Markets Overview – September 17, 2025

Major Indices Closed Mixed :

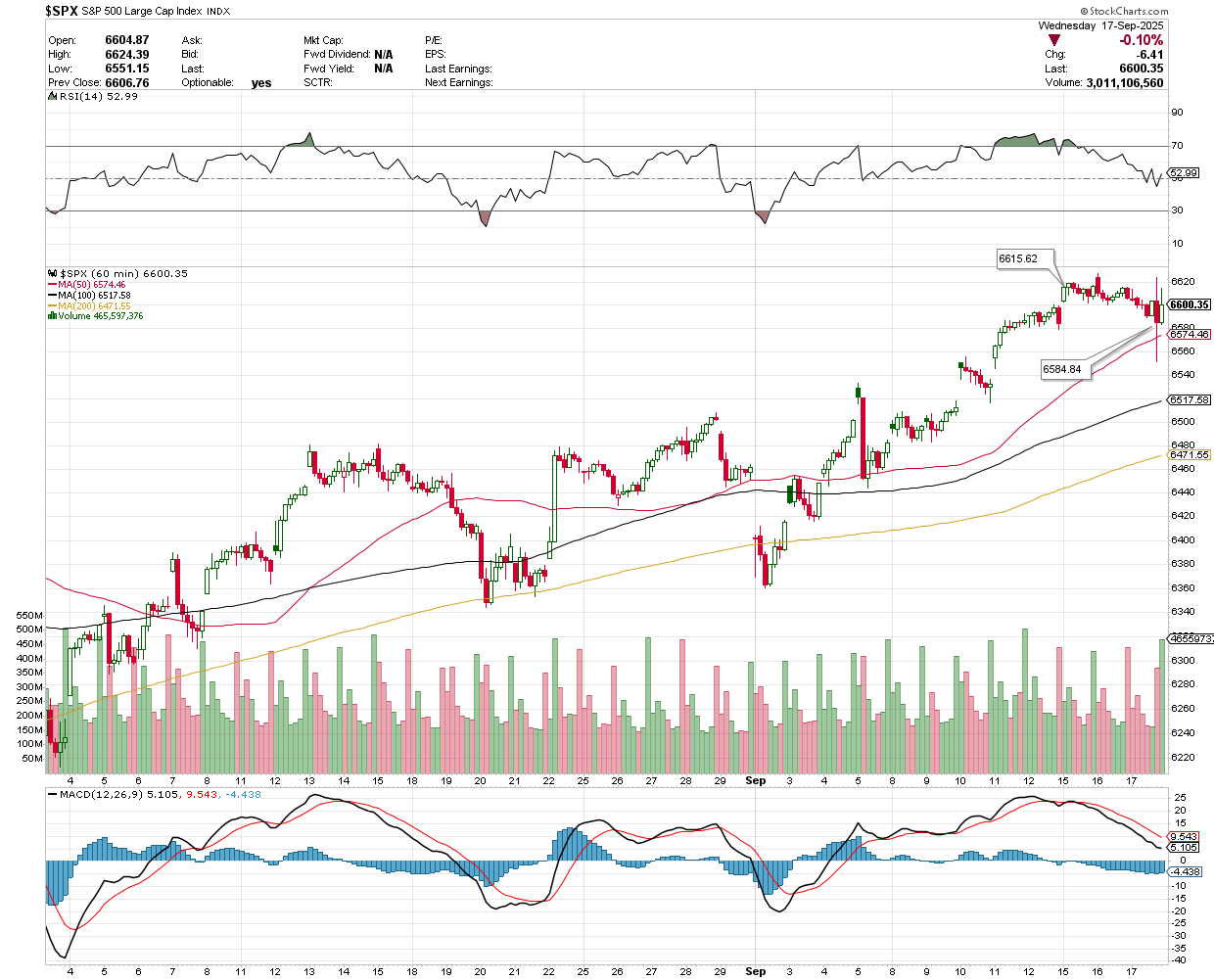

S&P 500 (SPX): -0.10% to 6,600.36

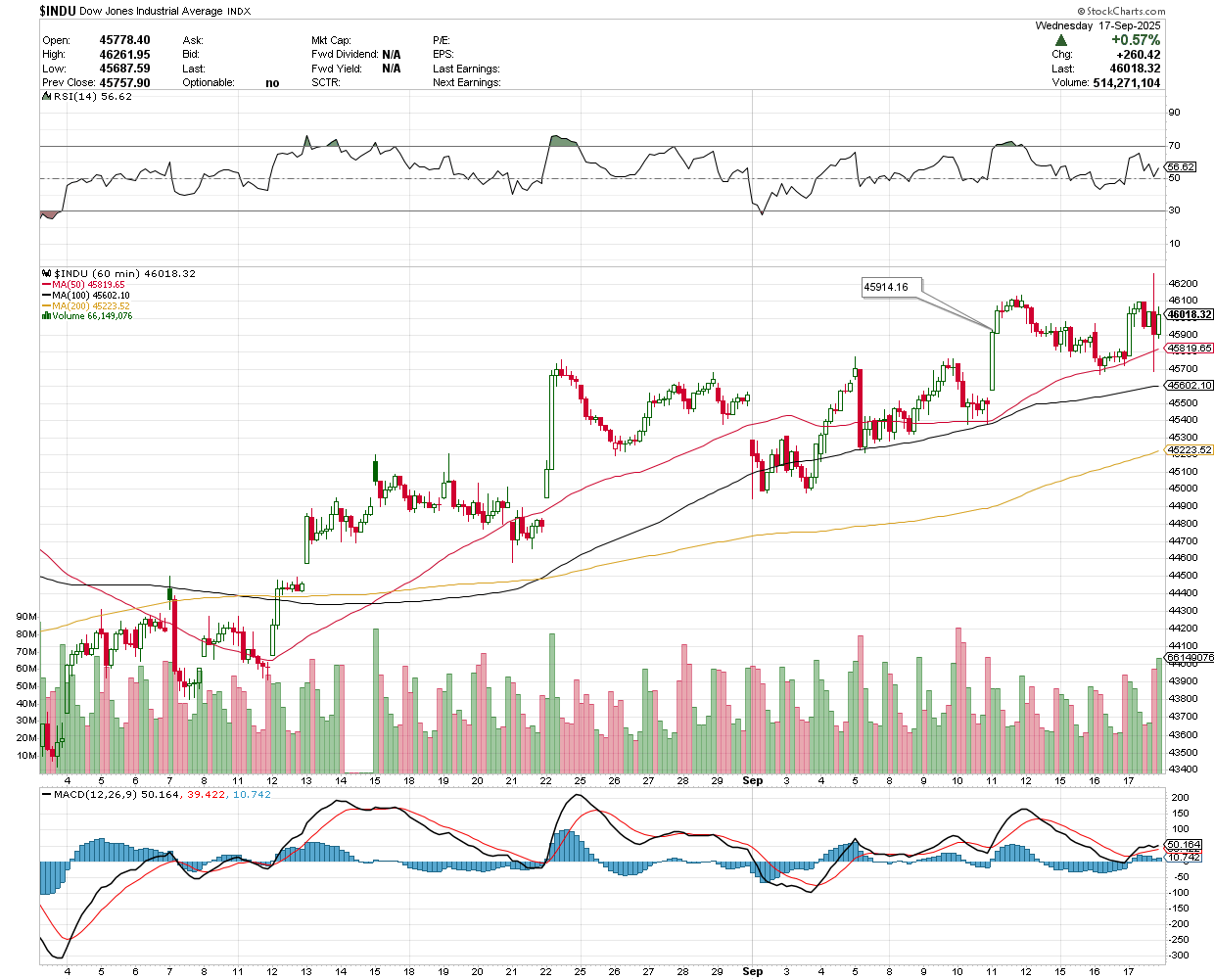

Dow Jones (DJI): +0.57% to 46,018.32

Russell 2000 (RUT): +0.18% to 2,407.34

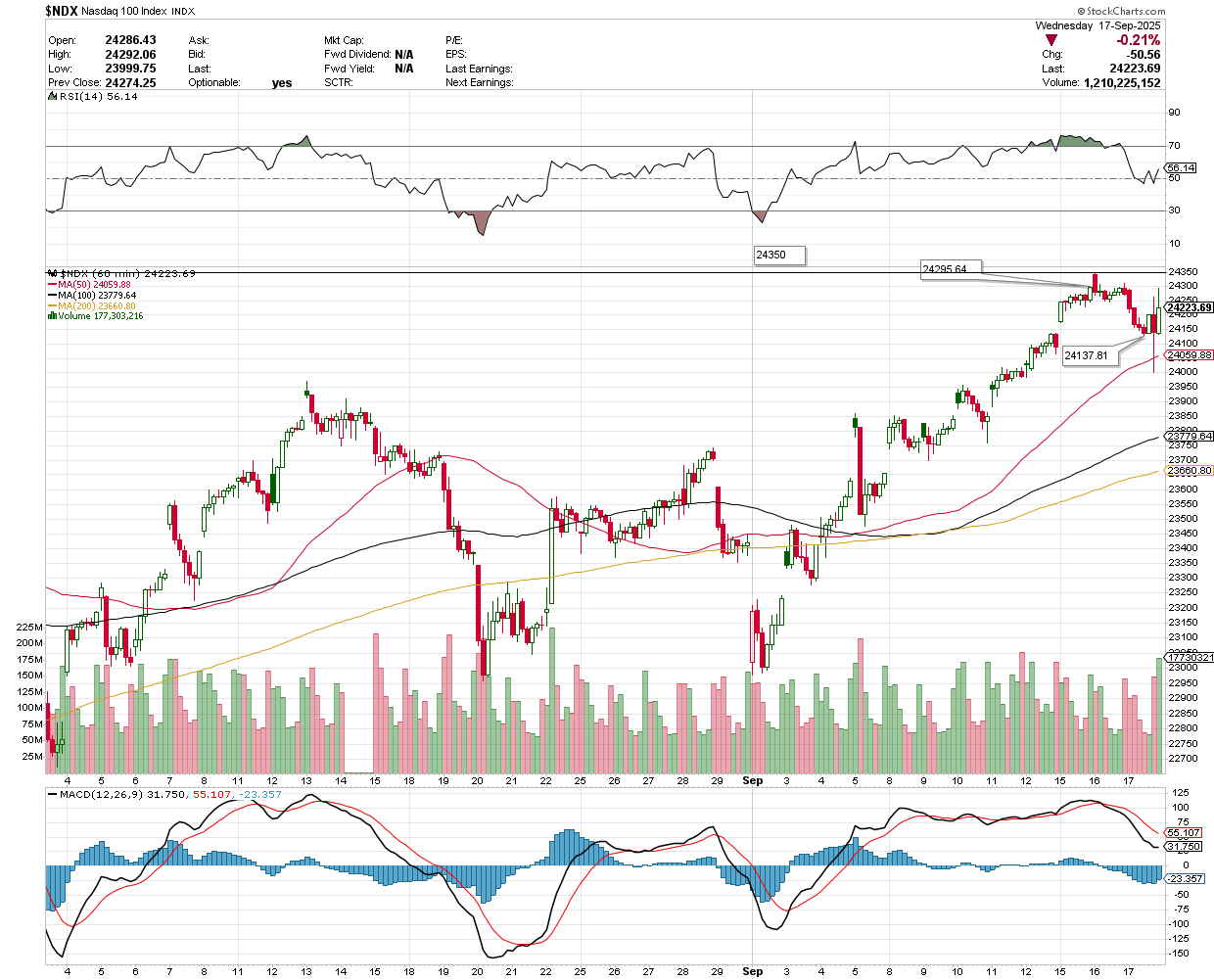

On September 17, 2025, U.S. stock indexes showed mixed results following the Federal Reserve's decision to cut its benchmark interest rate by a quarter percentage point to a range of 4% to 4.25%, the first cut since December. The Dow Jones Industrial Average rose 0.6%, reaching an intraday high of 46,261, while the Nasdaq Composite fell 0.3% and the S&P 500 dipped 0.1%.

The Fed signaled two more potential quarter-point cuts for 2025, though projections indicated a split among members on future cuts. The 10-year Treasury yield rose to 4.09% from 4.03%.

Gold futures fell to below $3,700/oz, oil dropped nearly 1% to below $64/barrel, and Bitcoin remained stable at $116,500. The U.S. dollar index rose 0.37% to 97. Concerns about layoffs and economic slowdown were noted, with some economists warning of recession risks due to trade policies and a softening labor market.

Key Movers: Winners and Losers

In corporate news, Nvidia and Broadcom shares dropped 2.6% and 3.8%, respectively, with Nvidia facing pressure from a reported Chinese ban on its AI chips.

Workday surged 7.3% after Elliott Investment Management disclosed a $2 billion stake, and Lyft jumped 13% following a partnership with Waymo for a Nashville robotaxi service, while Uber fell 5%.

