Markets Overview – August 27, 2025

Major Indices Surged :

S&P 500 (SPX): +0.24% to 6,481.41

Dow Jones (DJI): +0.32% to 45,565.23

Russell 2000 (RUT): +0.64% to 2,373.80

On Wednesday, U.S. stock indexes closed slightly higher as investors awaited Nvidia's quarterly earnings. The S&P 500 rose 0.2% to a record high, the Nasdaq Composite gained 0.2%, and the Dow Jones Industrial Average increased 0.3%, both just below their record highs.

Concerns arose over Federal Reserve independence following President Trump's dismissal of Fed Governor Lisa Cook.

Bitcoin traded at $112,100, up from $110,400, after a low of $108,700. The U.S. dollar index was at 98.20, and the 10-year Treasury yield was 4.24%. West Texas Intermediate crude oil futures rose 1% to $63.85 per barrel, and gold futures increased 0.5% to $3,450 per ounce.

Key Movers: Winners and Losers

Nvidia reported earnings of $1.05 per share on $46.74 billion in revenue, up 56% year-over-year, slightly above estimates. Data center sales reached $41.1 billion, missing projections slightly, impacted by a $180 million release from H20 chip inventory sales due to export restrictions. Nvidia projected third-quarter revenue of $54 billion, plus or minus 2%, and approved $60 billion in stock buybacks. Its shares fell over 2% after hours.

Other market movements included MongoDB soaring 38% after strong earnings and a raised outlook, driven by 29% Atlas platform revenue growth. Kohl's jumped 24% with $0.56 adjusted EPS, beating $0.31 forecasts, and raised its full-year EPS guidance to $0.50-$0.80.

Canada Goose surged 16% on takeover bids valuing it at $1.35 billion. J.M. Smucker fell 4.5% after a $0.41 per share loss due to tariffs impacting its coffee division. Cracker Barrel rose 8% after reverting to its original logo.

Today’s Economic Calendar — Thursday, August 28

8:30 am- Initial jobless claims (August 23) (230,000 median forecast vs 235,000 previous).

8:30 am- GDP (First revision) (Q2) (3.1% median forecast vs 3% previous).

10:00 am- Pending home sales (July) (0.3% median forecast vs -0.8% previous).

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The Dow gained 0.32%, closing at 45,565.23. Key support sits at 45,525-45,500; holding above could spark a rebound toward 45,665.91 and 45,762.77.

NASDAQ 100 (NDX)

The index ended at 23,565.85, consolidating between 23,400 and 23,600. Watch 23,456.41 as critical support; staying above favors a move toward 23,595.38 and 23,699.60.

S&P 500 (SPX)

Closing at 6,481.40, the S&P is trading above support at 6,467.64. If buyers hold this level, potential upside targets are 6,487 and 6,500.

SPDR S&P 500 ETF Trust (SPY)

SPY was trading at $646.71 pre-market, with support at $645.65 and potential upside targets at $647.04 and $647.97.

Invesco QQQ Trust Series 1(QQQ)

QQQ was trading at $573.19 pre-market, with key support at $572.37. Holding above this level keeps upside targets in play at $573.98 and $575.

IWM was trading at $237.08 pre-market. Support is nearby at $236.30, while the potential upside level stands at $237.90.

VanEck Semiconductor ETF (SMH)

SMH traded at $296.11 pre-market. Support lies at $295; a bounce could test $296.73 and $298.13.

