Markets Overview – August 13, 2025

Major Indices Surged :

S&P 500 (SPX): +0.32%

Dow Jones (DJI): +1.04%

Russell 2000 (RUT): +1.98%

On August 13, 2025, major U.S. stock indexes sustained their upward trend, with the S&P 500 and Nasdaq achieving new record highs, while the Dow Jones Industrial Average gained 1%, narrowly missing its first record close since December.

The S&P 500 gained 0.3%, the Nasdaq Composite added 0.14%, and the Russell 2000 surged 2% to its yearly peak. The rally was supported by stable July inflation data, boosting expectations for Federal Reserve interest rate cuts. However, mega-cap tech stocks like Microsoft, Meta, and Nvidia declined, while Apple and Amazon gained.

On August 14, 2025, U.S. stock futures were nearly flat as investors awaited key economic data, including July's producer price index and weekly jobless claims.

Key Movers

Notable movers included Paramount Skydance, which soared 37% and was labeled a meme stock, and CAVA Group and CoreWeave, which fell 17% and 21% respectively, after weak earnings.

The U.S. dollar index dropped to a two-week low, the 10-year Treasury yield fell to 4.24%, and oil prices continued a two-week slide. The International Energy Agency raised its global oil supply forecasts but noted weaker demand. Nuclear energy stocks were highlighted as a growing investment theme, with Talen Energy, Public Service Enterprise Group, and Vistra recommended by Morgan Stanley. Bullish, a crypto exchange, debuted with over 140% gain, reflecting strong IPO performance in 2025.

Today’s Economic Calendar — Thursday, August 14

8:30 am- Initial jobless claims for August 9 (229,000 median forecast vs 226,000 previous).

8:30 am- Producer Price Index (PPI) for July & YoY.

8:30 am- Core PPI for July & YoY.

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The index gained +1.04% to close at 44,922.27.

Support for the day: 44,841.51, with potential upside levels at 44,950 and 45,015.64.

NASDAQ 100 (NDX)

The index closed at 23,849.04, with support for the day at 23,800.38 and potential upside levels at 23,922.48 and 23,969.28.

S&P 500 (SPX)

The index closed at 6,466.58, with support at 6,456.11 and potential upside level at 6,480.99.

SPDR S&P 500 ETF Trust (SPY)

The price was trading at $644.52 pre-market, with support at $644.09 and potential upside levels at $645.62 and $646.24.

Invesco QQQ Trust Series 1(QQQ)

The price was trading at $580.25 pre-market, with support at $579.25 and potential upside levels at $580.64 and $581.89.

