Markets Overview – August 05, 2025

Major Indices Pulled Back :

S&P 500 (SPX): -0.49%

Dow Jones (DJI): -0.14%

Russell 2000 (RUT): +0.60%

U.S. stock indexes pulled back Tuesday, giving up Monday's gains amid trade tensions and economic uncertainty.

Weak services data and stagflation concerns added pressure, while investors await potential tariff decisions later this week.

Key Movers

Palantir (PLTR) soared nearly 8% to a record high after topping $1B in quarterly revenue and raising full-year guidance. Analysts lifted price targets as its AI business surges.

AMD (AMD) fell 1.4% ahead of earnings, later dropping further after hours despite a 32% revenue jump. China export restrictions weighed on margins.

Axon (AXON) surged 16.4% on a strong earnings beat and upbeat outlook, led by demand for TASER 10 and AI-powered software tools.

Today’s Economic Calendar — Wednesday, August 06

2:00 pm- Fed. Gov. Lisa Cook and Boston Fed President Susan Collins on panel.

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The index declined -0.14% to close at 44,111.74.

Support for the day: 44,025.81, with potential upside levels at 44,240.76 and 44,459.65.

NASDAQ 100 (NDX)

The index closed at 23,018.56, with support for the day at 22,884.59 and potential upside levels at 23,078.04 and 23,218.12.

S&P 500 (SPX)

The index closed at 6,299.19, with support at 6,279.35 and potential upside levels at 6,329.94 and 6,358.91.

SPDR S&P 500 ETF Trust (SPY)

The price was trading at $629.55 pre-market, with support at $628.04 and a potential upside level at $631.17.

