Markets Overview – August 14, 2025

Major Indices Showed Mixed Performance :

S&P 500 (SPX): +0.03%

Dow Jones (DJI): -0.02%

Russell 2000 (RUT): -1.24%

On August 14, 2025, U.S. stock markets showed mixed performance as a rally slowed due to hotter-than-expected wholesale inflation data from the Producer Price Index (PPI), which raised concerns about the impact of tariffs on inflation and tempered hopes for Federal Reserve rate cuts in September. The S&P 500 edged up slightly for its third consecutive record close, while the Dow Jones Industrial Average and Nasdaq Composite each dipped less than 0.1%.

The 10-year Treasury yield rose to 4.29% following the inflation report, Bitcoin hit a record high of $124,500 before settling at $117,400, and West Texas Intermediate crude oil rose 2% to $63.95 per barrel. Retail sales data indicated solid consumer spending in July, but concerns persisted about cautious consumer behavior and potential tariff-driven price increases.

On August 15, 2025, U.S. stock futures for the Dow Jones, S&P 500, Nasdaq 100, and Russell 2000 edged higher despite a significant 0.9% monthly rise in the Producer Price Index (PPI) for July, the largest in three years, driven by a 1.1% increase in services costs linked to tariffs. This unexpected wholesale inflation data reduced expectations for a Federal Reserve rate cut in September, with the likelihood dropping to about 85% from earlier in the week.

Analysts noted that businesses might be absorbing tariff costs, but concerns linger about future price pressures impacting corporate earnings. Despite the S&P 500 slipping on Thursday, with seven sectors declining, consumer discretionary, financials, and healthcare stocks performed well. Upcoming retail sales data and earnings from companies like Walmart and Home Depot are in focus.

Key Movers

Key market movers included Intel, which surged 7.4% on reports of potential government investment, and Amazon, up 3% after announcing expanded fast grocery delivery.

Conversely, Tapestry plummeted 16% after cutting its profit outlook due to tariff impacts, and Deere fell nearly 7% after lowering its full-year forecast amid a challenging economic environment.

Today’s Economic Calendar — Friday, August 15

8:30 am- U.S. retail sales & Retail sales minus autos for July.

8:30 am- Empire State manufacturing survey for Aug.

8:30 am- Import price index & Import price index minus fuel for July.

9:15 am- Industrial production & Capacity utilization for July.

10:00 am- Business inventories for June and Consumer sentiment (prelim) for Aug.

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The index declined -0.02% to close at 44,911.26.

Support for the day: 44,841.51, with potential upside levels at 44,950 and 45,015.64.

NASDAQ 100 (NDX)

The index closed at 23,832.44, with support for the day at 23,800.38 and potential upside levels at 23,863.81 and 23,922.48.

S&P 500 (SPX)

The index closed at 6,468.54, with support at 6,458.64 and potential upside level at 6,480.99.

SPDR S&P 500 ETF Trust (SPY)

The price was trading at $645.04 pre-market, with support at $644.39 and potential upside levels at $645.62 and $647.02.

Invesco QQQ Trust Series 1(QQQ)

The price was trading at $579.27 pre-market, with support at $577.98 and potential upside levels at $580.23 and $580.64.