StubHub debuted on the NYSE, closing 5.7% lower after an initial 8% gain. Hologic led S&P 500 gainers, up 7.7% amid acquisition talks, while Builders FirstSource was the top decliner, down 5.6%.

Today’s Economic Calendar — Thursday, September 18

8:30 am- Initial jobless claims (September 13) & Philadelphia Fed manufacturing survey (Sep)

10:00 am- U.S. leading economic indicators (Aug)

Technical Setups- Indices & ETFs

Dow Jones Industrial Average (DJI)

The Dow gained +0.57%, closing at 46,018.32. Key support sits at 45,914.16; holding above could spark a rebound toward 46,150 and 46,300.

NASDAQ 100 (NDX)

The index ended at 24,223.69. Key support lies at 24,137.81; holding above this level could open upside toward 24,295.64 and 24,350.

S&P 500 (SPX)

Closing at 6,600.35, the S&P is trading above support at 6,584.84. If buyers hold this level, the potential upside targets are 6,615.62 and 6,630.

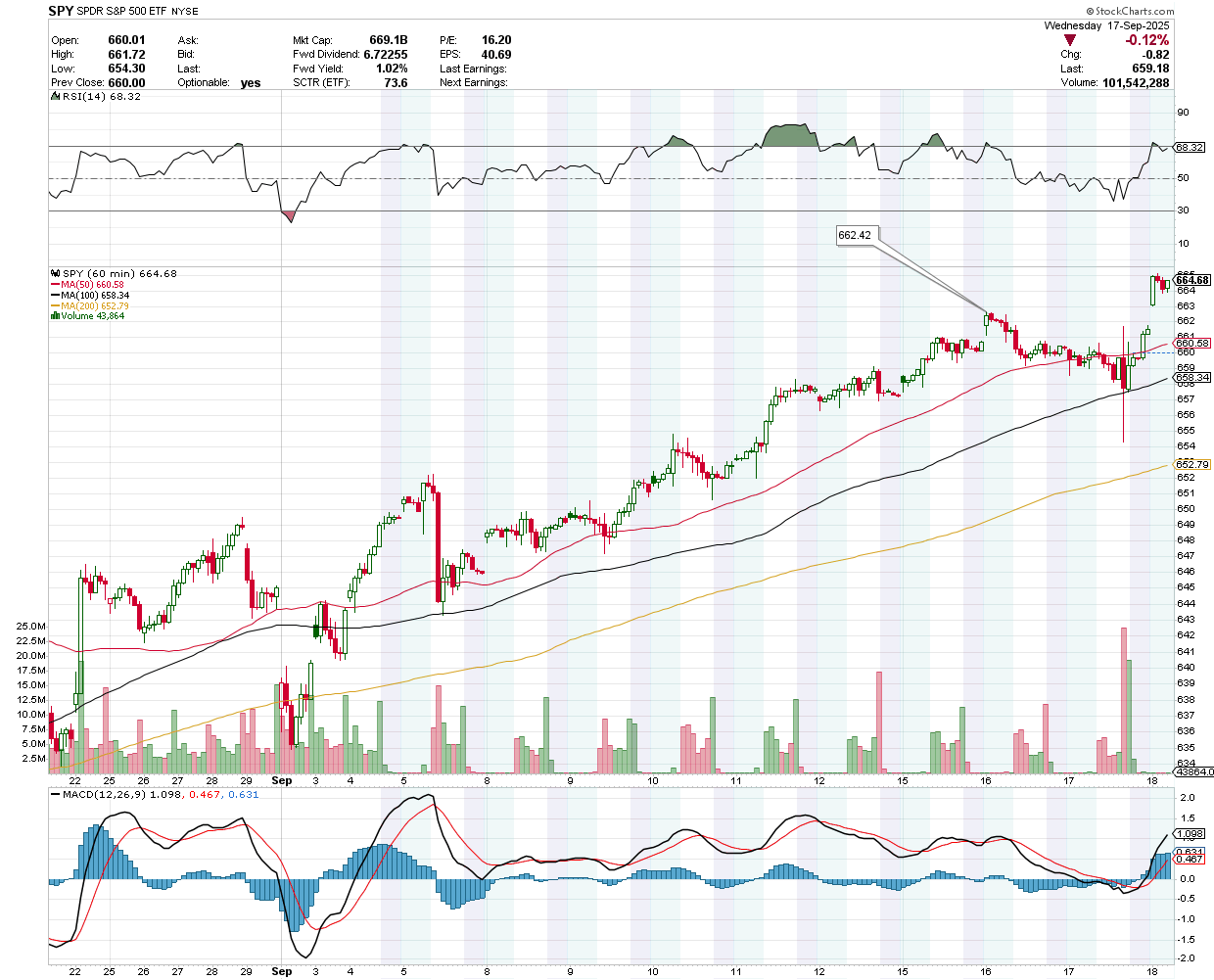

SPDR S&P 500 ETF Trust (SPY)

SPY was trading at $664.68 pre-market, with support at $662.42 and potential upside targets at $666 and $667.

