Markets Overview – August 26, 2025

Major Indices Surged :

S&P 500 (SPX): +0.41% to 6,465.94

Dow Jones (DJI): +0.30% to 45,418.07

Russell 2000 (RUT): +0.83% to 2,358.60

U.S. stock markets closed higher, with the Dow Jones Industrial Average up 0.3%, and the S&P 500 and Nasdaq Composite each gaining 0.4%, shrugging off concerns about President Trump's attempt to dismiss Federal Reserve Governor Lisa Cook.

Investors focused on upcoming Nvidia earnings, expected to influence markets significantly due to Nvidia's 8% weight in the S&P 500. Key economic indicators, including a slightly better-than-expected consumer confidence report, were noted, with the Fed’s preferred inflation measure due Friday.

Key Movers: Winners and Losers

Top S&P 500 performers included Eli Lilly (+5.9%) after positive weight-loss pill trial results and Boeing (+3.5%) following a $36 billion deal with Korean Air.

Keurig Dr Pepper (-6.9%) led decliners due to concerns over its $18 billion acquisition of JDE Peet’s. Interactive Brokers will replace Walgreens Boots Alliance in the S&P 500 on Thursday.

Bitcoin fell below $110,000, hitting a seven-week low, while the 10-year Treasury yield dipped to 4.27%, and West Texas Intermediate (WTI) crude oil futures fell 2.3% to $63.30 per barrel.

EchoStar shares surged 70% after selling spectrum to AT&T for $23 billion. The Trump administration is eyeing stakes in defense contractors like Lockheed Martin, which gained 1.7%.