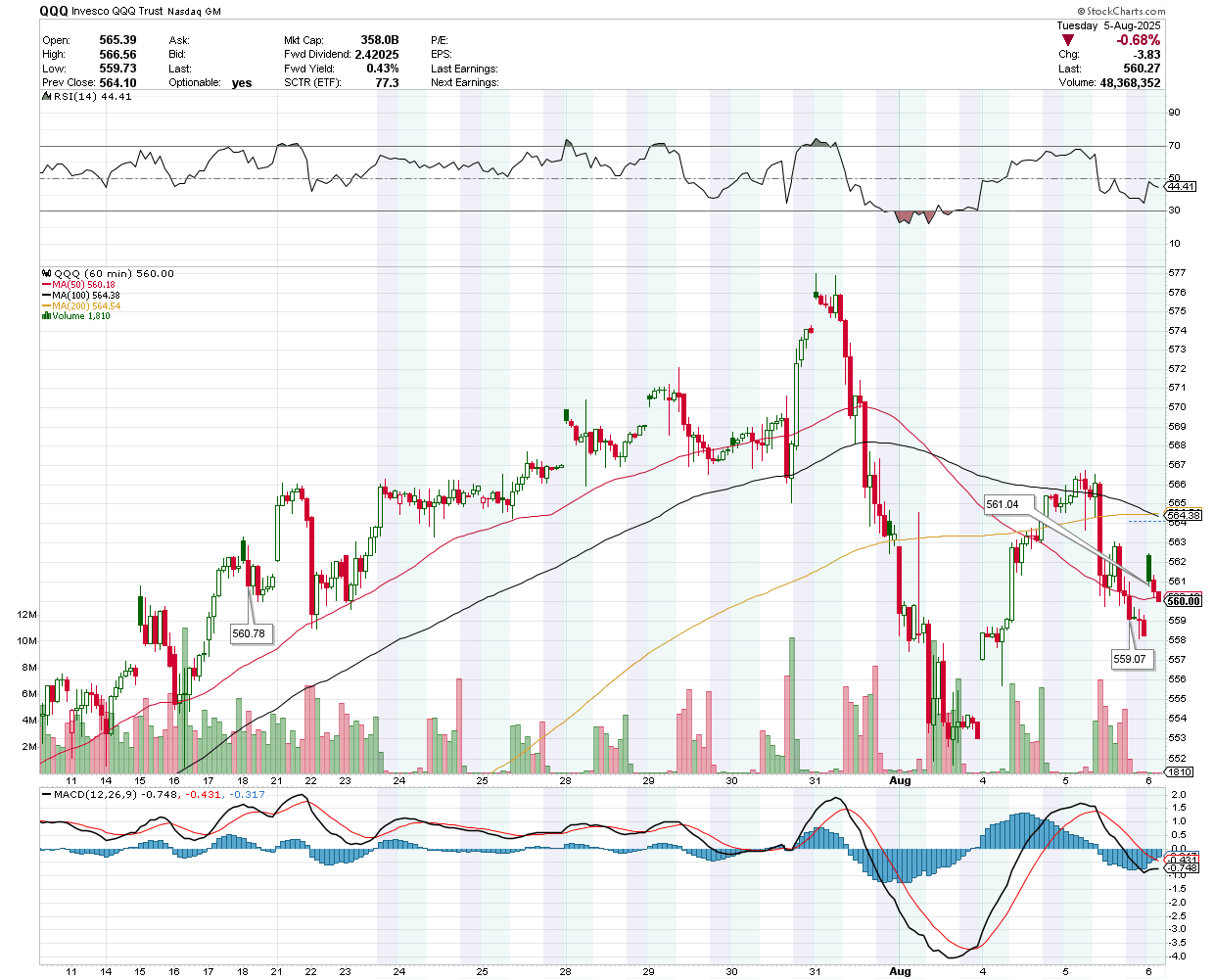

Invesco QQQ Trust Series 1(QQQ)

The price was trading at $560 pre-market, with support at $559.07 and potential upside levels at $560.78 and $561.04.

The price was trading at $221.62 pre-market, with support at $221.11 and potential upside levels at $222.06 and $223.05.

VanEck Semiconductor ETF (SMH)

The price was trading at $285.50 pre-market, with resistance at $285.99 and potential downside levels at $284.51 and $284.13.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

The price was trading at $24 pre-market, with resistance at $24.145 and potential downside levels at $23.90 and $23.83.

Earnings Snapshot: Reporting Today (Before Open)

Uber Technologies Inc (UBER)

Wall Street expects Uber to post $0.62 EPS on $12.47B revenue for Q2. Gross bookings are seen between $45.75B–$47.25B (+16–20% YoY).

Analysts highlight stable Mobility and Delivery trends. Focus remains on expanding robotaxi partnerships with Lucid, Nuro, and Baidu.

The stock was trading at $91.39 pre-market, with support at $90.77 and potential upside levels at $91.74 and $92.49.

Walt Disney Co (DIS)

Disney's streaming segment earned a $346 million profit in Q3 2025, with Disney+ and Hulu subscribers reaching 183 million. Domestic parks drove an 8% revenue increase to $9.1 billion, boosting overall earnings to $1.61 per share on $23.7 billion revenue, beating Wall Street forecasts.

Linear TV networks saw declines, while ESPN's revenue rose slightly despite higher sports rights costs. A new NFL deal gives ESPN control over NFL Network and additional games.

The stock was trading at $116 pre-market, with support at $115.77 and potential upside levels at $116.61 and $116.89.

Shopify Inc (SHOP)

Shopify (SHOP) reports Q2 2025 on August 06, expecting ~25% revenue growth to $2.54B and 7.69% earnings growth to $0.28/share. GMV is projected at $81B (+20.8% YoY), driven by merchant growth and Shop Pay. AI tools and partnerships (Cognizant, Google Cloud, Roblox) boost performance, but macro challenges and high valuation persist.

The stock was trading at $140 pre-market, with a potential upside level at $140.93.