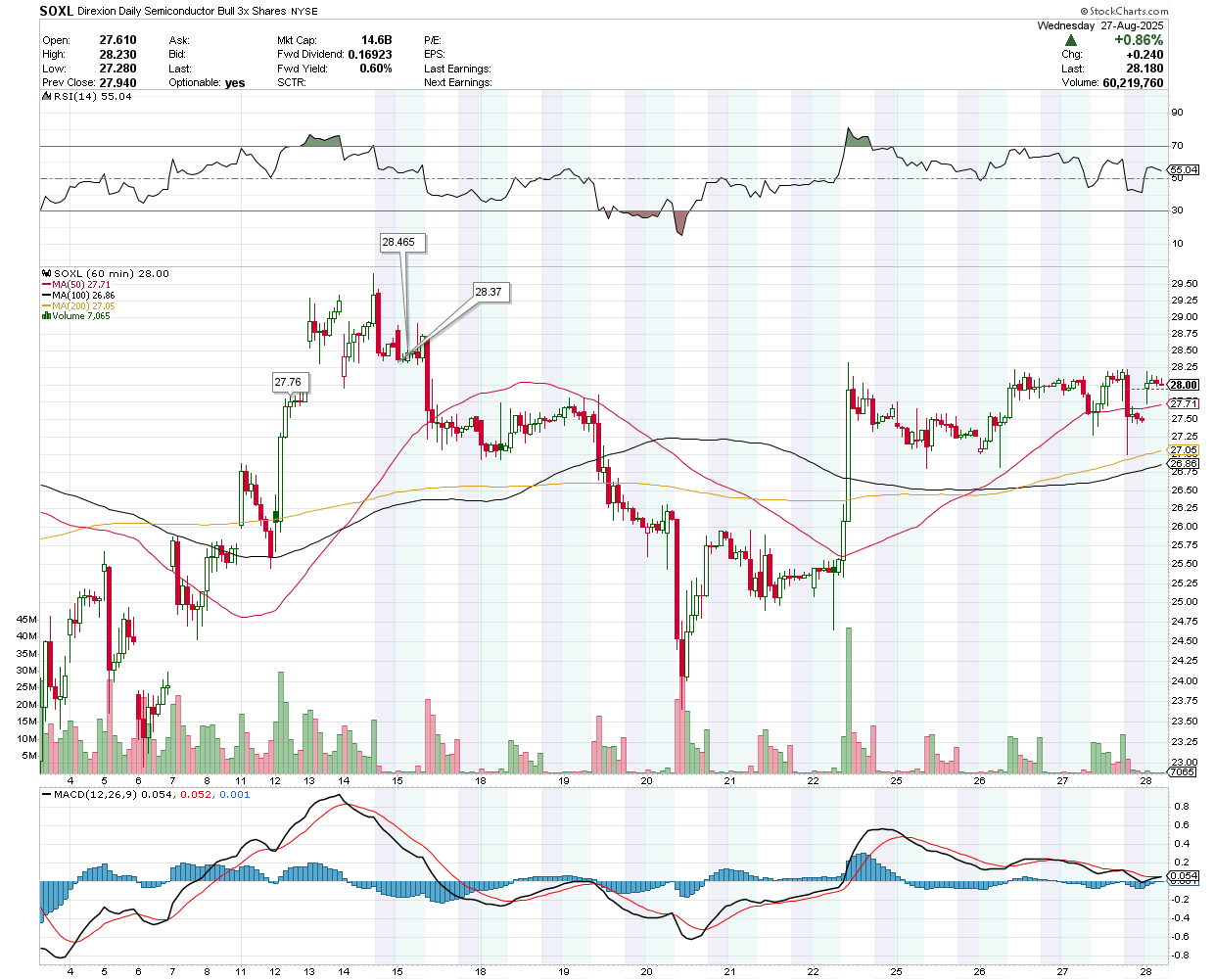

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL was at $28.00 pre-market. Support at $27.76 must hold to fuel a move towards $28.37 and $28.465.

Earnings Snapshot: Reporting Today (Before Open)

Dollar General Corp (DG)

Q2 Expectations: Earnings per share (EPS) projected at $1.57 with revenue of about $10.68 billion, reflecting ~4.6% sales growth but lower EPS than last year.

Q1 Recap: Delivered record sales of $10.44 billion, EPS of $1.78, and same-store sales growth of 2.4%, beating estimates.

Upgraded Guidance: Full-year EPS forecast raised to $5.20–$5.80; sales growth outlook at 3.7%–4.7%; same-store sales now expected to grow 1.5%–2.5%.

Consumer Trends: Increasing appeal among middle- and higher-income shoppers seeking bargains, helping offset pressure on core low-income customers.

Economic Backdrop: Inflation and uncertainty weigh on consumers but also drive more traffic to value retailers like Dollar General.

Operational Pressures: Rising costs, markdowns, and shrinkage remain challenges, though cost-control initiatives under its “Back to Basics” strategy aim to stabilize margins.

DG was trading at $113.46 in pre-market. Immediate support is seen at $112.48, while a rebound could push the stock toward $114.55 and $115.48.