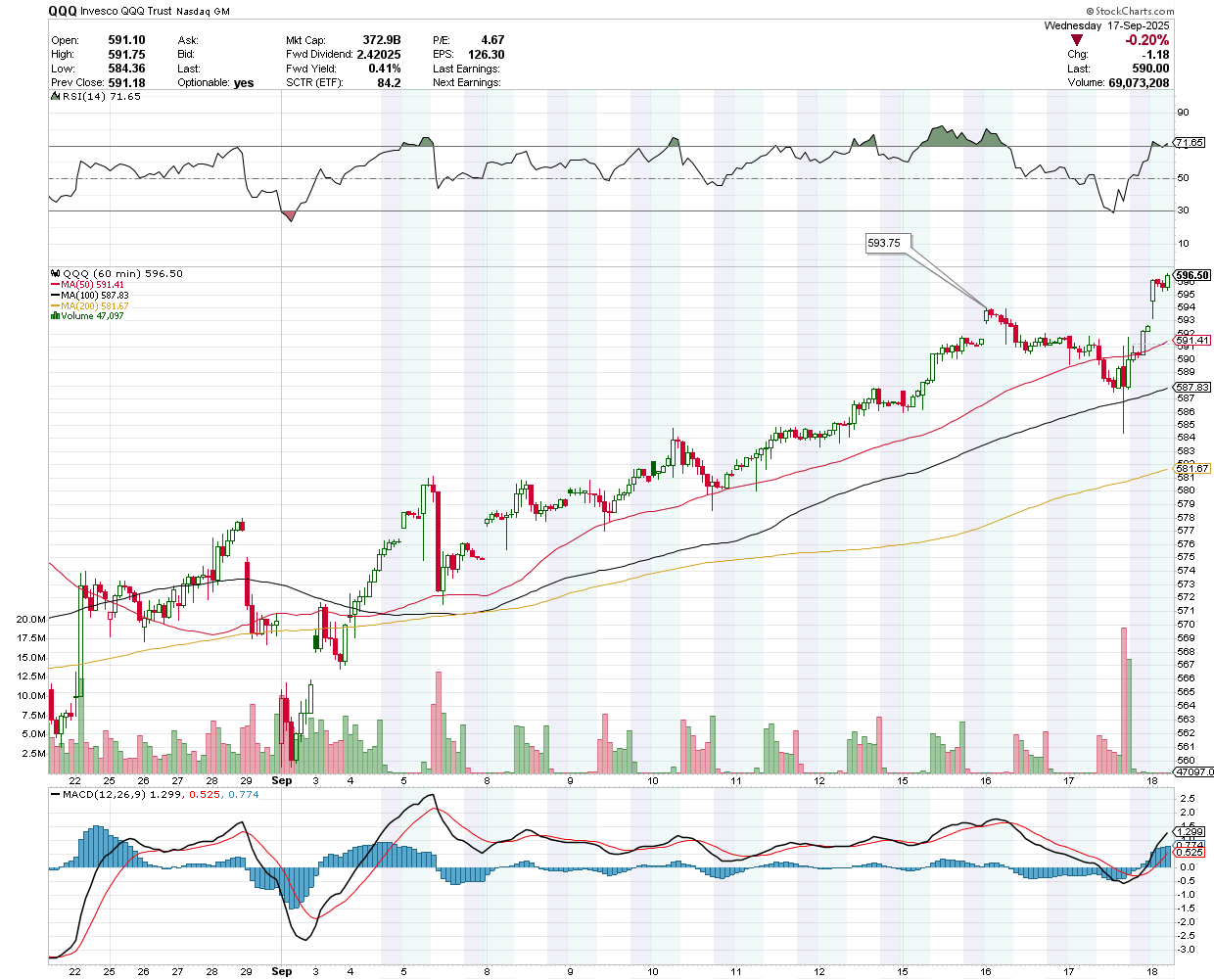

Invesco QQQ Trust Series 1(QQQ)

QQQ was trading at $596.50 pre-market, with key support at $593.75. Holding above this level keeps upside targets in play at $598 and $600.

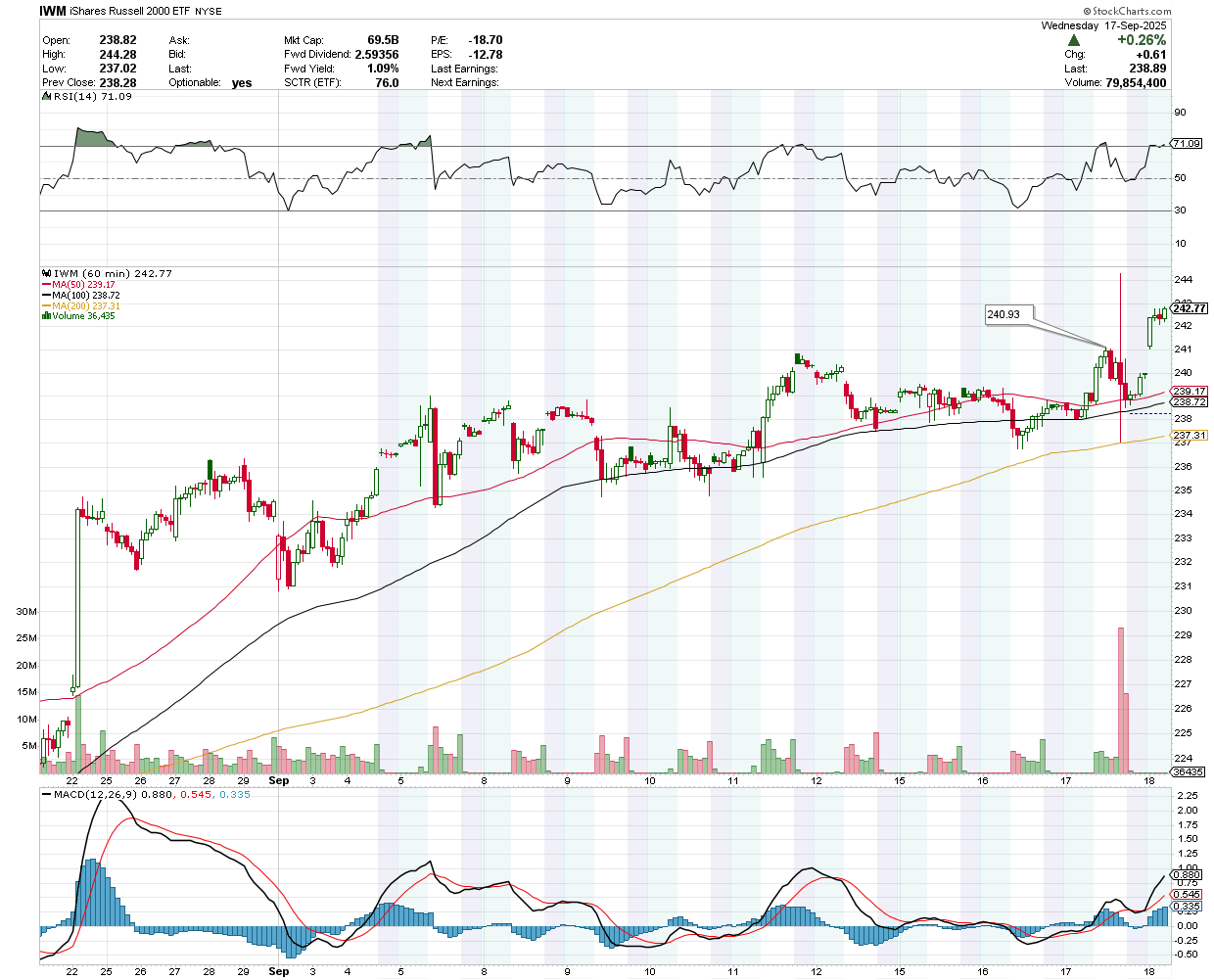

IWM was trading at $242.77 pre-market. Support is nearby at $240.93, while the potential upside levels stand at $244 and $245.