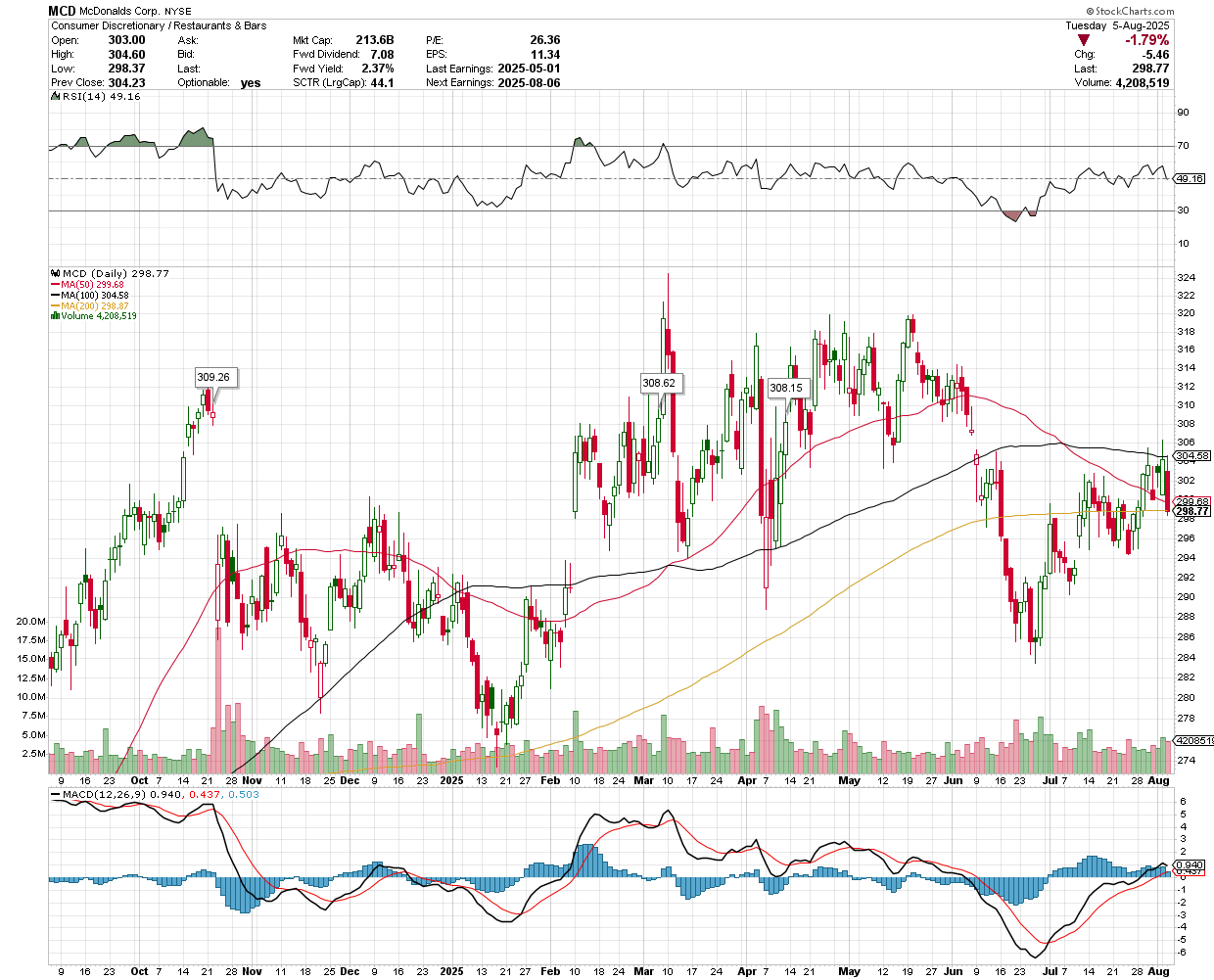

McDonald's Corporation (MCD)

McDonald’s Q2 2025 global comparable sales rose 3.8%, beating 2.49% expectations, with EPS of $3.19 and revenue of $6.84B, topping estimates. AI investments and value offerings drove growth; shares climbed 3% premarket.

The stock was trading at $308.50 pre-market, with support at $308.15 and potential upside levels at $308.62 and $309.26.