Markets Overview – August 21, 2025

Major Indices Fell :

S&P 500 (SPX): -0.40%

Dow Jones (DJI): -0.34%

Russell 2000 (RUT): +0.21%

On August 21, 2025, the S&P 500 fell 0.4%, marking its fifth consecutive day of losses, while the Dow Jones Industrial Average and Nasdaq Composite each dropped 0.3%.

Investors were cautious ahead of Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Economic Policy Symposium, scheduled for August 22, 2025, where he is expected to address interest rates and the economy. Expectations for a September rate cut had softened, with futures indicating a 73% chance of a 25-basis-point cut, down from 92% a week earlier.

Key Movers

Walmart shares declined 4.5% after reporting weaker-than-expected earnings, despite raising its full-year outlook. Other major decliners included First Solar, down 7% after comments from President Trump against renewable energy projects, and Coty, which plunged 21.6% due to a surprise loss and weak guidance.

Tech giants like Meta, Tesla, and Nvidia also saw losses, while Paramount Skydance surged nearly 15%, and Hewlett Packard Enterprise rose 3.7% after a Morgan Stanley upgrade.

Bitcoin dropped to $112,400, down 10% from its recent high, reflecting caution before Powell’s speech. The 10-year Treasury yield rose to 4.33%, the U.S. dollar index increased 0.4%, and Boeing shares remained steady amid reports of potential sales of 500 jets to China.

Today’s Economic Calendar — Friday, August 22

10:00 am- Fed Chair Jerome Powell speaks from Jackson Hole.

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The index fell -0.34% to close at 44,785.50.

Support for the day: 44,708.70, with potential upside levels at 44,841.51 and 44,901.21.

NASDAQ 100 (NDX)

The index closed at 23,142.58, with support for the day at 23,099.70 and potential upside levels at 23,200 and 23,300.59.

S&P 500 (SPX)

The index closed at 6,370.17, with support at 6,348.01 and potential upside levels at 6,390.62 and 6,410.

