Markets Overview – September 10, 2025

Major Indices Closed Mixed :

S&P 500 (SPX): +0.30% to 6,532.03

Dow Jones (DJI): -0.48% to 45,490.92

Russell 2000 (RUT): -0.16% to 2,378.01

On September 10, 2025, the S&P 500 and Nasdaq Composite reached new closing highs, driven by cooler-than-expected producer-price data and strong earnings from Oracle, which surged 36% due to booming AI demand and a $300 billion cloud deal with OpenAI.

The Dow Jones Industrial Average, however, fell 0.5%, dragged by declines in Salesforce, Amazon, and Apple. Investors awaited key Consumer Price Index data ahead of the Federal Reserve’s upcoming meeting, with expectations of rate cuts growing due to a weakening labor market. The 10-year Treasury yield dipped below 4.05%.

Novo Nordisk cut 9,000 jobs to streamline operations amid rising competition. Mortgage applications surged to a 2022 high as rates fell to 6.49%. Oracle’s market cap neared $1 trillion, and its chair, Larry Ellison, became the world’s richest person, surpassing Elon Musk.

Key Movers: Winners and Losers

Other notable movers included Broadcom (+9.8%), Nvidia (+4%), and Advanced Micro Devices (+2.4%) in the AI sector, while Synopsys plummeted 36% after missing earnings and cutting forecasts.

Klarna shares rose 15% in their NYSE debut. Bitcoin hit $114,000, gold futures neared $3,680/ounce, and oil futures rose to $63.80/barrel. Chewy shares dropped 16.6% after a sharp profit decline, and GameStop rose 3.3% after exceeding earnings and announcing a $528.6 million Bitcoin investment.

Today’s Economic Calendar — Thursday, September 11

8:30 am- Consumer price index & Core CPI (Aug & YoY).

8:30 am- Initial jobless claims (August 16)

2:00 pm- Monthly U.S. federal budget (Aug)

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The Dow declined -0.48%, closing at 45,490.92. Key support sits at 45,393.14; holding above could spark a rebound toward 45,640.67 and 45,698.33.

NASDAQ 100 (NDX)

The index ended at 23,849.27. Key support lies at 23,772.20; holding above this level could open upside toward 23,863.81 and 23,922.48-23,950.

S&P 500 (SPX)

Closing at 6,532.04, the S&P is trading above support at 6,512.40. If buyers hold this level, the potential upside targets are 6,546.23 and 6,555.97.

SPDR S&P 500 ETF Trust (SPY)

SPY was trading at $653.71 pre-market, with support at $652 and potential upside targets at $654.55 and $656.

Invesco QQQ Trust Series 1(QQQ)

QQQ was trading at $582.42 pre-market, with key support at $580.83. Holding above this level keeps upside targets in play at $583.88 and $585.

IWM was trading at $236.26 pre-market. Support is nearby at $235.12, while the potential upside levels stand at $237.77 and $239.16.