Today’s Economic Calendar — Wednesday, August 27

12:00 pm- Richmond Fed President Tom Barkin speaks

Technical Setups- Indices & ETFs

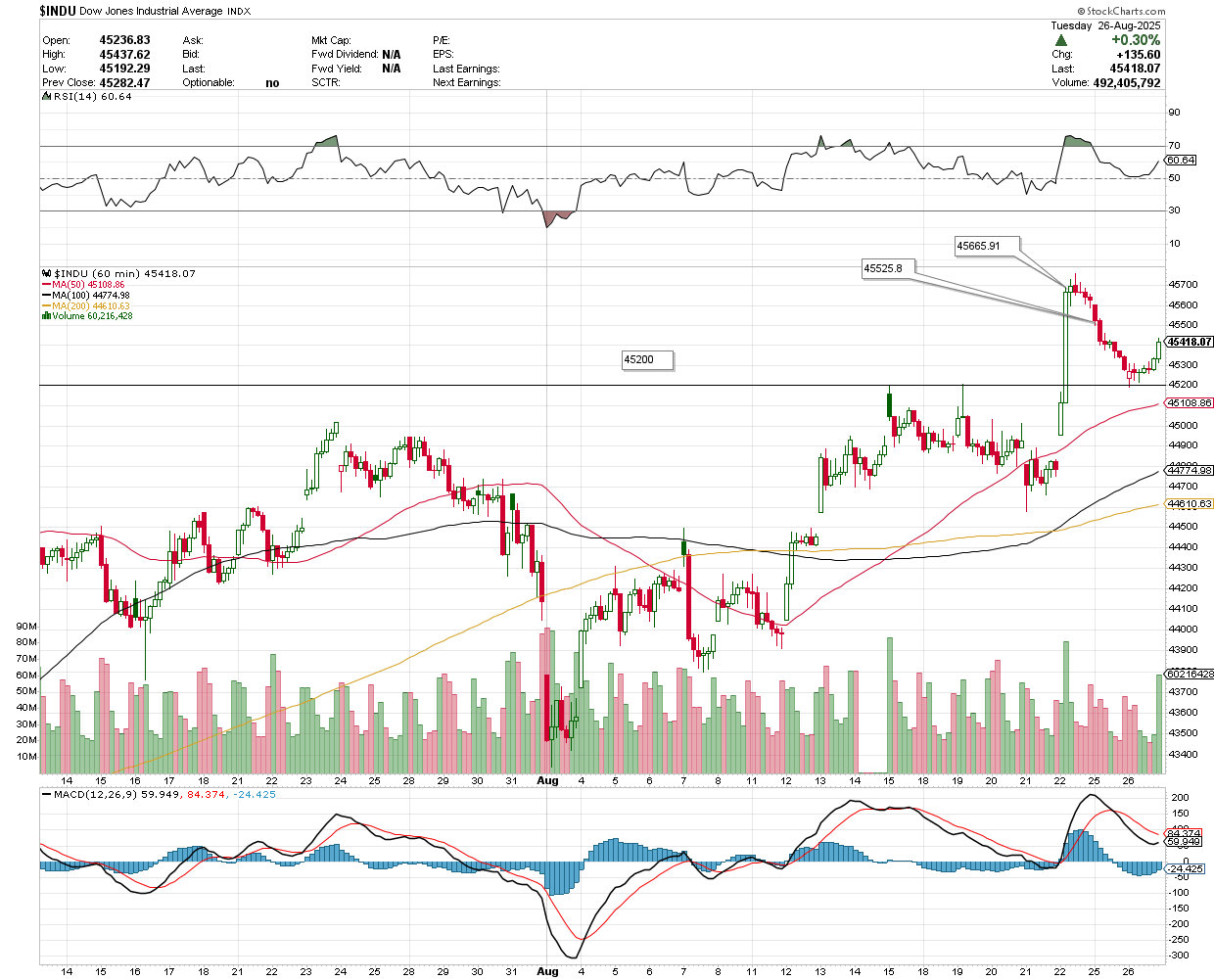

Dow Jones Industrial Average (DJI)

The Dow gained 0.30%, closing at 45,418.07. Key support sits at 45,200; holding above could spark a rebound toward 45,525.80 and 45,665.91.

NASDAQ 100 (NDX)

The index ended at 23,525.29, consolidating between 23,400 and 23,500. Watch 23,408.55 as critical support; staying above favors a move toward 23,595.38 and 23,699.60.

S&P 500 (SPX)

Closing at 6,465.94, the S&P is trading above support at 6,440.48. If buyers hold this level, potential upside targets are 6,480 and 6,500.

SPDR S&P 500 ETF Trust (SPY)

SPY was trading at $645.64 pre-market, with support at $644.77 and potential upside targets at $645.77 and $647.