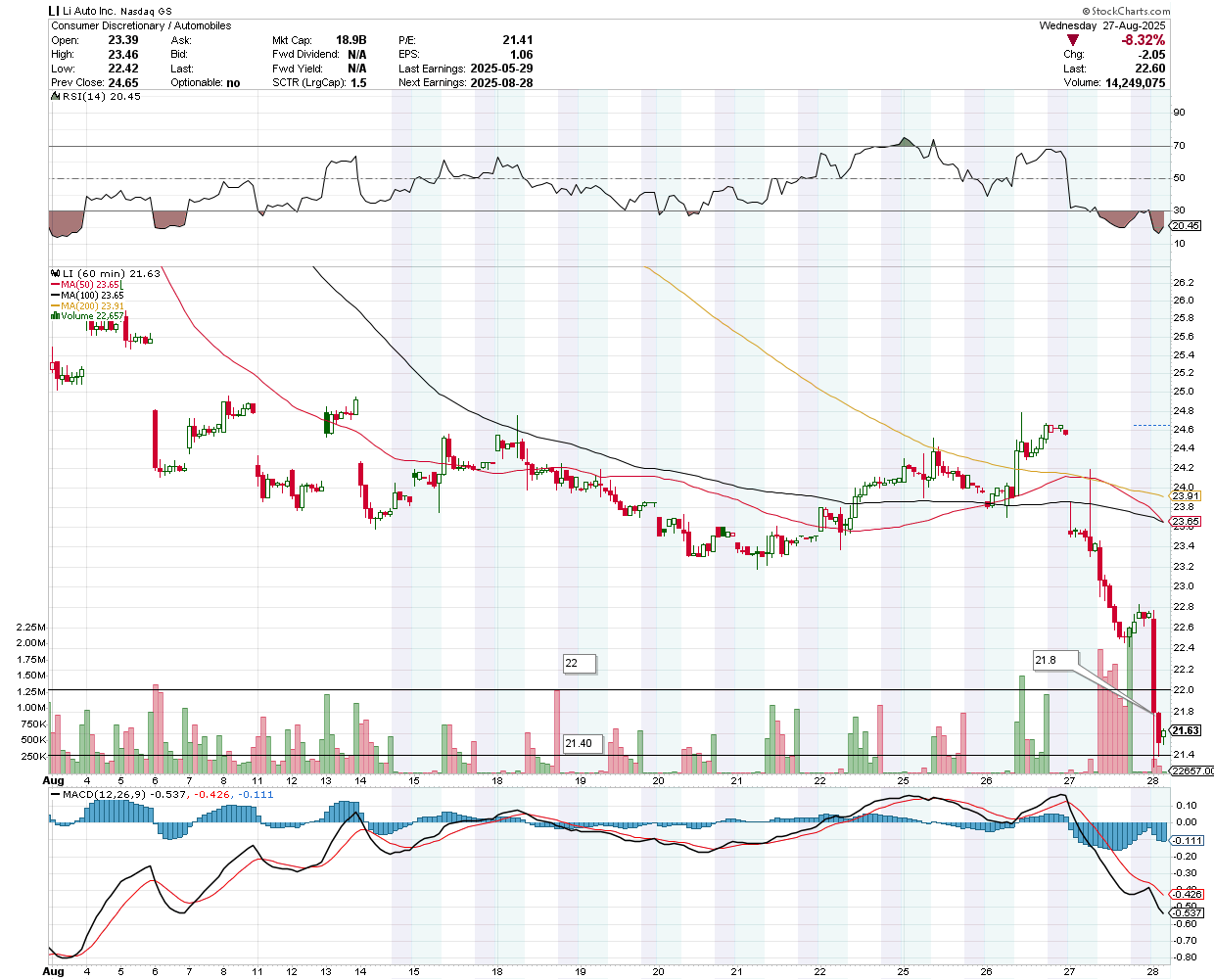

Li Auto Inc (LI)

Q2 Revenue: Reported $4.2 billion, up 16.7% QoQ, but down 4.5% YoY, reflecting weaker demand and fading subsidies.

Adjusted Net Income: Rose 44.7% QoQ to about RMB 1.5 billion (~$204.9 million), but slipped 2.3% YoY.

Margins: Vehicle margin held strong at 19.4% despite market pressures.

Q3 Guidance: Revenue projected at $3.5–3.7 billion, well below the $5.8 billion market expectation. Deliveries guided at 90,000–95,000 units, versus estimates near 135,000.

Market Reaction: The Stock fell over 8% in regular trading and another 4.5% pre-market, as analysts issued multiple downgrades.

Strategic Focus: Launch of the battery-electric SUV Li i8 could drive future growth, but execution risk is high amid intense EV competition and shrinking subsidies.

LI was trading at $21.63 during pre-market. The stock has immediate support at $21.40, with potential for a rebound to $21.80 and $22.

DICK'S Sporting Goods Inc (DKS)

Last Quarter Recap: Revenue came in at $3.17 billion (+5.2% YoY), beating estimates by 0.7%. EBITDA also exceeded expectations, but full-year EPS guidance was softer than forecast.

Q2 Expectations: Revenue projected at $3.61 billion (+3.8% YoY), with adjusted EPS around $4.30.

Analyst Sentiment: Estimates have remained steady over the past month. Dick’s has missed revenue only once in the past two years, typically beating by ~1.7%.

Peer Snapshot: Specialty retail peers show mixed growth — some flat, others reporting double-digit gains — pointing to modest sector momentum.

DKS was trading at $226 during pre-market. The stock has immediate resistance at $228.09, with potential for a downside towards $224 and $221.98.

Toronto-Dominion Bank (TD)

Earnings & Capital Strength: Delivered an adjusted Q3 EPS of $2.06, surpassing expectations, backed by a strong 14.9% CET1 capital ratio.

Cost-Cutting Strategy: Announced a comprehensive cost-cutting plan targeting $9 billion in savings, including restructuring steps like the wind-down of its U.S. point-of-sale financing business—expected to yield $550–650 million annually.

Operational Advantage: Focused on improving efficiency as a defensive advantage in a high-interest-rate environment, offsetting margin pressures.

Strategic Trade-offs: While the strategy improves short-term margins, significant emphasis on compliance costs (e.g., AML-related spending) and the reduction of revenue diversification—including exiting certain businesses—bring sustainability questions into play.

Management Priorities: Leadership emphasizes operational discipline and efficiency while navigating the tension between profitability, regulatory demands, and maintaining customer trust.

TD was trading at $77 during pre-market. The stock has immediate support at $76.405, with potential for a rebound to $77.50 and $77.64.