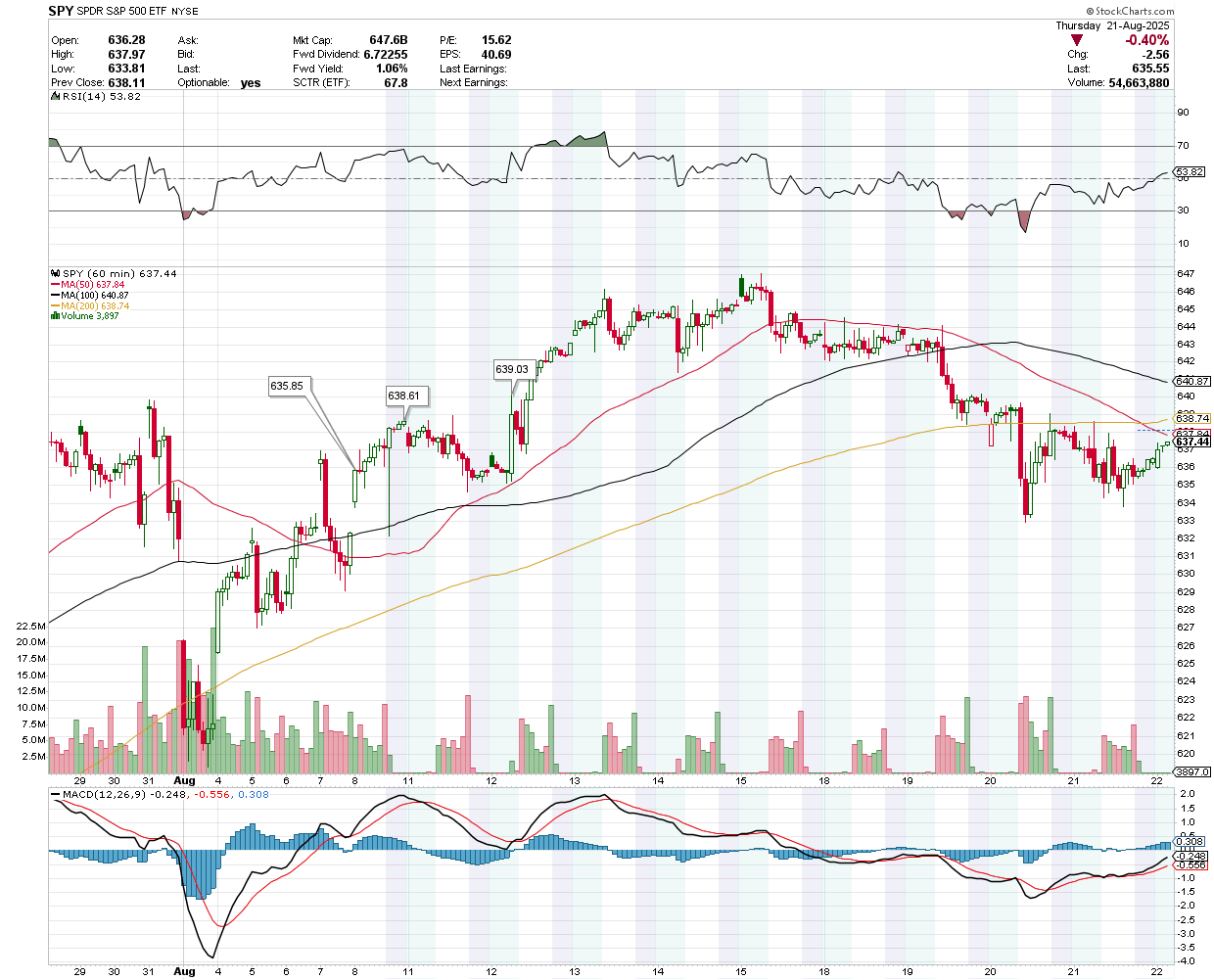

SPDR S&P 500 ETF Trust (SPY)

The price was trading at $637.44 pre-market, with support at $635.85 and potential upside levels at $638.61 and $639.03.

Invesco QQQ Trust Series 1(QQQ)

The price was trading at $564.66 pre-market, with support at $563.89 and potential upside levels at $566.07 and $567.07.

The price was trading at $227.32 pre-market, with support at $226.12 and potential upside levels at $227.93 and $228.97.

VanEck Semiconductor ETF (SMH)

The price was trading at $287.80 pre-market, with support at $287.06 and potential upside levels at $288.42 and $288.92.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

The price was trading at $25.47 pre-market, with support at $25.22 and potential upside levels at $25.629 and $25.82.

Earnings Snapshot: Reported Yesterday (After Close)

Zoom Communications Inc (ZM)

Zoom reported non-GAAP earnings per share of $1.53, beating the consensus estimate of $1.37, with a non-GAAP operating margin of 41.3%, surpassing the expected 38.8%.

Revenue reached $1.217 billion, a 5% year-over-year increase, exceeding the $1.198 billion forecast. Free cash flow was $508 million, well above the $392 million estimate. Current remaining performance obligations (cRPO) grew 6% to $2.411 billion.

Despite a 10% year-to-date stock decline, Zoom shares surged 6% in after-hours trading, driven by strong financial performance and a 76.4% gross profit margin.

The stock was trading at $77 pre-market, with support at $76.055 and potential upside levels at $77.89 and $78.57.

Earnings Snapshot: Reporting Today (Before Open)