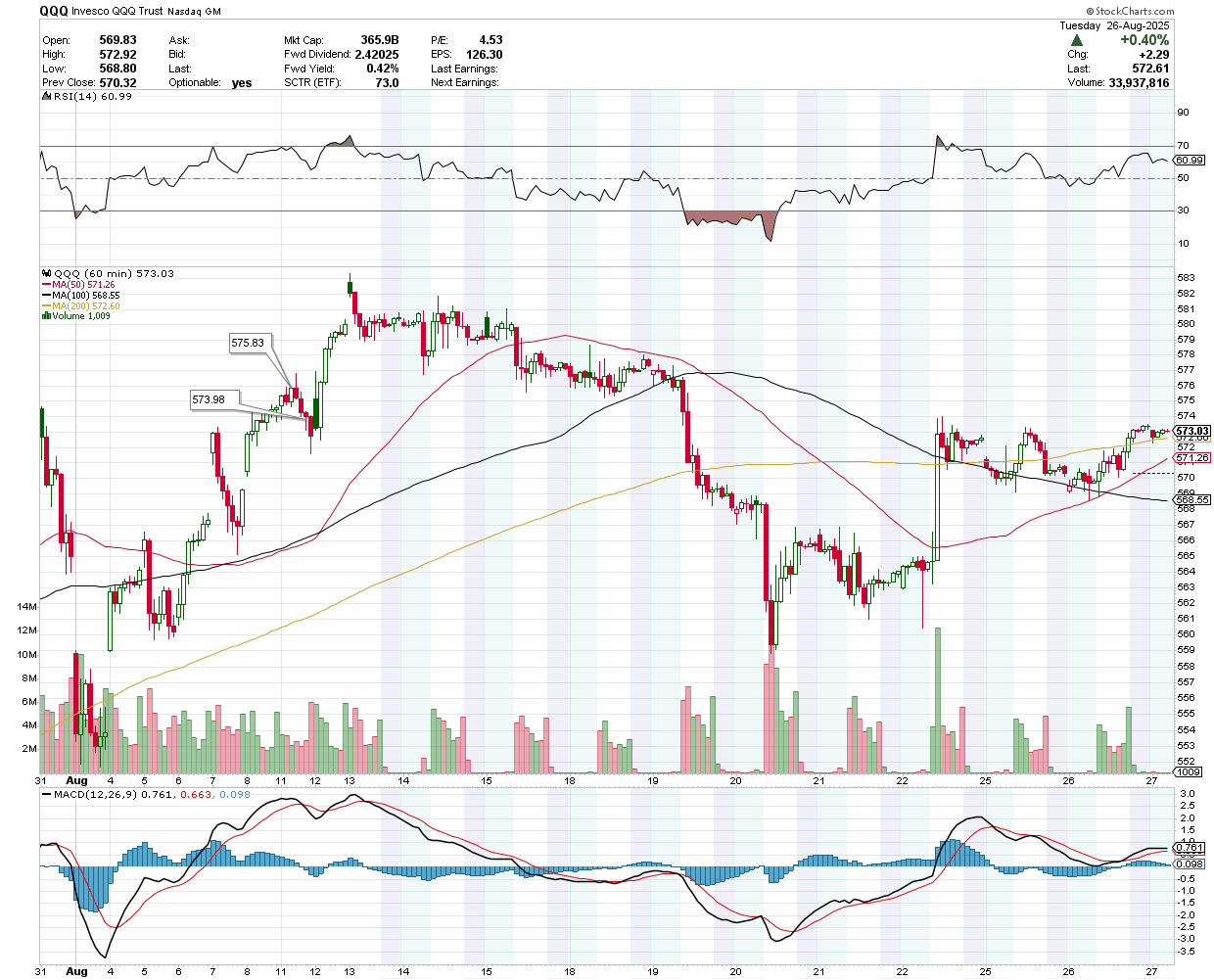

Invesco QQQ Trust Series 1(QQQ)

QQQ was trading at $573.03 pre-market, with key support at $571.26. Holding above this level keeps upside targets in play at $573.98 and $575.83.

IWM was trading at $234.11 pre-market. Support is nearby at $233.67, while potential upside levels are at $234.56 and $235.42.

VanEck Semiconductor ETF (SMH)

SMH traded at $297.32 pre-market. Support lies at $296.22; a bounce could test $297.89 and $298.80.