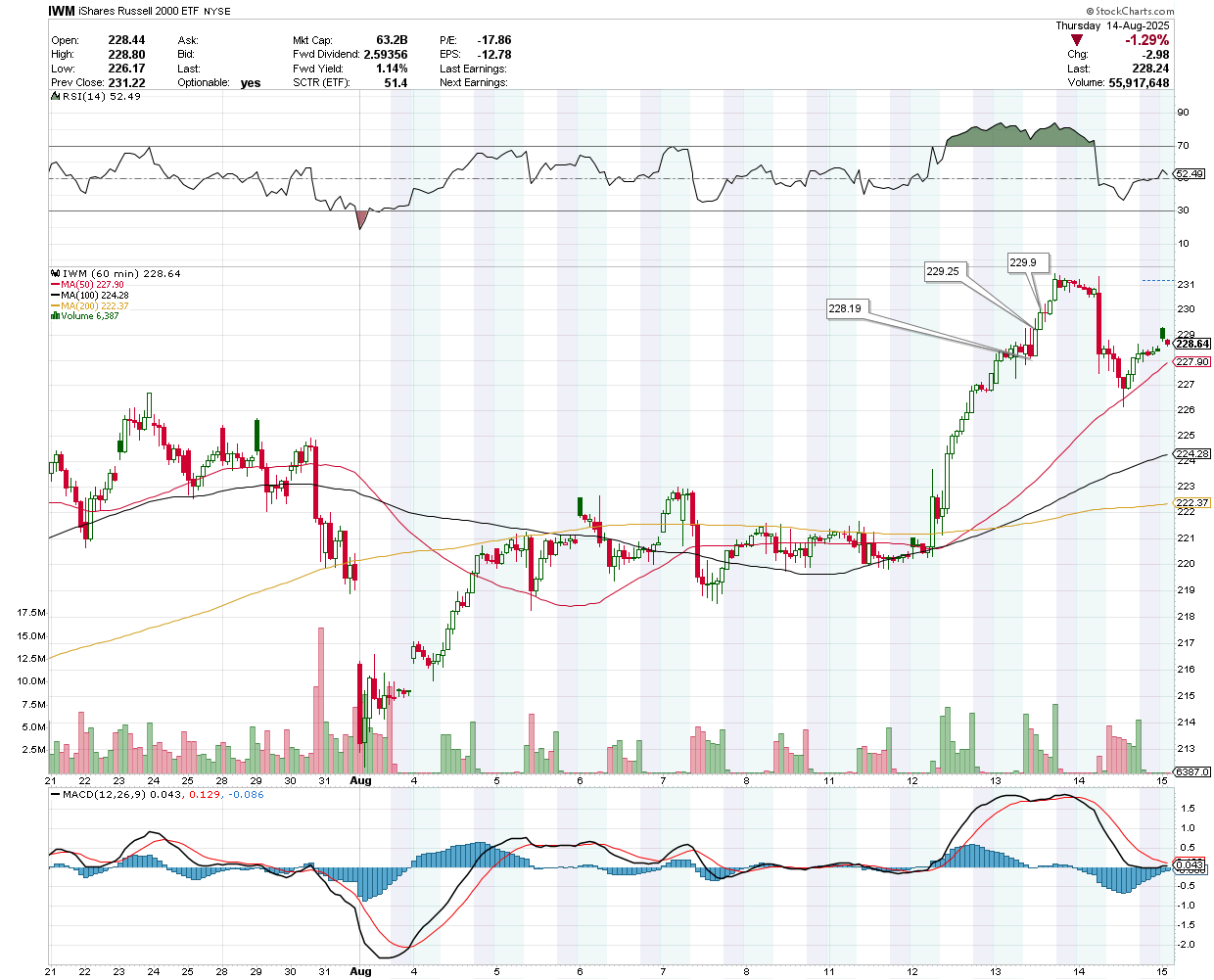

The price was trading at $228.64 pre-market, with support at $228.19 and potential upside levels at $229.25 and $229.90.

VanEck Semiconductor ETF (SMH)

The price was trading at $298.19 pre-market, with support at $297.89 and potential upside levels at $299.13 and $300.09.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

The price was trading at $28.35 pre-market, with support at $28.10 and potential upside levels at $28.52 and $28.701.

Earnings Snapshot: Reported Yesterday (After Close)

Nu Holdings Ltd (NU)

Nu Holdings Ltd. reported strong Q2 2025 results on August 14, with revenues reaching $3.7 billion (up 85% annualized since 2021, beating estimates of $3.16 billion), gross profit at $1.5 billion, and net income of $637 million (nearly tripled in two years).

Customer base grew to 123 million (83% activity rate), credit portfolio expanded 40% YoY to $27.3 billion, and deposits rose 41% to $36.6 billion. Efficiency ratio improved to 28.3%, NIM to 9.2%, and ROE to 28%.

Outlook includes FY2025 revenue at $6.92 billion, aiming to boost ARPAC from $12 to $20-30 via credit expansion and AI modeling. Risks involve market volatility and competition in Latin America.

The price was trading at $13.35 pre-market, with support at $13.24 and potential upside levels at $13.43 and $13.53.

Earnings Snapshot: Reporting Today (Before Open)

Flowers Foods Inc (FLO)

Flowers Foods (NYSE: FLO) is set to report Q2 2025 earnings on August 15, with expected revenues of $1.27 billion (+3.6% YoY) but an EPS of $0.29 (-19.4% YoY).

Despite a focus on brand investment, exiting low-margin businesses, and improving cost structures, challenges include weak demand for traditional bread, cake, and private label categories, higher promotional costs, and a projected 2% volume decline.

The price was trading at $16.55 pre-market, with support at $16.505 and potential upside levels at $16.605 and $16.65.

BitFuFu Inc (FUFU)

BitFuFu Inc. (NASDAQ: FUFU) reported Q2 2025 revenues of $115.4 million, up 47.9% sequentially but down 10.8% YoY, led by cloud-mining at $94.3 million (up 22.3% YoY).

Net income rose to $47.1 million, including a $39.6 million Bitcoin fair value gain, with adjusted EBITDA at $60.7 million (vs. $8.3 million YoY). Mining capacity grew 46.6% to 36.2 EH/s, hosting to 728 MW, and cloud-mining users to 623,114. BTC holdings reached 1,792. Despite the Bitcoin halving, strategic expansions position BitFuFu for sustained growth.

The price was trading at $5.53 pre-market, with support at $5.35 and potential upside levels at $5.60 and $5.80.

So-Young International Inc (SY)

So-Young International Inc. (SY) reported a Q2 2025 net loss of RMB36.039 million, compared to a profit of RMB18.941 million in Q2 2024. Earnings per share were -RMB0.46, down from RMB0.24, with a net loss per ADS of RMB0.35 versus a profit of RMB0.18 last year.

Adjusted loss was RMB30.544 million, compared to adjusted earnings of RMB22.186 million in Q2 2024. Revenues declined to RMB378.748 million from RMB407.380 million year-over-year.

The price was trading at $4.45 pre-market, with support at $4.335 and potential upside levels at $4.50 and $4.63.