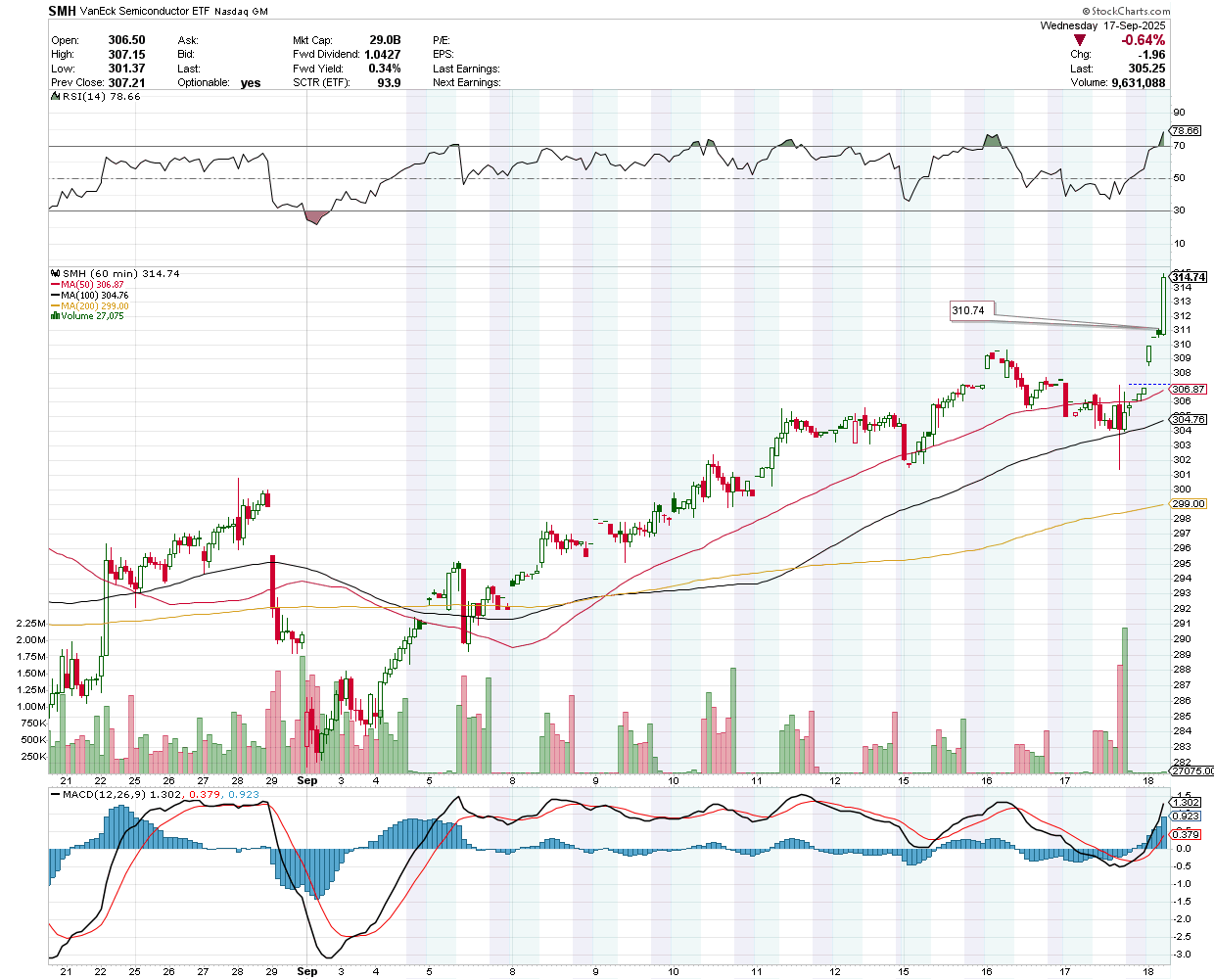

VanEck Semiconductor ETF (SMH)

SMH traded at $314.74 pre-market. Support lies at $310.74; a bounce could test $317 and $319.