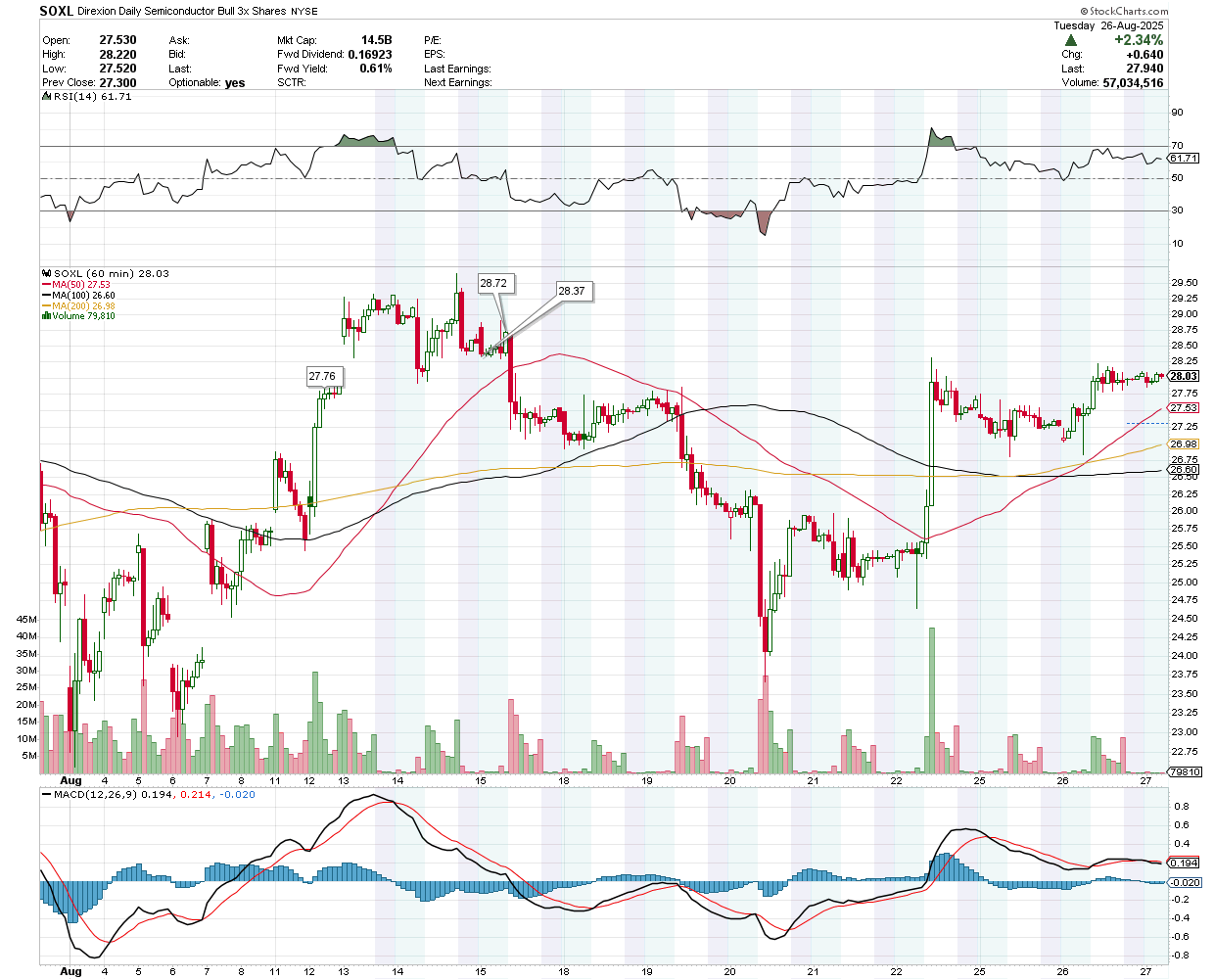

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL was at $28.03 pre-market. Support at $27.76 must hold to fuel a move towards $28.37 and $28.72.

Earnings Snapshot: Reporting Today (After Close)

NVIDIA Corp (NVDA)

Financials: Expected EPS $1.01 (+49% YoY), Revenue $46.2B (+53% YoY), Data Center $41.2B, Gaming $3.8B; $8B impact from China chip sales fee.

Stock: Up 1% on August 26, +35% YTD, $4T market cap.

Key Drivers: GB200 shipments (15K–17K Q4 racks), Blackwell Ultra ramp, AI spending, China sales; growth moderated but retains strong upside.

NVDA traded at $183 pre-market; support at $181.57 is key to drive potential upside to $183.48 and $184.48.

Crowdstrike Holdings Inc (CRWD)

Financial Expectations: Analysts forecast Q2 EPS of $0.83 (-20% YoY) and revenue of $1.15B (+19% YoY). CrowdStrike has beaten EPS estimates for nine consecutive quarters.

Stock Performance: Up 22% YTD and 57% over the past year, driven by AI-powered security and Falcon platform growth, but high valuation raises concerns.

Analyst Views: BMO Capital sees steady demand but cautions on H2 FY26 growth; Guggenheim notes large Q1 deals and U.S. government potential but limited near-term upside.

CRWD was trading at $421.35 pre-market, with resistance at $424.51. Failure to break higher could open downside toward $417.06 and $413.53.

Veeva Systems Inc (VEEV)

Last Quarter: Revenue $759M (+16.7% YoY), beat estimates; strong EPS guidance.

Q2 Forecast: Revenue $768.4M (+13.6% YoY), Adjusted EPS $1.90 expected.

Track Record: Has beaten revenue estimates by avg. 1.9% over the past 2 years.

Stock & Sector: VEEV down ~1.33% in the past month; vertical software group down ~5.3%.

VEEV was trading at $289.55 pre-market, with support at $287.00. Holding this level could pave the way toward $291.33 and $292.24.

HP Inc (HPQ)

Revenue: Expected $13.96B (+3.3% YoY).

Personal Systems: $9.99B (+6.7% YoY) on AI PC demand, Windows 11 refresh.

Printing: $3.95B (-4.6% YoY), weak consumer demand in China.

AI Push: $116M Humane AI deal, new Saudi R&D hub; AI PCs targeted at 25% of revenue by 2026.

Risks: $10.7B debt, margin pressures, competition from Dell/Lenovo.

HPQ traded at $27.16 pre-market, with support at $27.02. A hold above this level may open upside toward $27.32 and $27.495.