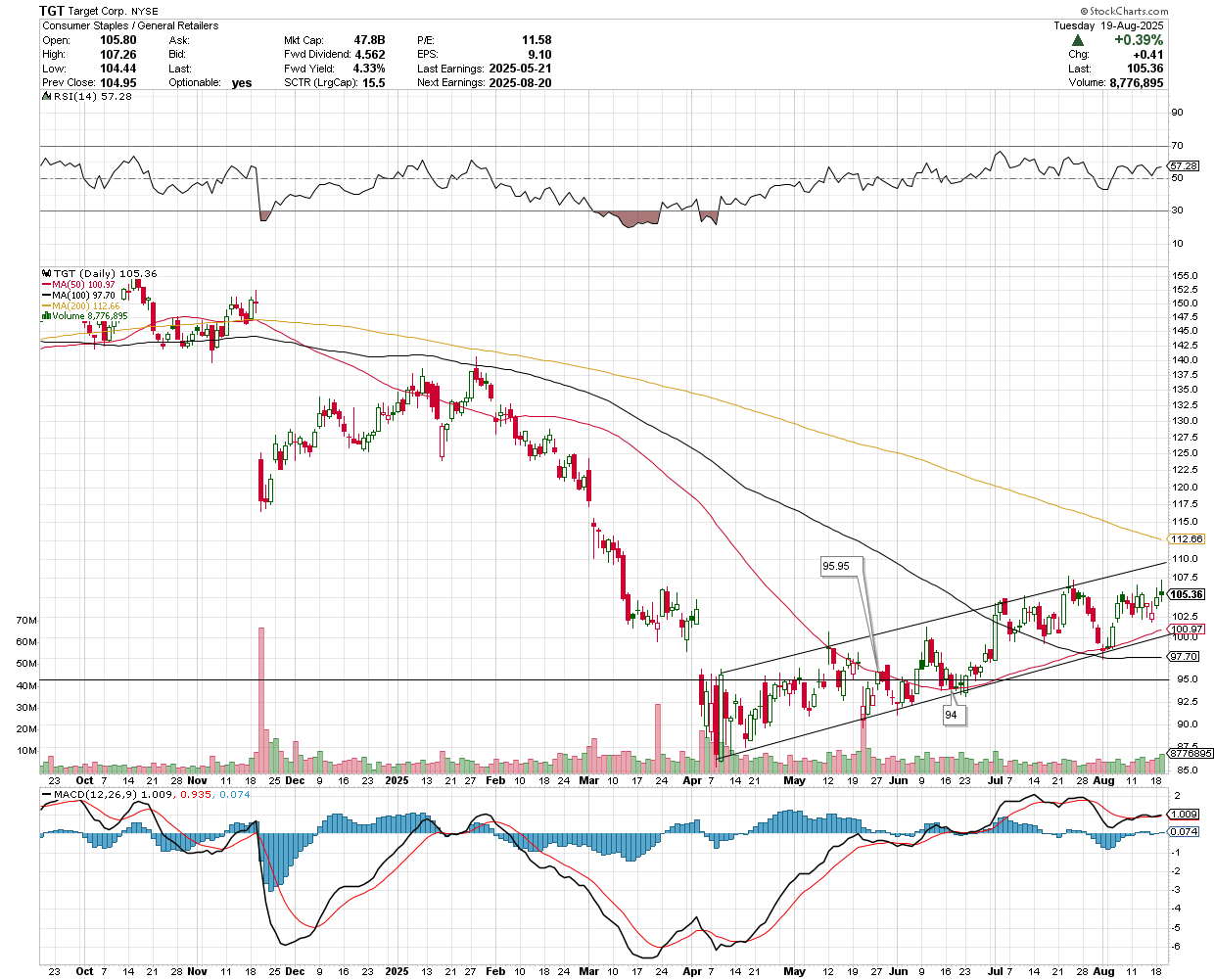

Target Corp (TGT)

Target Corporation reported Q2 2025 net sales of $25.2 billion, down 0.9% year-over-year, with GAAP and Adjusted EPS at $2.05, a decline from $2.57 in 2024, and operating income falling 19.4% to $1.3 billion due to a lower gross margin rate of 29.0%.

Despite a 1.9% drop in comparable sales, digital sales grew 4.3%, driven by over 25% growth in same-day delivery, and non-merchandise sales like Roundel and membership rose 14.2%.

The company saw improved traffic and sales trends, particularly in stores, and appointed Michael Fiddelke as the new CEO, succeeding Brian Cornell, to drive future growth. Target maintains its FY2025 outlook of a low-single-digit sales decline, with GAAP EPS of $8.00-$10.00 and Adjusted EPS of $7.00-$9.00, focusing on execution for the back-to-school and holiday seasons.

The stock was trading at $95.40 pre-market, with resistance at $95.95 and potential downside levels at $95 and $94.

Baidu Inc (BIDU)

Baidu (NASDAQ: BIDU) reported mixed Q2 2025 results, with earnings per share of RMB13.58 surpassing consensus estimates of RMB13.33, but revenue of RMB32.71 billion ($4.57 billion) fell 4% year-over-year, missing the expected RMB32.92 billion.

Baidu Core revenue was RMB26.3 billion ($3.66 billion), down 2%, with online marketing revenue dropping 15% to RMB16.2 billion ($2.27 billion), offset by a 34% rise in non-online marketing revenue to RMB10.0 billion ($1.40 billion), driven by strong AI Cloud growth.

iQIYI revenue declined 11% to RMB6.6 billion ($926 million). CEO Robin Li highlighted robust AI Cloud performance, emphasizing Baidu’s focus on high-impact AI initiatives. Adjusted EBITDA was RMB6.5 billion ($906 million) with a 20% margin.

The stock was trading at $88.72 pre-market, with resistance at $89.52 and potential downside levels at $88.57 and $88.10.