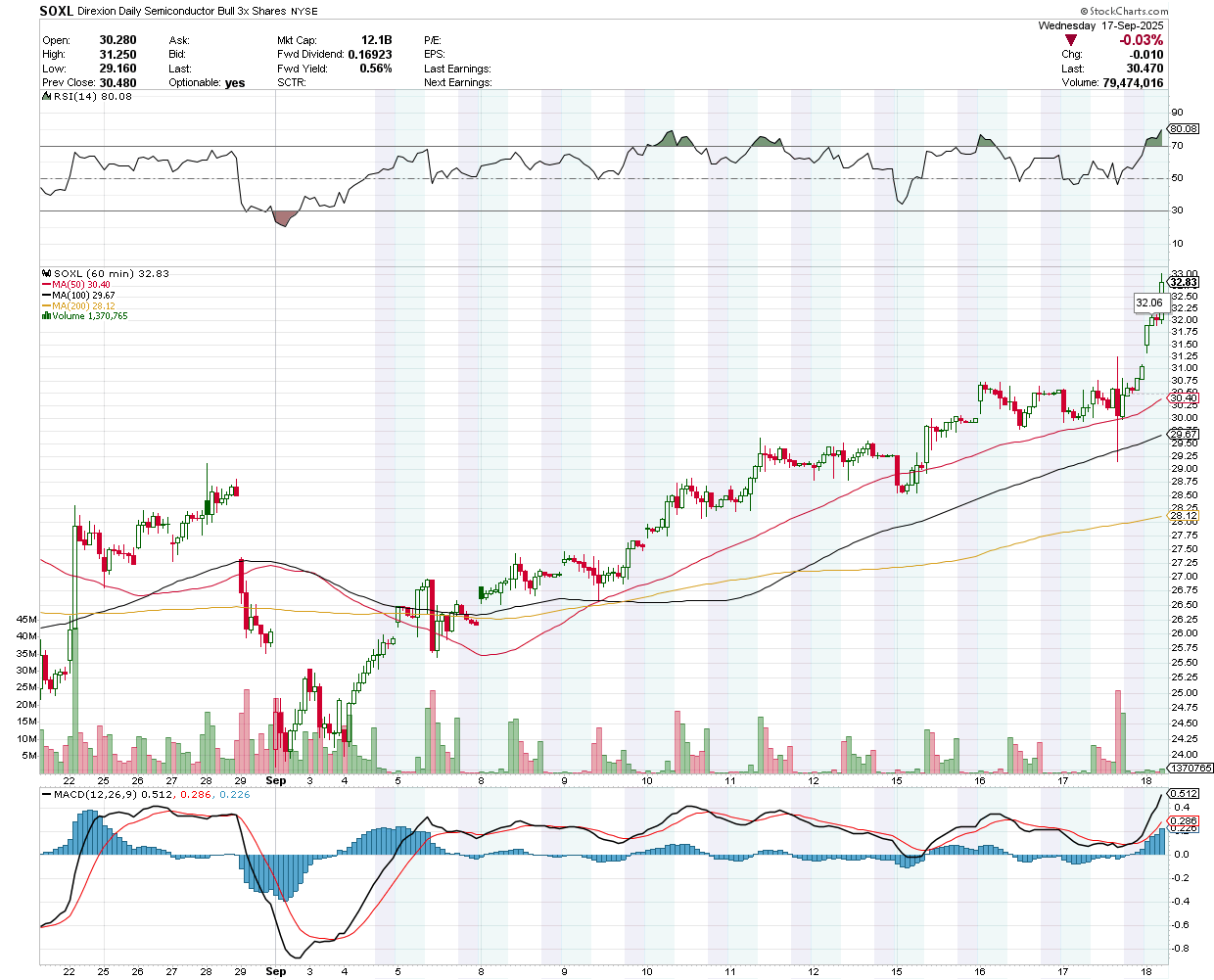

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL was at $32.83 pre-market. Support at $32.06 must hold to fuel a move towards $33.50 and $34.

Earnings Snapshot: Reporting Today (Before Open)

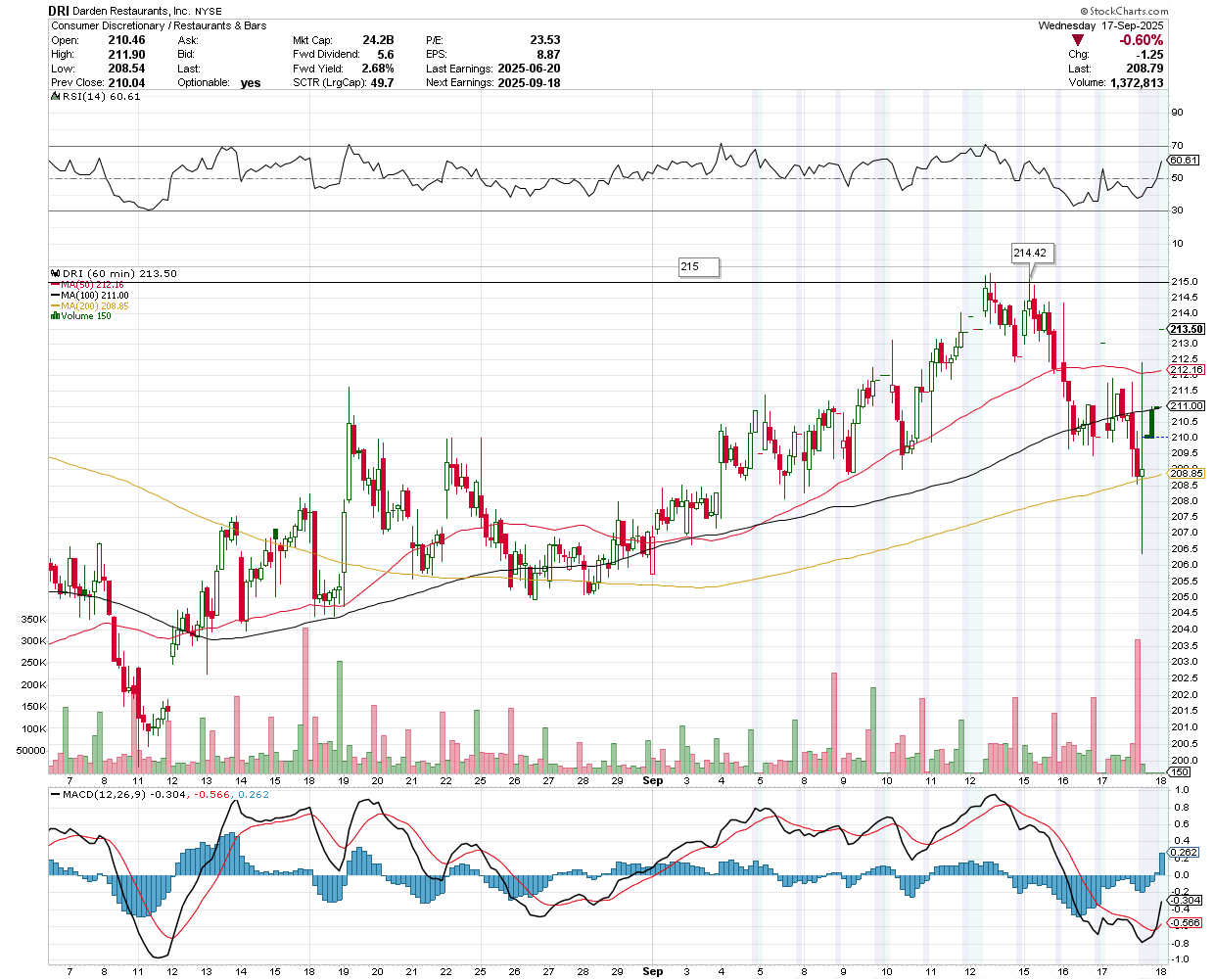

Darden Restaurants Inc (DRI)

Company Overview- Darden Restaurants (NYSE: DRI) runs brands like Olive Garden and LongHorn Steakhouse, emphasizing growth in a tough restaurant market.

Financial Performance- Q1 EPS forecast at $2.01 (up from $1.75), revenue at $3.04B (10.17% YoY rise).

Growth Strategies- Uber Direct partnership for Olive Garden deliveries; 60-65 new restaurants planned for FY2026, aiming for 7-8% sales growth.

Earnings Outlook- FY2026 adjusted EPS $10.50-$10.70, boosted by an extra fiscal week.

DRI was trading at $213.50 pre-market. Support is at $212.16, while the potential upside levels stand at $214.42 and $215.