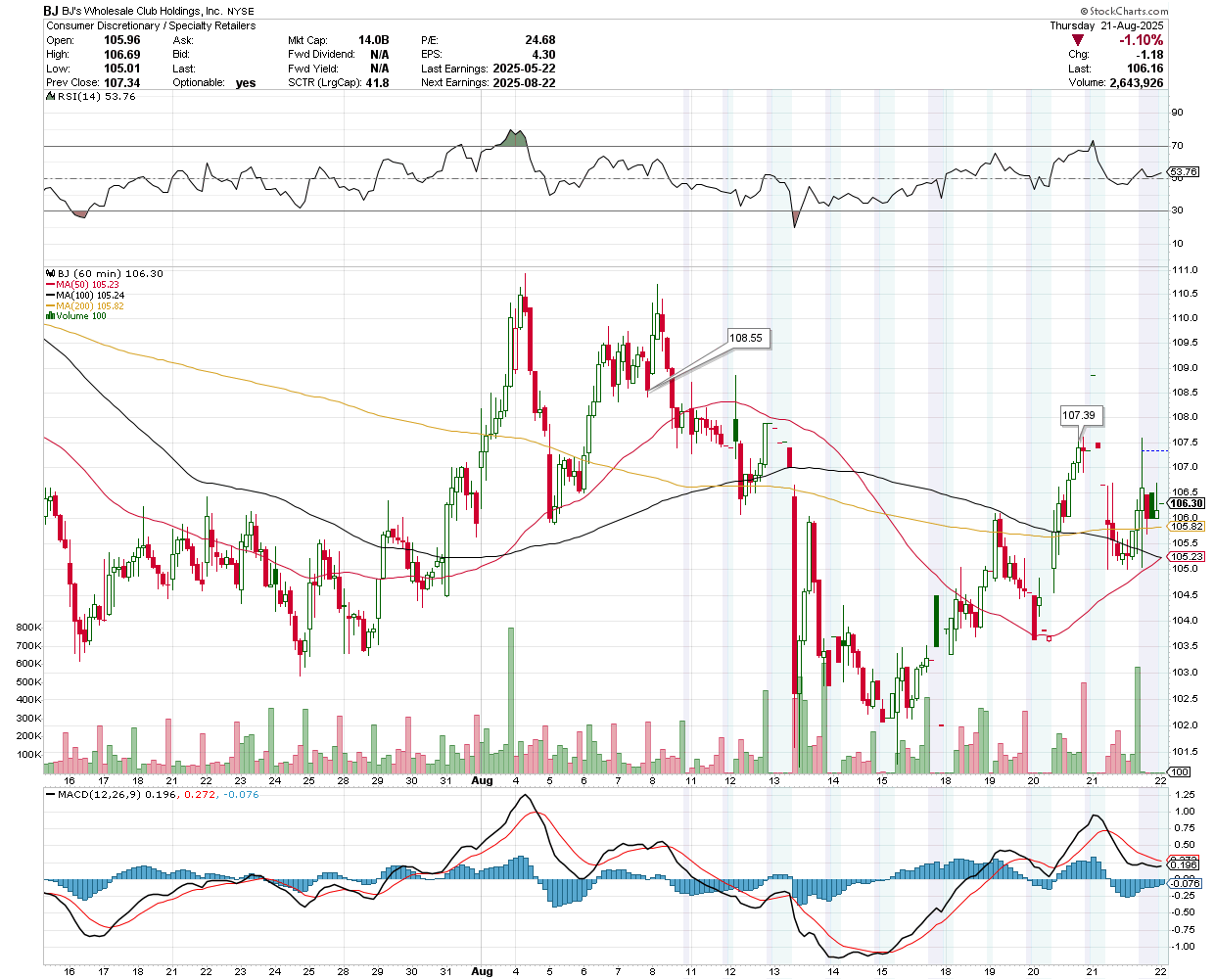

BJ's Wholesale Club Holdings Inc (BJ)

BJ’s Wholesale Club (NYSE: BJ), a membership-only discount retailer, is set to release its Q2 2025 earnings on August 22, 2025. Analysts expect revenue to grow 5.4% year-over-year to $5.49 billion, aligning with the 4.9% growth seen in the same quarter last year, and adjusted earnings per share of $1.09.

In Q1, BJ’s missed revenue expectations by 0.6%, reporting $5.15 billion, but exceeded EBITDA and EPS estimates. The company has missed Wall Street’s revenue forecasts four times in the past two years.

The stock was trading at $106.30 pre-market, with support at $105.23 and potential upside levels at $107.39 and $108.55.

RLX Technology Inc (RLX)

RLX Technology (NYSE: RLX), a leading global e-vapor company, reported strong Q2 2025 financial results, with net revenues surging 40.3% year-over-year to RMB880.0 million (US$122.8 million), driven by successful international expansion and improved gross margins of 27.5% (up from 25.2%).

Non-GAAP income from operations rose 147.6% to RMB116.2 million, while non-GAAP net income reached RMB291.2 million; the company announced a US$0.01 per ADS dividend payable around September 26, 2025.

Management attributed the performance to effective strategy execution, cost control, and data-driven localization, expressing confidence in navigating industry changes with a focus on global compliance.

The stock was trading at $2.40 pre-market, with support at $2.34 and potential upside levels at $2.45 and $2.49.

Buckle Inc (BKE)

The Buckle, Inc. (BKE) is set to announce its Q2 2026 earnings on August 22, 2025, with analysts forecasting an EPS of $0.83, a 6.4% year-over-year rise, and revenue of $292.61 million, up 3.6% from last year, fueled by an 11.0% surge in comparable store net sales for the four weeks ending August 2, 2025.

This growth is expected to boost revenue and net profit, with analysts forecasting an increase in earnings per share (EPS) compared to prior quarters. In Q1 2026, Buckle reported revenue of $272.12 million, net income of $35.19 million, and EPS of $0.70, reflecting strong operational performance. The company’s focus on high-quality clothing, new product arrivals, and exceptional customer experience supports a bullish outlook.

The stock was trading at $54.01 pre-market, with support at $53.95 and potential upside levels at $54.50 and $55.