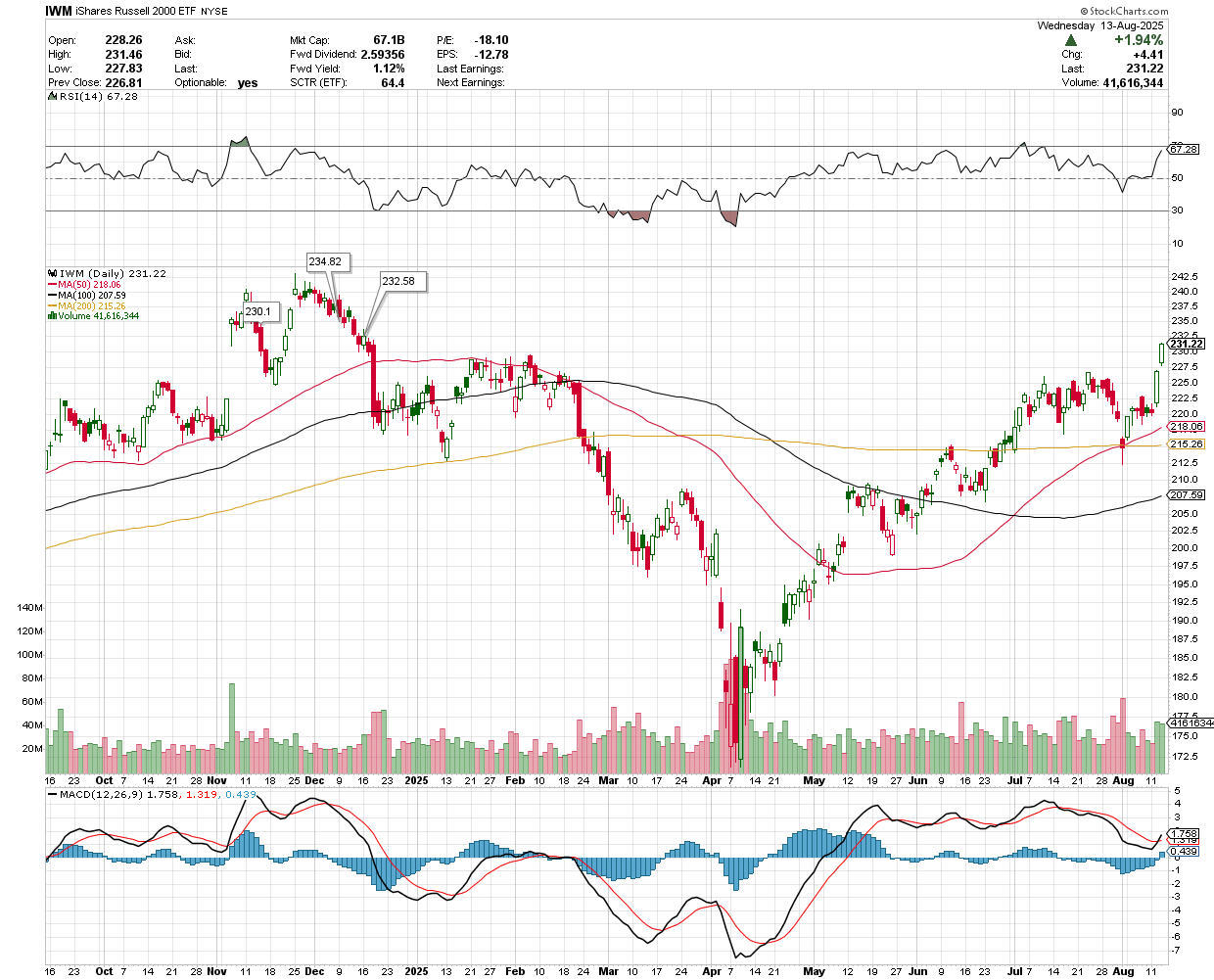

The price was trading at $230.79 pre-market, with support at $230.10 and potential upside levels at $232.58 and $234.82.

VanEck Semiconductor ETF (SMH)

The price was trading at $300.60 pre-market, with support at $300.09 and potential upside levels at $301 and $301.72.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

The price closed at $29.27, with support at $29.03 and potential upside levels at $29.41 and $29.63.

Earnings Snapshot: Reported Today (Before Open)

JD.Com Inc (JD)

On August 14, 2025, JD.com, a leading Chinese e-commerce company, reported a 22.4% increase in quarterly revenue to 356.66 billion yuan ($49.73 billion), surpassing analysts' expectations of 331.63 billion yuan.

The growth was driven by strong consumer spending, boosted by price cuts, promotions, and government subsidies, particularly during the record-breaking 618 shopping festival, which saw a 15.2% rise in gross merchandise value to 855.6 billion yuan. Despite the revenue beat, net income fell to 6.2 billion yuan from 12.6 billion yuan a year earlier.

The stock was trading at $32.70 pre-market, with support at $32.53 and potential upside levels at $32.83 and $33.056.

Deere & Co (DE)

Deere & Company reported a 9% decline in Q3 2025 net sales to $12.02 billion and a 26% drop in net income to $1.29 billion, with EPS falling 24% to $4.75 from $6.29 year-over-year.

The Production and Precision Agriculture segment saw the steepest decline, with net sales down 16% and operating profit halved to $580 million. Small Agriculture and Turf sales fell 1%, with operating profit down 2% to $485 million, while Construction and Forestry sales dropped 5%, with operating profit down 47% to $237 million. Financial Services’ net income rose 34% to $205 million.

Deere anticipates a tough market, projecting a 30% sales decline for Large Ag equipment in the U.S. and Canada, with full-year net income guidance unchanged at $4.75–$5.25 billion. The company maintains its focus on inventory management, cost control, and precision agriculture investments.

The stock was trading at $483.24 pre-market, with support at $476.94 and potential upside levels at $488.44 and $492.50.

Amcor PLC (AMCR)

Amcor (NYSE: AMCR) reported Q4 fiscal 2025 net sales of $5.08 billion, up 43% excluding currency effects, driven by the April 30, 2025, all-stock acquisition of Berry Global.

Adjusted EBITDA rose 43% to $789 million, but GAAP net income was a $39 million loss due to acquisition costs. Full-year 2025 net sales increased 11% to $15.01 billion, with adjusted EBITDA up 13% to $2.19 billion and adjusted EPS up 3% to 71.2 cents.

The company identified a $20 billion core consumer packaging portfolio and plans to divest $2.5 billion in non-core assets, including North America Beverage. For fiscal 2026, Amcor forecasts adjusted EPS of 80-83 cents (12-17% growth) and free cash flow of $1.8-1.9 billion, with $650 million in synergies expected by 2028 from the Berry integration. The board declared a quarterly dividend of 12.75 cents per share, raising the annual dividend to 51 cents.

The stock was trading at $9.67 pre-market, with support at $9.625 and potential upside levels at $9.735 and $9.77.

Earnings Snapshot: Reporting Today (After Close)

Applied Materials Inc (AMAT)

Applied Materials, Inc. (NASDAQ: AMAT) is set to report Q3 2025 earnings, with analysts expecting an EPS of $2.36, up from $2.12 last year, and revenue of $7.21 billion, a 6.42% increase from $6.78 billion.

Despite a 50% stock rally since April, AMAT is down 5.4% over the past year due to volatility and U.S. export restrictions impacting its China market, which dropped from 43% to 25% of sales. Q2 2025 showed strong performance with $7.1 billion in revenue (up 7%) and record GAAP EPS of $2.63. However, concerns linger about potential overhyping of AI chip demand, possible inventory corrections, and further U.S.-China trade tensions affecting growth. Management’s commentary on product demand and market adaptability will be key.

The stock was trading at $190.20 pre-market, with support at $189.25 and potential upside levels at $190.57 and $192.05.