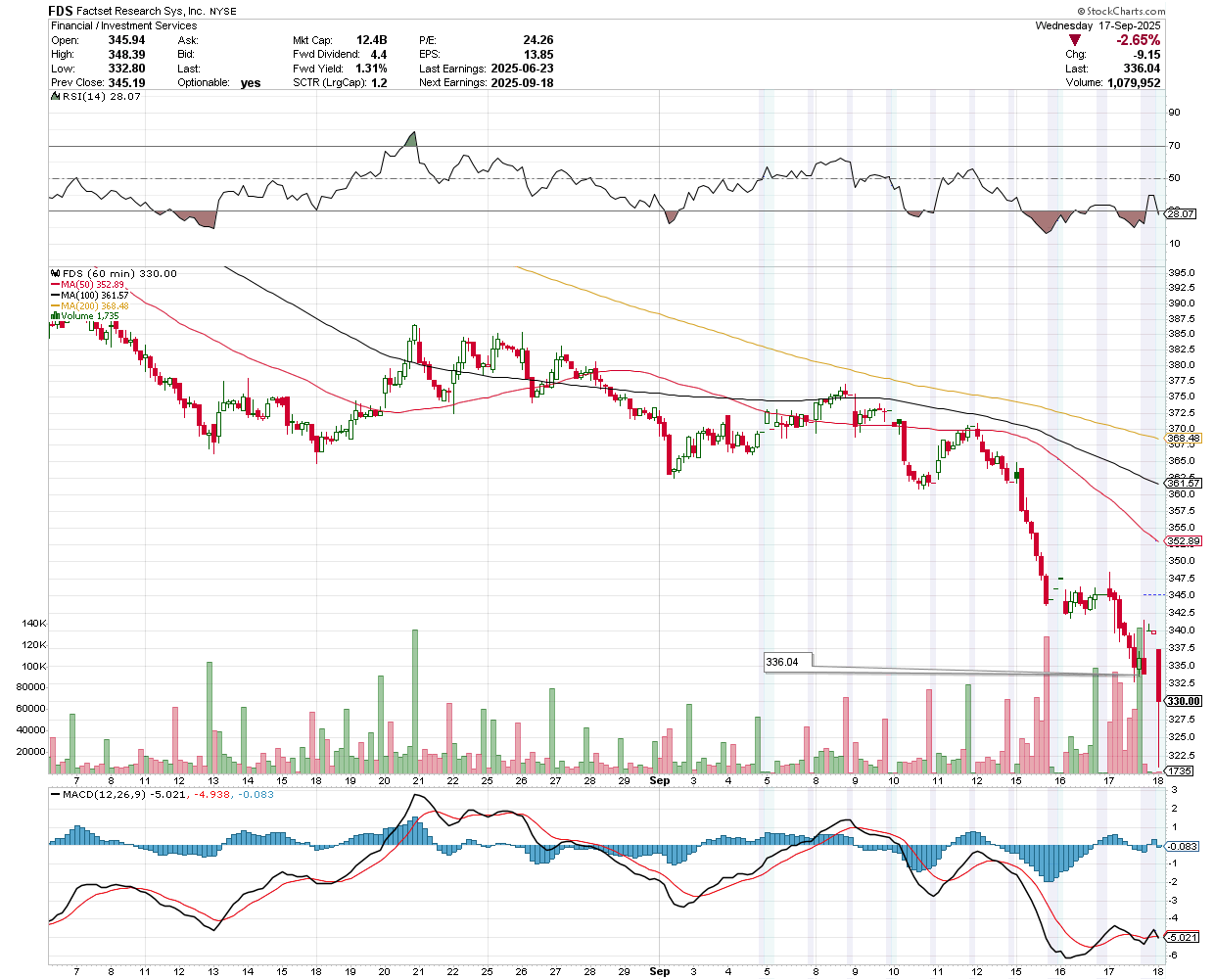

FactSet Research Systems Inc (FDS)

Financial Expectations- FDS to release Q4 fiscal 2025 results on September 18, before market open. Revenue projected at $592.6M, up 5.6% year-over-year, driven by growth across Americas, EMEA, and Asia Pacific. EPS expected at $4.15, reflecting an 11% year-over-year increase.

Regional Revenue Outlook- Americas ($381.2M, +5.2%), EMEA ($147.5M, +3.1%), and Asia Pacific ($60.2M, +6.4%) fueled by banking and wealth sector retention.

FDS was trading at $330 pre-market. Support is at $325, while the potential upside levels stand at $333 and $336.04.

Earnings Snapshot: Reporting Today (After Close)