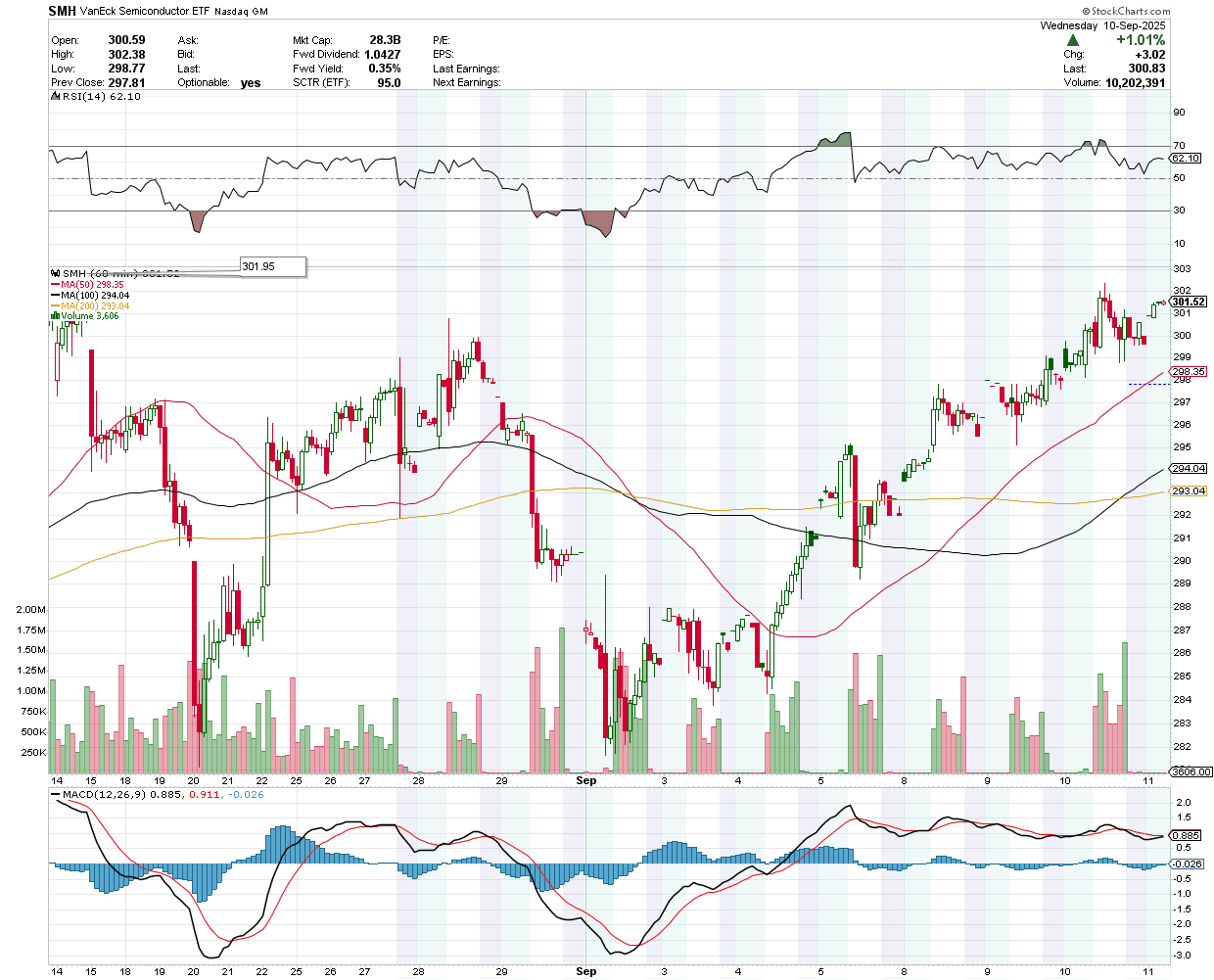

VanEck Semiconductor ETF (SMH)

SMH traded at $301.52 pre-market. Support lies at $300; a bounce could test $301.95 and $303-303.50.