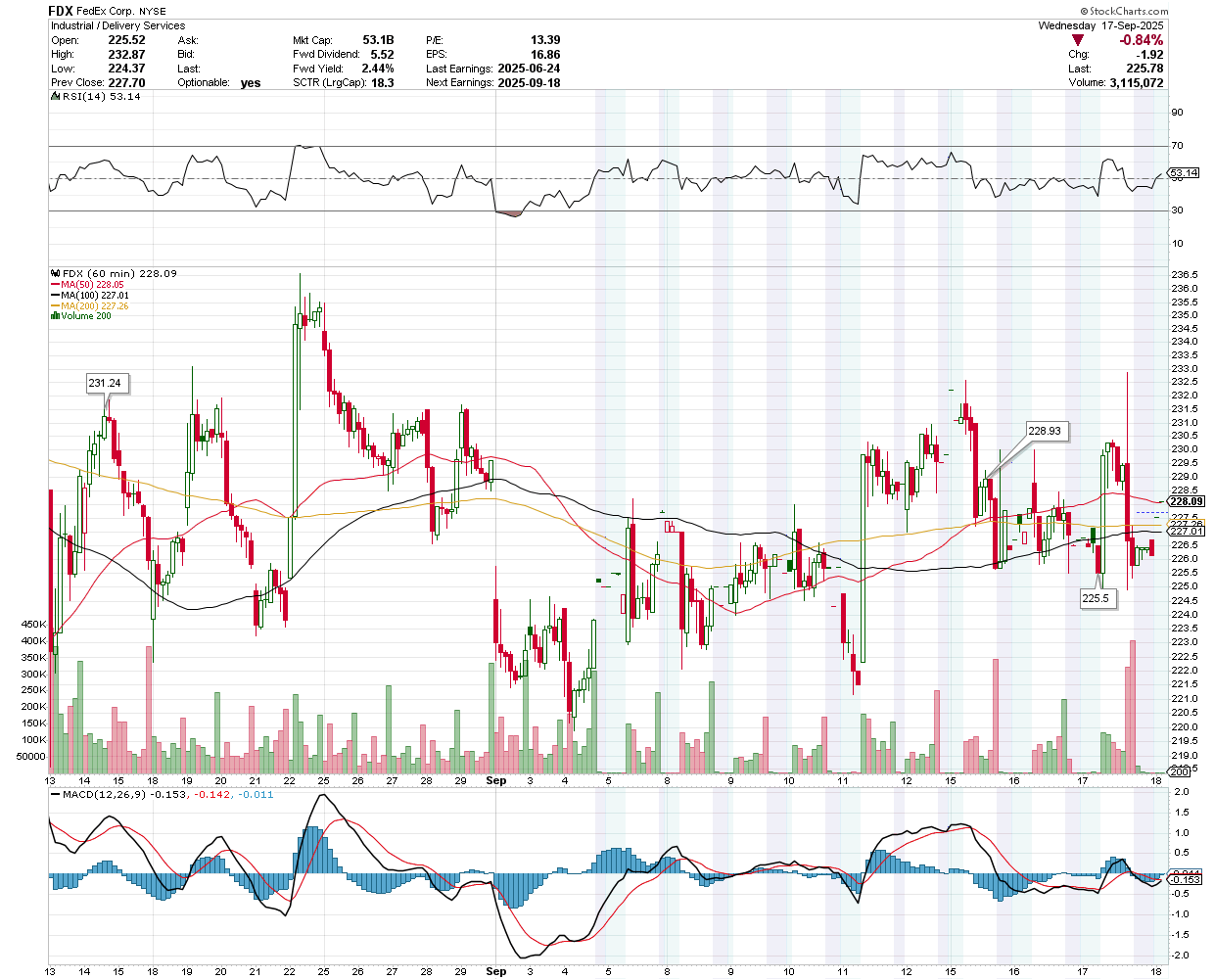

FedEx Corp (FDX)

Earnings Overview- FedEx (NYSE: FDX) to report fiscal Q1 2026 earnings on September 18, 2025, with projected EPS of $3.64 and sales of $21.7B.

Financial Fundamentals- FedEx has a $53.3B market cap, with $88B in revenue, $6.0B in operating profits, and $4.1B in net income over the last 12 months.

FDX was trading at $228.09 pre-market. Support is at $225.50, while the potential upside levels stand at $228.93 and $231.24.

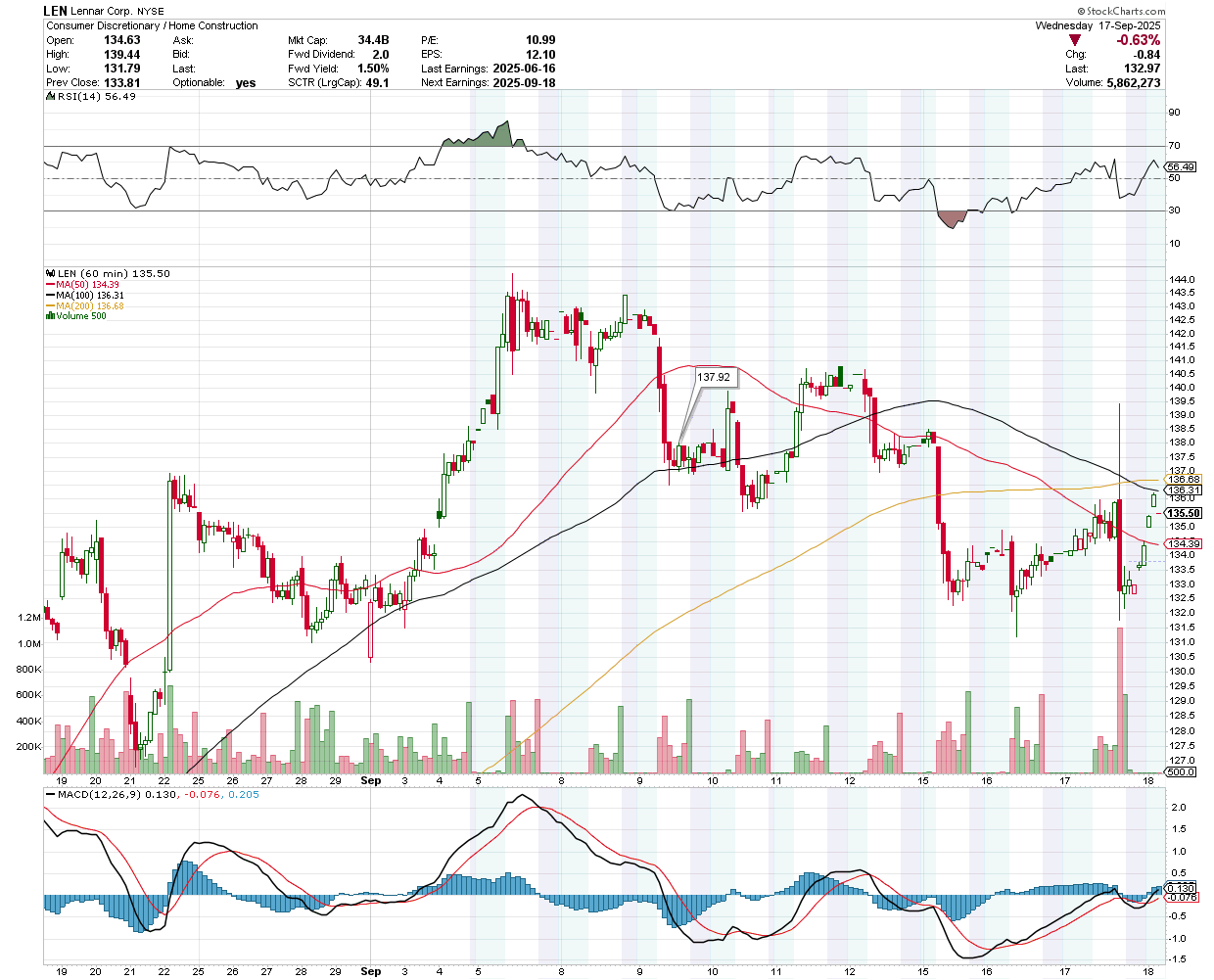

Lennar Corp (LEN)

Earnings Overview- Lennar (LEN) to report Q3 fiscal 2025 earnings after market close on September 18, with expected revenue of $9.05–$9.07B and EPS of $2.10–$2.14.

Housing Market Context- U.S. housing starts rebounded in July (+2.8% for single-family), but soft demand, high mortgage rates, and uneven inventory dynamics persist.

Operational Performance- Lennar maintained 18% gross margins in Q2 through cost control and shorter build cycles, despite pricing pressure and 13%+ incentives.

Investor Expectations- Q3 results and management commentary on orders, cancellations, and margins will signal if July’s housing rebound is sustainable or temporary.

LEN was trading at $135.50 pre-market. Support is at $134.39, while the potential upside levels stand at $136.68 and $137.92.