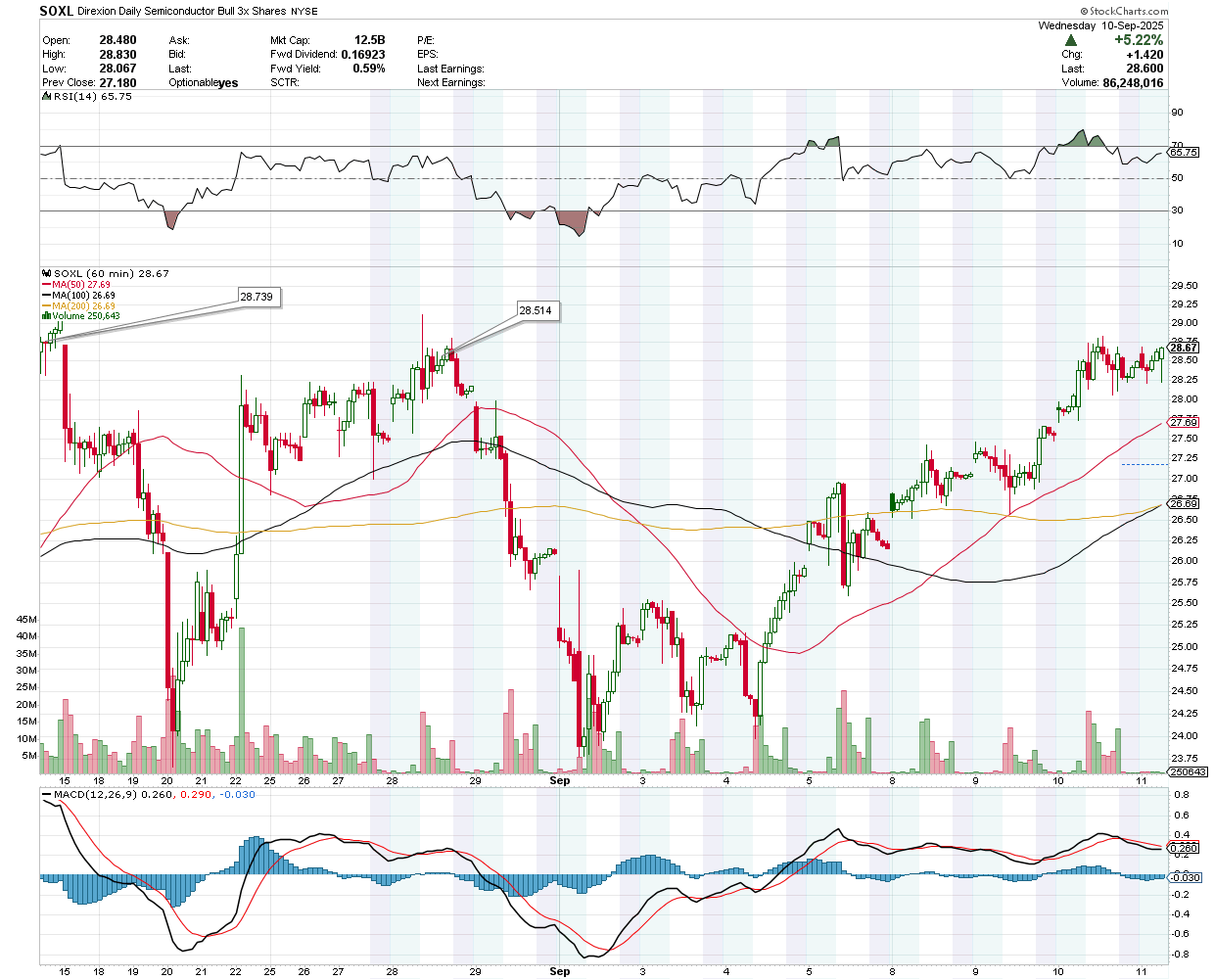

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL was at $28.67 pre-market. Support at $28.514 must hold to fuel a move towards $28.739 and $29.

Earnings Snapshot: Reporting Today (Before Open)

Lovesac Co (LOVE)

Earnings Expectations- Analysts expect Lovesac’s revenue to grow 2.4% year-over-year to $160.3 million. An adjusted loss of -$0.52 per share is anticipated for the quarter.

Previous Quarter Performance- Last quarter, Lovesac exceeded revenue expectations by 0.7%, reporting $138.4 million, up 4.3% year-over-year.

LOVE was trading at $18 pre-market, with resistance at $18.145 and potential downside levels at $17.77 and $17.436.

Hooker Furnishings Corp (HOFT)

Financial Performance- Hooker Furniture Corp. reported a $3.3 million loss in its fiscal second quarter. The company recorded a loss of 31 cents per share.

Revenue Performance- Hooker Furniture Corp. reported revenue of $82.1 million for its fiscal second quarter.

HOFT was trading at $9.25 pre-market, with resistance at $9.386 and potential downside levels at $9.06 and $8.963.

Earnings Snapshot: Reporting Today (After Close)

Adobe Inc (ADBE)

Earnings Expectations- Adobe projects Q3 fiscal 2025 revenues of $5.87B-$5.92B and non-GAAP EPS of $5.15-$5.20.

AI Portfolio Growth- Strong adoption of AI-powered tools like Acrobat AI Assistant and Firefly Services drove over 700M monthly active users by Q2 end.

Segment Revenue Forecasts- Digital Media segment expected to generate $4.37B-$4.40B, and Digital Experience segment projected at $1.45B-$1.47B.

Competitive Challenges- Adobe faces intense competition in AI and GenAI from Microsoft-backed OpenAI and others, with limited monetization of AI solutions.

ADBE was trading at $356.80 pre-market. Support is at $352.83, while the potential upside levels stand at $359.10 and $361.33.

RH (RH)

Earnings Expectations- Consensus EPS estimate is $3.22, representing a 90.5% year-over-year increase, and consensus revenue estimate is $905.36 million, reflecting a 9.1% year-over-year growth.

Growth Outlook- RH anticipates demand acceleration into 2026, driven by new product pipelines and gallery openings.

RH was trading at $229.01 pre-market. Support is at $228, while the potential upside levels stand at $231.06 and $232.43.